- AUD/USD has ample upside momentum right now

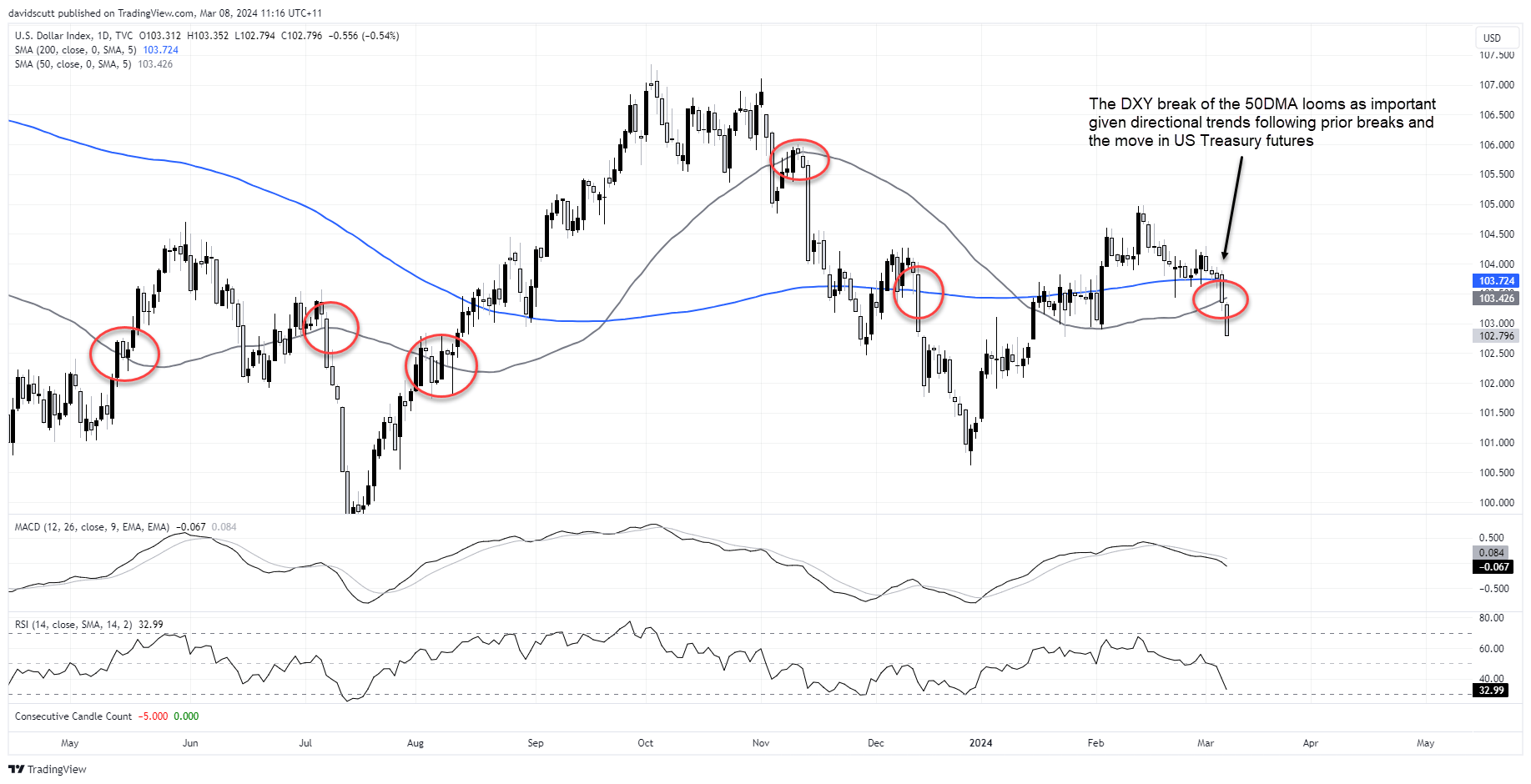

- Just as higher bond yields helped power the USD rally this year, lower yields are deflating bullish dollar bets

- US 10-year bond futures and DXY have broken key moving averages this week

- US non-farm payrolls is the largest known event risk on Friday

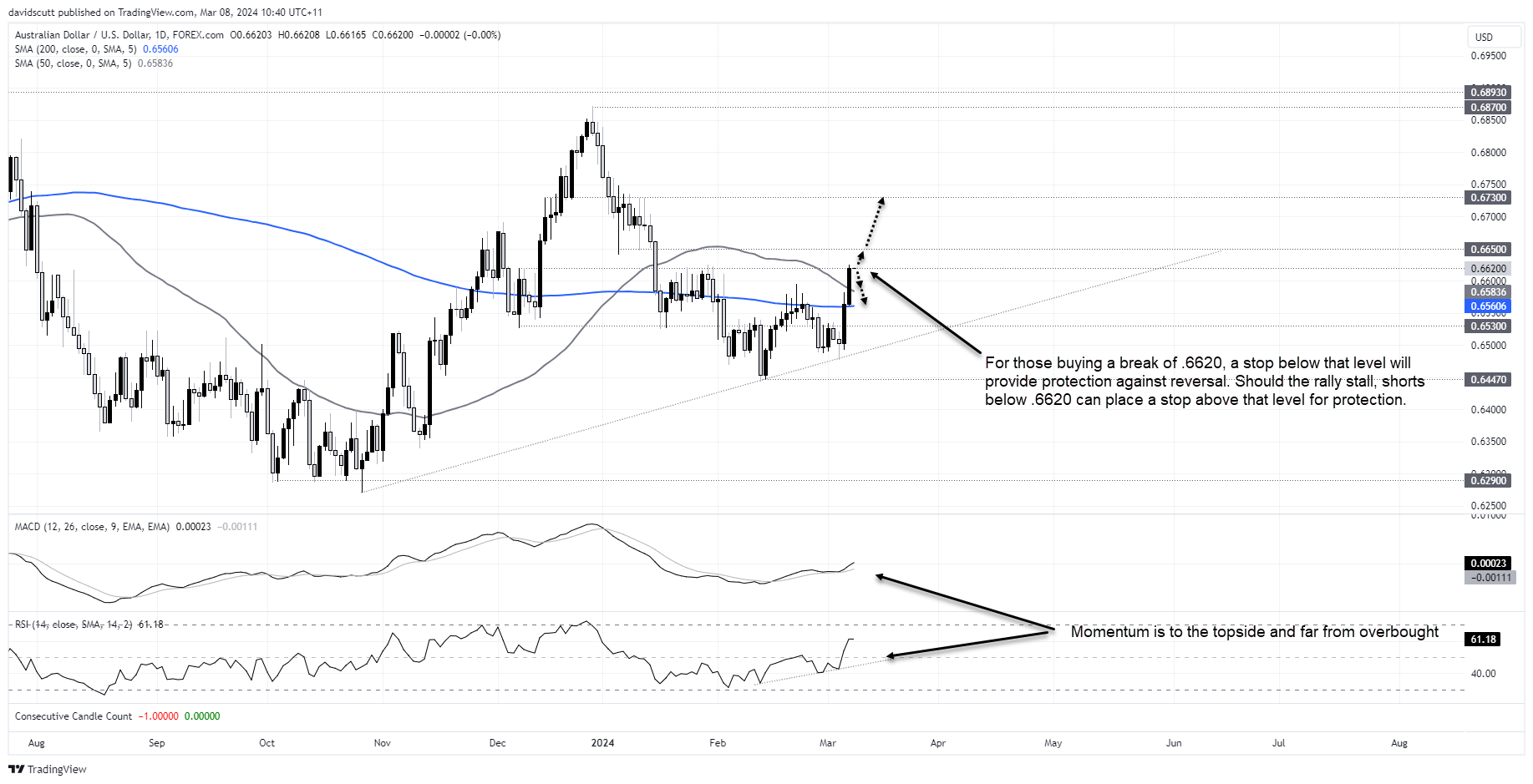

AUD/USD has surged to a technical level where it’s done plenty of work around in the past, providing an opportunity for traders to establish trades with excellent risk-reward potential. With declining US bond yields suffocating the US dollar rally, directional risks appear slanted to the upside unless we get another hot nonfarm payrolls report later in the session.

AUD/USD rebound gathers speed

On the charts, AUD/USD has been respectful of existing levels during the week, testing uptrend support on Wednesday following a soft Australian GDP report and disappointment over the details provided at China National People’s Congress before rebounding to prior resistance at .6530. From there, the daily candles have been big and bullish, sending AUD/USD back above its 50 and 200-day moving averages for the first time since early December.

As things stand, AUD/USD is testing horizontal support at .6620, a level which successfully capped rallies back in December and February. The price tried to break through on Thursday only to be knocked back lower, suggesting near-term action may determine which direction the price heads.

Caution ahead of US nonfarm payrolls could explain the reluctance to go on with the explosive move, although some noteworthy developments earlier this week in US markets suggests the AUD/USD may continue its upward thrust.

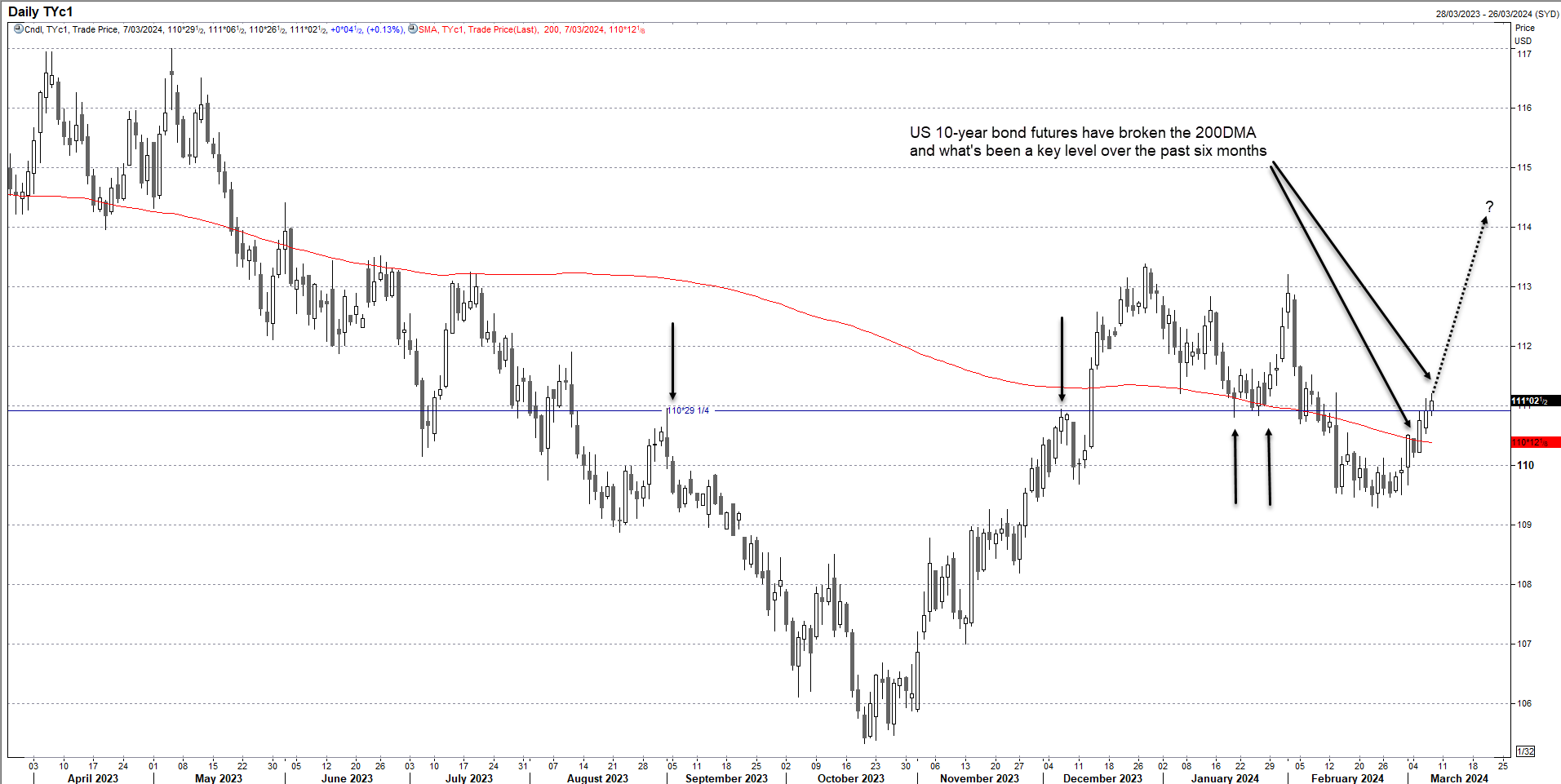

US bond futures break key level

The first was US 10-year Treasury futures breaking cleanly though the 200-day moving average, an outcome that looms as significant given prior breaks have regularly led to prolonged directional changes. If that’s the case on this occasion, that points to the potential for lower US yields.

Source; Refinitiv

DXY breaks down

Secondly, with the US yield advantage over the rest of the world starting to compress again, its seen capital move from the big dollar to other currencies, sending the broader US dollar index (DXY) through the 200-day moving average, too.

AUD/USD trade ideas

While the domestic Australian economic picture is hardly looking stellar right now, sitting at historically low levels with most commodity prices enjoying tailwinds from a softer USD, technicals and fundamentals have been working in the AUD/USD’s favour recently.

Depending on how the price evolves, the proximity of resistance at .6620 allows traders to use that level for protection.

For those considering longs, which is my favoured play, buying a clean break of .6620 allows for a stop loss to be placed below for protection. With only minor resistance located at .6650, an initial upside target could be .6730, where the price did plenty of work either side over the turn of the calendar year.

With MACD and RSI trending higher, momentum remains to the upside, especially after the break of the two moving averages earlier in the week.

However, should the price be unable to break .6620, establishing shorts below the level with a stop loss above offers decent risk-reward for those targeting a reversal to the 50 and potentially 200DMA.

Non-farm payrolls loom

Nonfarm payrolls is the largest known risk event on Friday by some distance. Based on what we’ve seen over recent days, price action suggests markets are expecting a far cooler outcome than the large increase in hiring and wages growth reported in January, so another hot outcome is the risk. But alterative labour market indicators received prior to the report signal continued gradual cooling in overall conditions.

-- Written by David Scutt

Follow David on Twitter @scutty