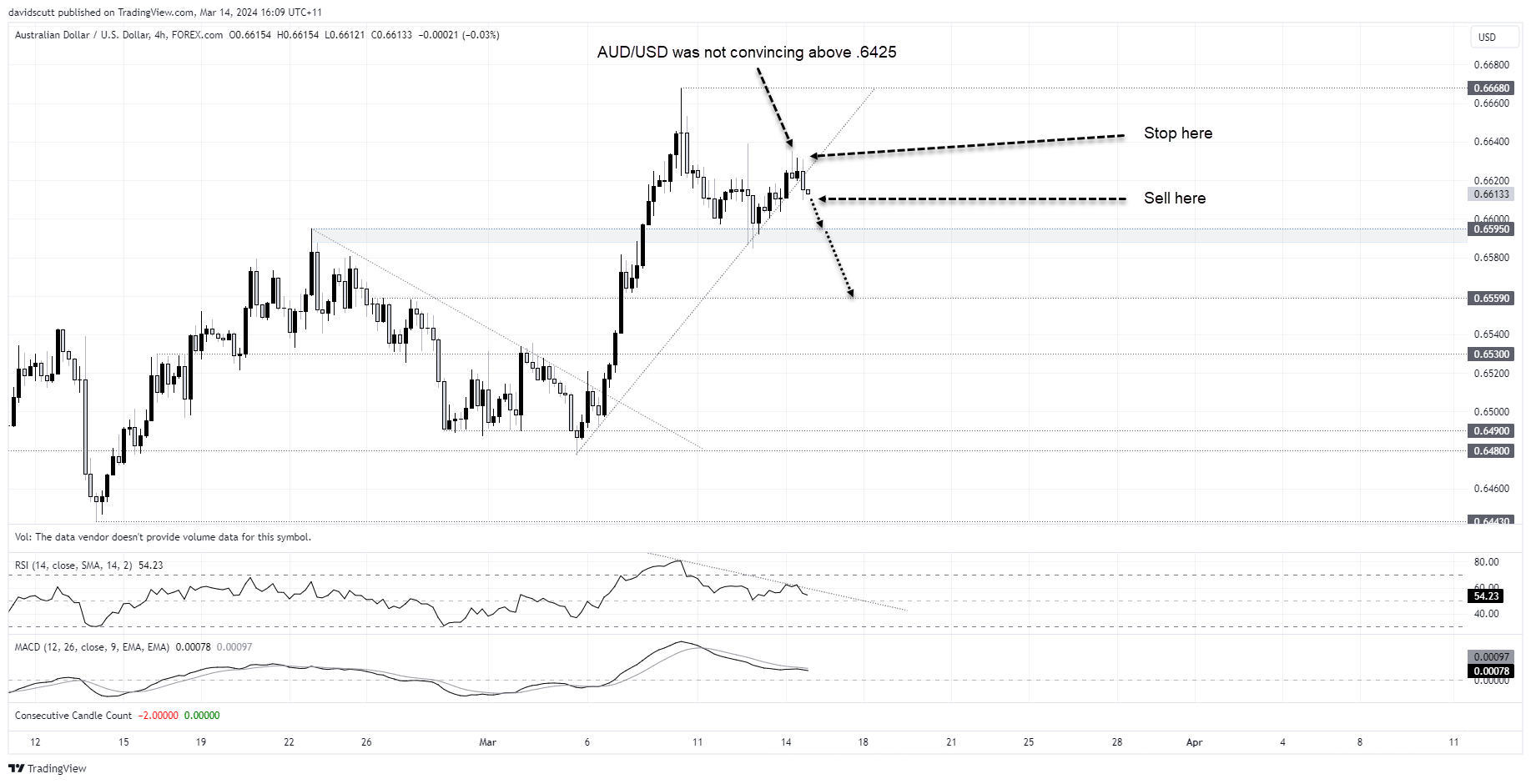

- AUD/USD has broken the uptrend it’s been sitting in since early March

- Iron ore and coal prices are being hammered. They are Australia’s largest mineral exports

- Interest rate differentials are working in favour of the US dollar

- US PPI and retail sales figures for February will be released Thursday

AUD/USD looks heavy on the charts, weighed down by tumbling iron ore and coal prices and widening interest rate differentials with the United States.

Commodities look great, just not those important for Australia

While commodities are generally faring well right now, those most important to Australia are not. Iron ore futures, the nation’s largest mineral export by dollar value, have tumbled into a bear market with no sign of a bottom yet. Coking coal futures are also in the wars, sliding to six-month lows after breaking out of a bearish pennant pattern on Wednesday.

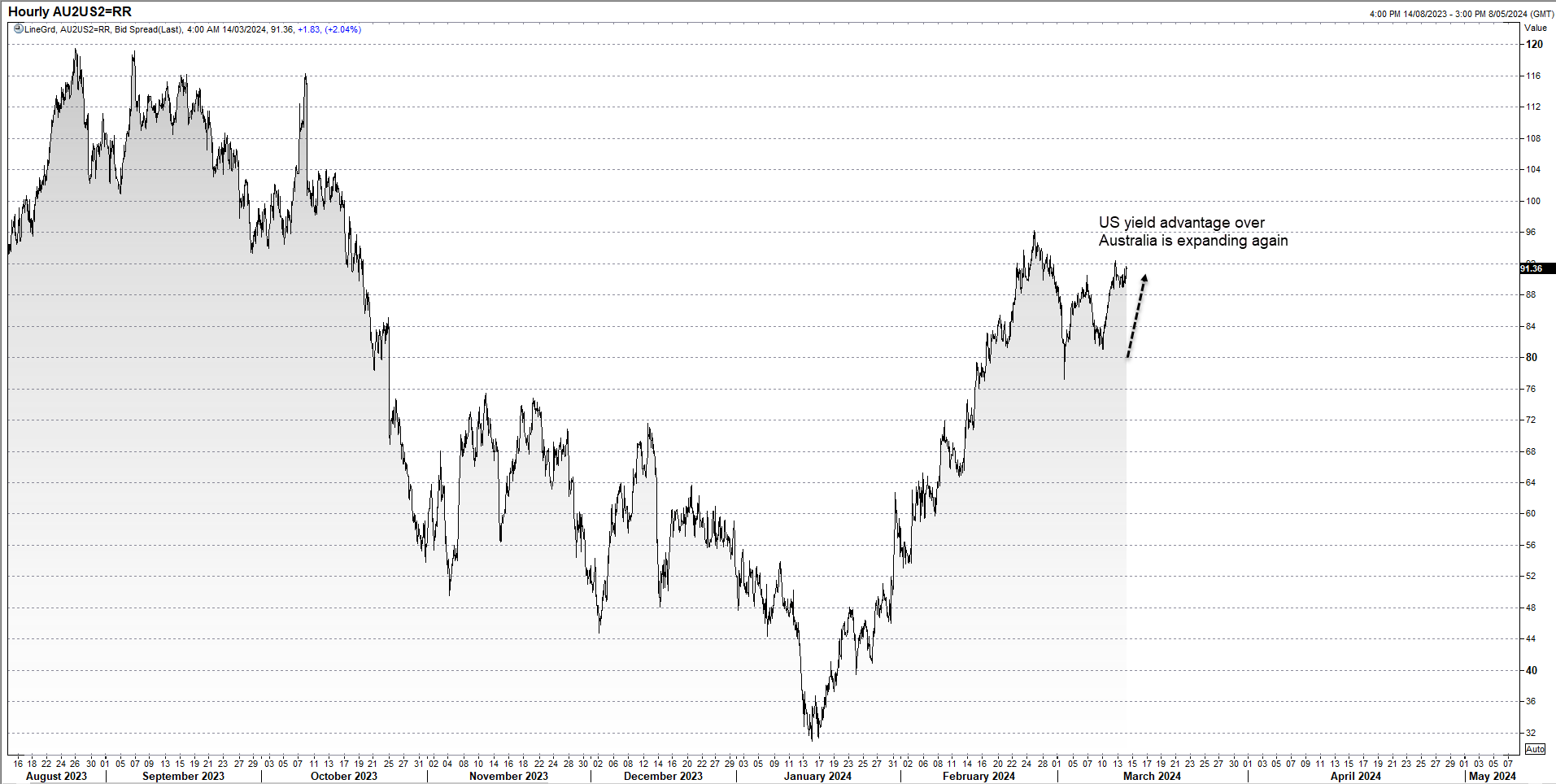

Yield differentials are weighing again

It’s not just soggy bulk commodity prices that are doing the damage, either. Interest rate differentials are also weighing with two-year yield spread with the United States widening pushing back above 90 basis points.

Source: Refinitiv

US two-year yields have risen 22 basis points from last week’s lows, outpacing the move seen in Australian short-dated bonds.

Later Thursday, US producer price inflation and retail sales data for February will be released. In January, US PPI and CPI was surprisingly strong, so markets may be sniffing out a similar outcome after February’s CPI report showed continued strength earlier this week. Retail sales are also expected to rebound 0.8% in February after severe weather dampened spending in January. If there was a common trend prior to the drop in January, it was for spending to surprise to the upside.

AUD/USD breaks uptrend

Having roared higher last week, fueled by a technical break and anticipation of a soft US CPI release that ultimately proved to be incorrect, AUD/USD has not been able to go on with the move this week, offered whenever it attempted to push above .6425. The last two H4 candles prior to the uptrend break were both inverse hammers, indicating sellers having the upper hand near-term.

The clean break makes for a more compelling downside case with momentum still moving in that direction. Below the downtrend, there’s been a support/resistance zone that’s been in place over the past few weeks, so that would be the initial target for those keen to short. Below, .6559 and .6530 would be the next targets. A stop should be placed above the former uptrend for protection.

-- Written by David Scutt

Follow David on Twitter @scutty