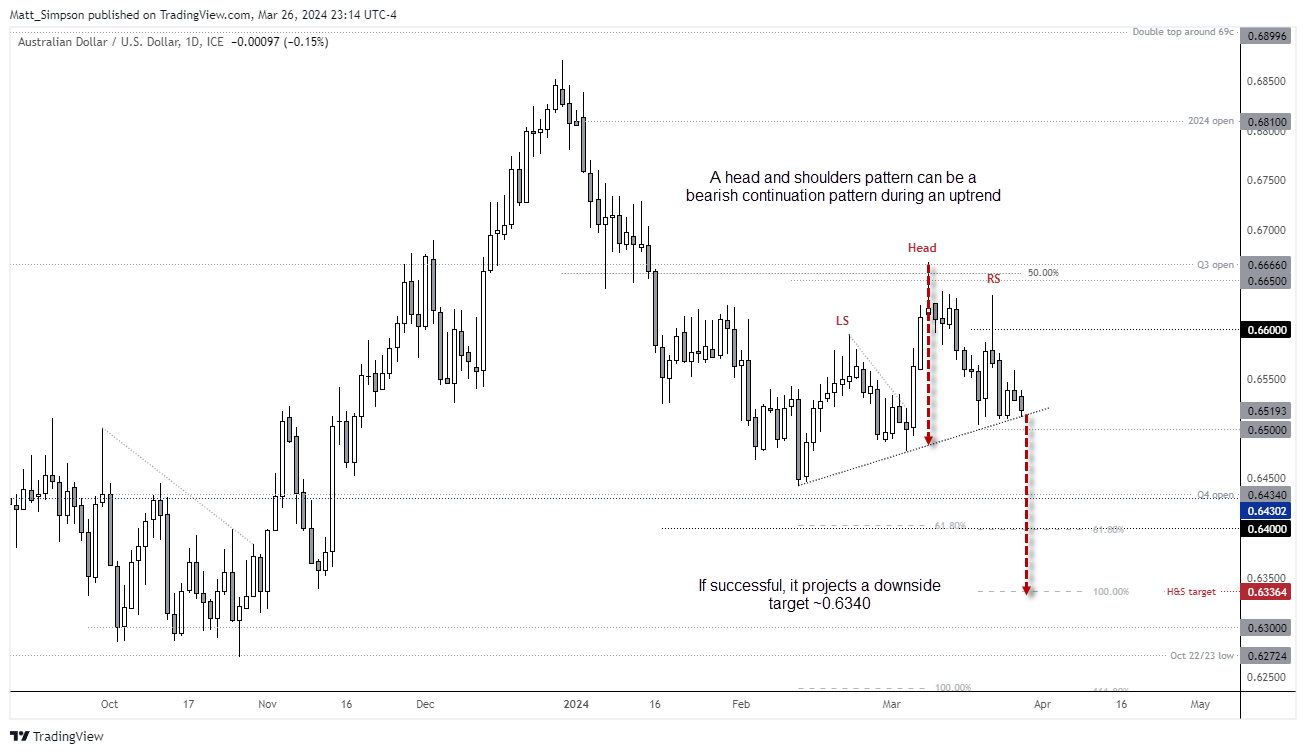

AUD/USD technical analysis:

The daily chart sports a potential head and shoulders pattern. Whilst this is usually a bearish reversal pattern seen at market tops, it can also be a continuation pattern during a downtrend. Conversely, an inverse head and shoulders pattern is usually associated with market bottoms as a reversal pattern can also be bullish continuation patterns during an uptrend. They are treated the same as the reversal patterns, in that a break of the neckline confirms the move and the distance between the neckline and top of its head is projected from the breakout point, to estimate a potential target.

In this instance, the head and shoulders top projects a downside target just below the 0.6336. And whilst it appears on the cusp of breaking the neckline, bears may want to see if it breaks the 65c handle nearby for added confirmation. But will that be enough?

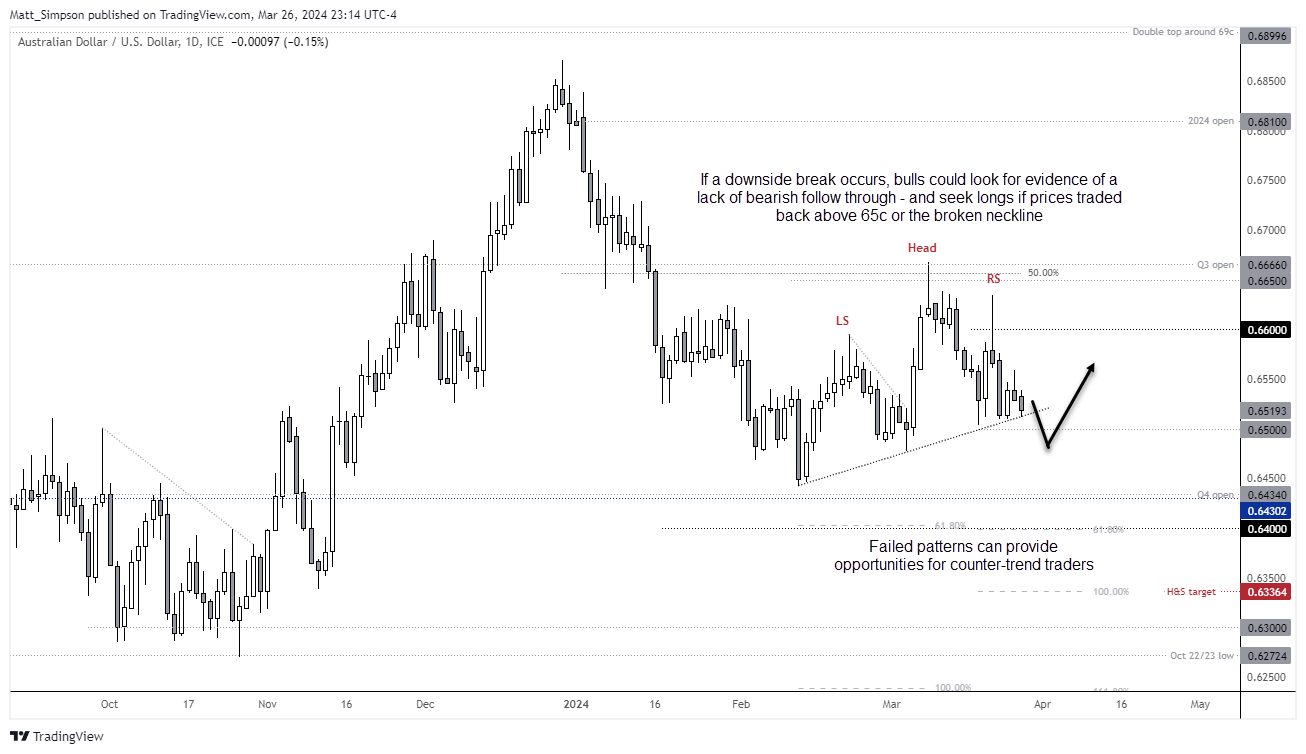

AUD/USD: A failed pattern can also bring opportunity

As great as this pattern looks, there are a few things troubling me about this pattern.

- A breakout from a head and shoulders pattern should be hard and fast. No messing around. Yet AUD/USD has been messing around since Friday's close

- AUD/USD is holding above 65c despite weighed-mean inflation coming in softer than expected today.

- We're also at end of the month and quarter, heading into the long Easter weekend. And that can lead to fickle price action and false breakouts.

- Traders were also net-short AUD/USD by a record amount last week - so shorting the Aussie is NOT a new idea. Far from it.

So unless we're treated to a sudden bout of risk off, my guess is that any break of 65c could be a failure for bears. And in turn, an opportunity for countertrend traders.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge