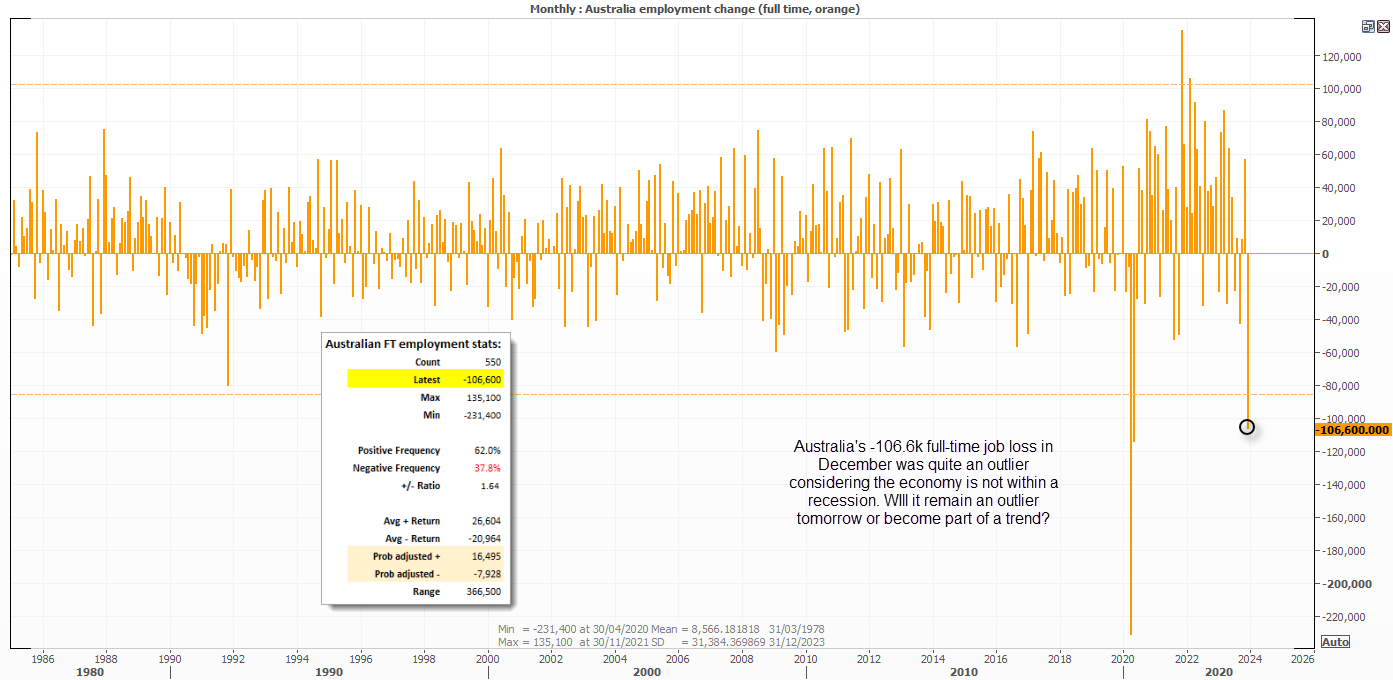

Australia’s employment figures for January are released tomorrow, and I’m particularly keen to see if the significant loss of full-time jobs is seen for a second consecutive month. It is unlikely to result in the RBA cutting or even dropping their easing bias any time soon, but it would be more evidence of a slowing economy and could bring forward expectations of when the RBA perform a dovish pivot. And markets could react on that.

Whilst December’s 106k culling of full-time employees was the standout figure, it was not alone with its festive gloom.

- Headline employment fell -65.1k

- The participation rate fell at it’s fastest m/m pace in 15 months

- Employment to population ratio fell to a 19-months low.

Admittedly, the participation and E/P ratio have fallen from very high levels and unemployment remains relatively low at 3.9%, so I’m looking at the full-time figures to see if they are the canary in the jobless coalmine.

To put the -106k figure into perspective, it is the third worst print on record – and arguably the worst if you consider that Australia is not within a recession. The average positive return is 26.6k (16.5k probability adjusted) and the average negative return is -20.9k (-7.9k probability adjusted).

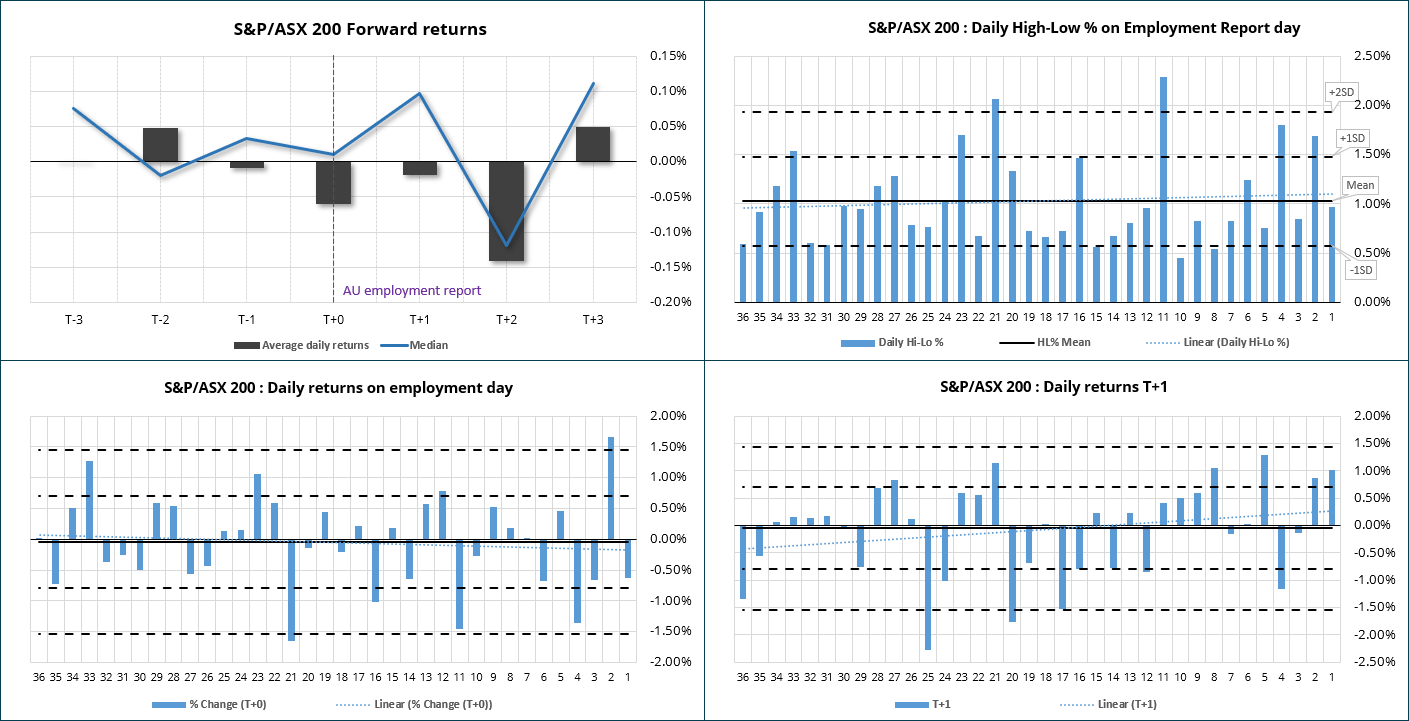

ASX 200 performance on Australia’s employment-report day:

The ASX 200 has averaged negative returns on the day of the employment report using data since 2007. T+2 averaged the strongest losses, although it is worth median gains were delivered between T_1 to T+1 to suggest a minority of down days has dragged the averages lower.

As for volatility levels on the day, the ASX has an average high-low range of +/- 1.05% over the past three years. The -1 to +1 standard deviation band suggests a 68% chance that the high-low range will land between 0.57 – 1.48% on the day.

Looking at the performance on the day (T+0) doesn’t reveal any major clues, although I have noted the it has closed lower 6 of the past 4 reports. The days after (T+1, or this Friday) has seen returns trend higher over the past 14 months.

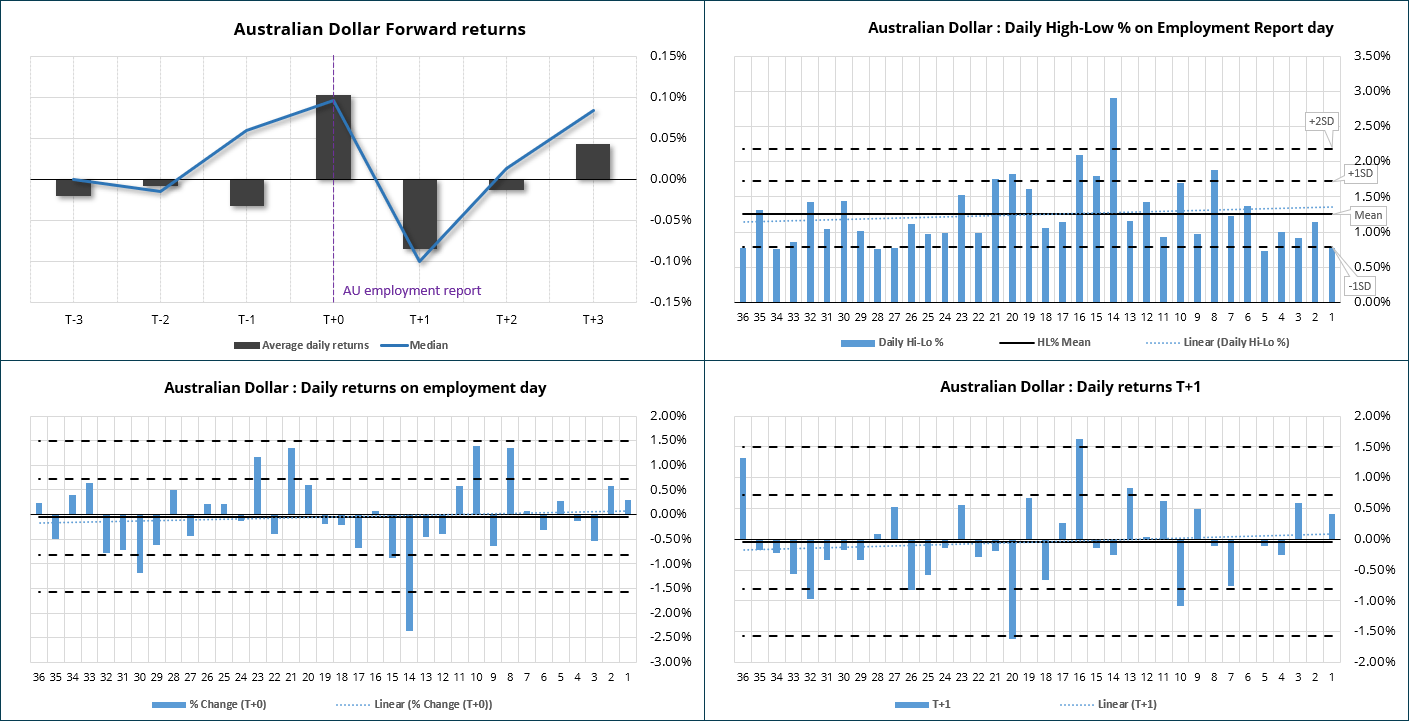

AUD/USD performance on Australia’s employment-report day:

- AUD/USD tends to perform on employment-report day, with an average and median gain of 0.1%

- The average high-low range at T+0 is 1.25% (although the past five reports have been less than 1%)

- There is no clear trend for AUD/USD’s direction at T+0 or T+2 over the past three years

- The 1-standard deviation band implies with a 68% probability the range will be between 0.79% to 1.72%

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge