AUD/USD was the weakest forex major on Wednesday following weak growth figures for Q3. At 0.8% y/y, it was the slowest GDP figure in four years and beneath the 1.1% estimate, while the 0.3% q/q print also missed its forecast of 0.5%.

Interest rates traders have now fully priced in a 25bp cut for April, which could mark the RBA’s first act of easing in over four years to take the cash rate from 4.35% to 4.1%. Two more 25bp cuts have also been priced in for August 2025 and February 2026, which assumes a cash rate of 3.6% - a level not seen since April 2023. The 2-year yield fell -13bp during its worst day in nearly five months.

Of course, we will need to wait for the quarterly CPI figures in January for confirmation of whether the RBA really will begin cutting in the first half of 2024, but for now at least the risks of them doing so are now on the radar.

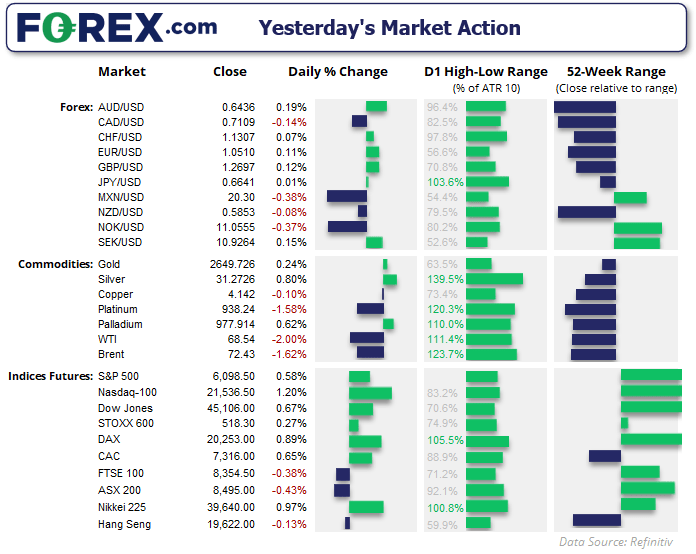

- Wall Street reached record highs after Jerome Powell thanks to strong earnings from Salesforce and Jerome Powell’s comments on a strong US economy

- The Nasdaq 100 led the rally with a 1.2% rise on the day, with the Dow Jones up 0.7% and S&P 500 up 0.6%

- Bitcoin also rallied 3% and retested 99k (just shy of its record high) after Powell likened it to gold

- Oil prices were sharply lower ahead of today’s OPEC meeting (with an extension of output cuts expected), and EIA data showed a larger-than-expected draw on stockpiles last week

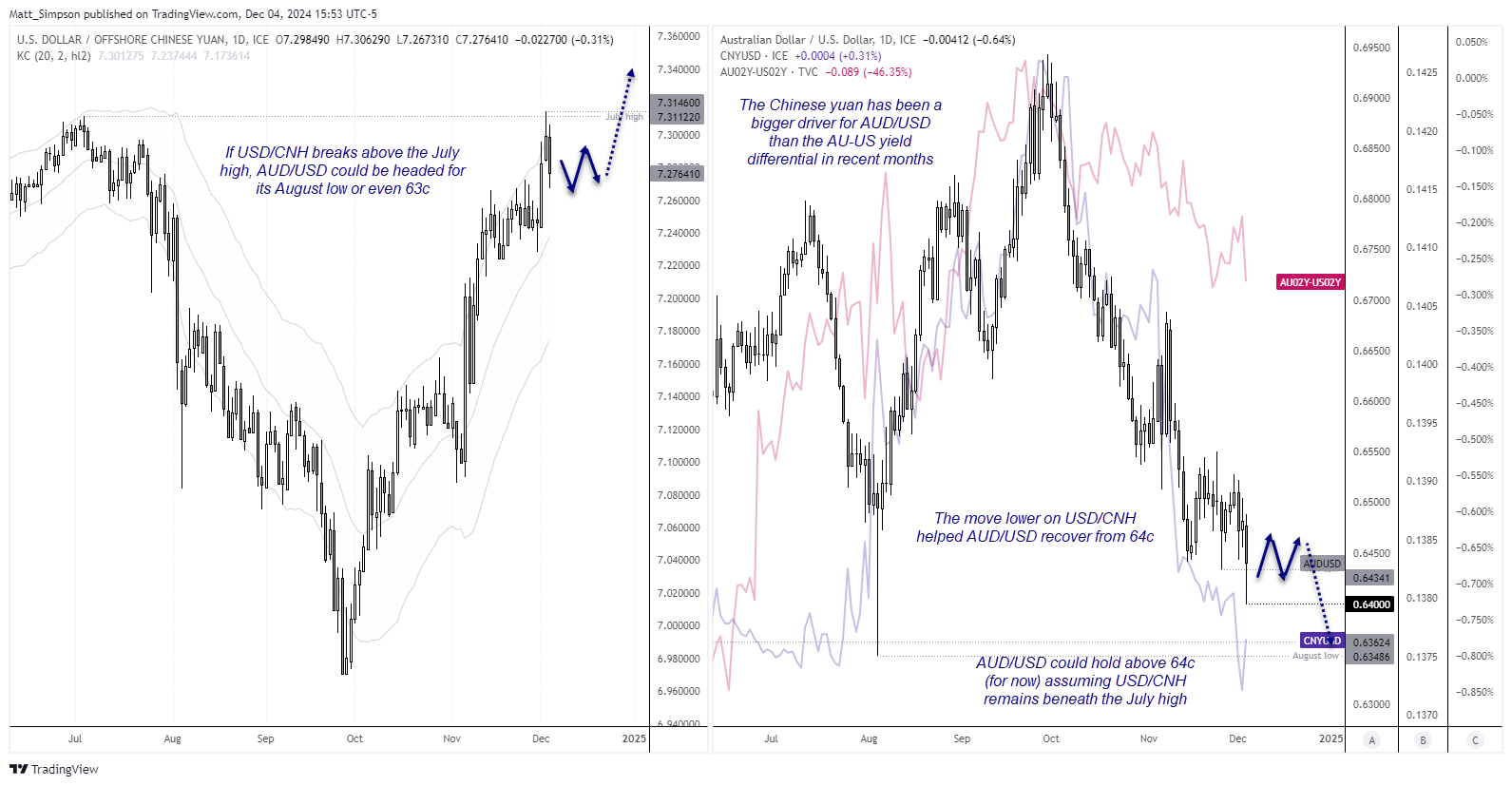

AUD/USD, USD/CNH technical analysis

I had warned of the growing risks of a downside break for AUD/USD in the weekly outlook, and Australia’s weak GDP was the trigger to send the Aussie to an 8-month low. Yet it has managed to recoup around half of the day’s losses thanks to the strength of the yuan.

The Chinese yuan has been the bigger driver for the Australian dollar in recent months, even more so that the AU-US 2-year yield differential. And it could be thanks to USD/CNH retracing lower from the July high that AUD/USD was able to recover from 64c at the day’s low.

Given the significance of the resistance level on USD/CNH, I suspect AUD/USD will be able to hold above 64c for now. But a break above the July high suggests the Aussie could be headed for the August low around 0.6350.

As noted in last week, while the USD tends to be bearish in December, price action is choppy and erratic heading towards Christmas. This could translate to AUD/USD being better suited on a ‘per day’ basis for traders, with the potential for a cleaner bullish move to develop on AUD/USD after December 20th when the USD tends to deliver bearish daily returns.

Economic events in focus (AEDT)

- 10:00 – JP Reuters Tankan

- 10:50 – JP foreigner bond and stock purchases

- 11:30 – AU trade balance

- 12:30 – JP BOJ board member Nakamura speaks

- 14:35 – JP 10-year JGB auction

- 16:00 – SG retail sales

- 21:00 – OPEC meeting

- 21:00 – EU retail sales

- 23:30 – US job cuts

- 00:30 – US jobless claims

- 03:30 – US FOMC Barkin speaks

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge