AUD monthly outlook: January performance and highlights

- AUD/USD suffered its worst month in 11 in January, and was the second weakest FX major behind the yen

- Traders scaled back bets of several Fed cuts this year which helped the US dollar rally from its December low and force AUD/USD -3.5% lower for the month

- Even further promise of stimulus from China failed to revive sentiment towards the Australian dollar

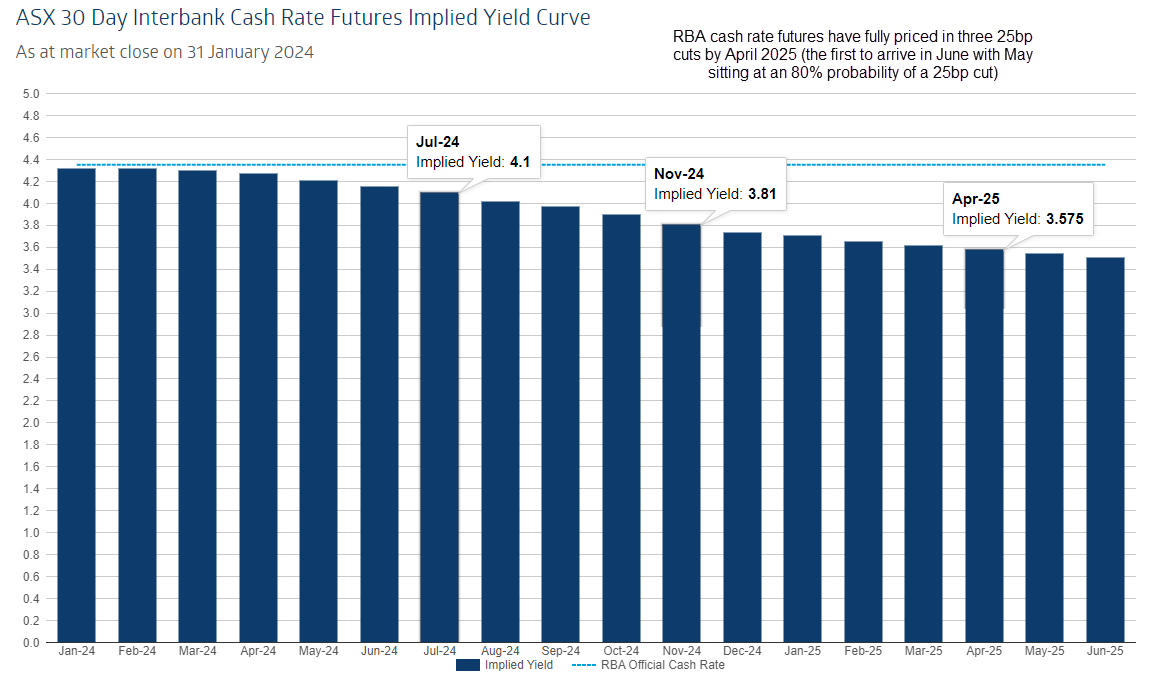

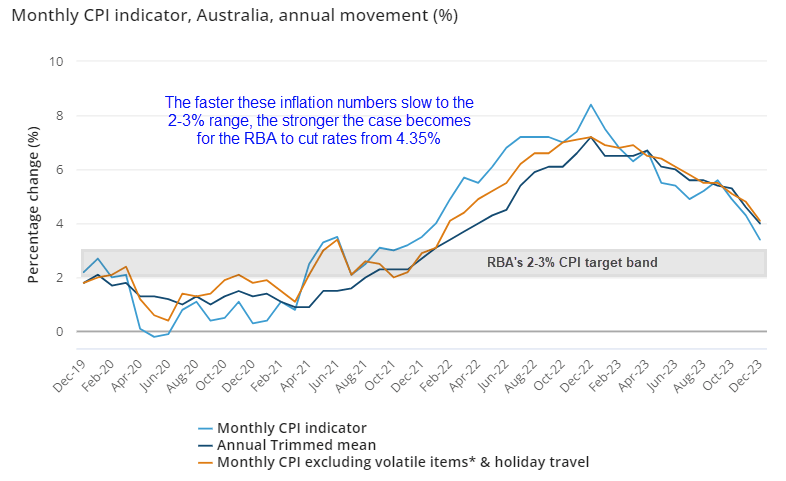

- The rate of Australian CPI softened faster than expected in Q4, which brought forward bets that the RBA could cut rates as early as May

- The odds of a cut by May rose to 80% and a July cut is now full priced in, according to the RBA’s cash rate futures curve

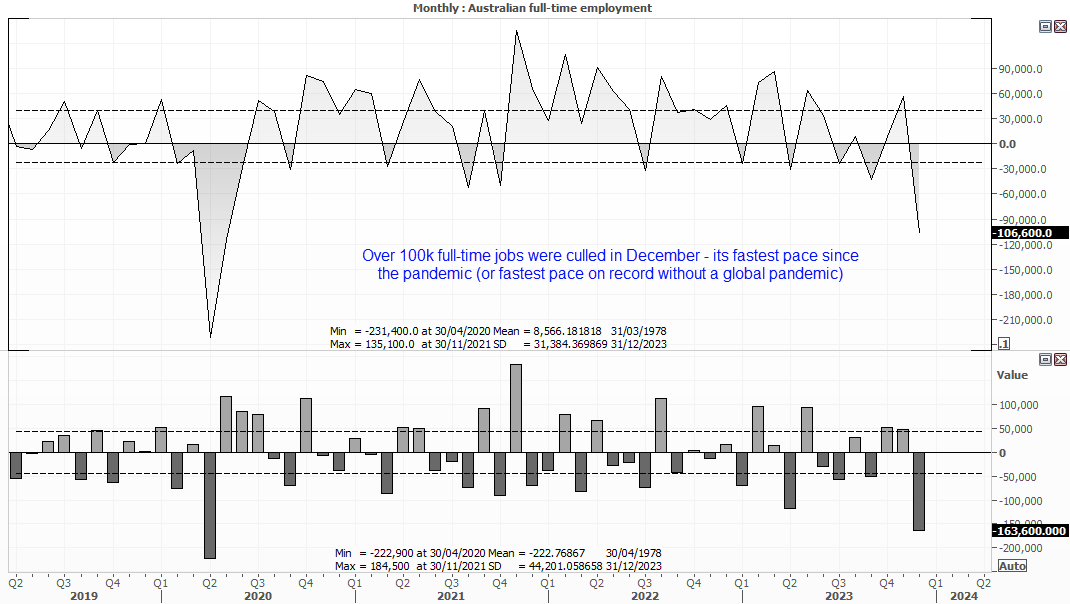

- January reports showed that the economy was cooling in December, with retail sales down -2.6% m/m and over 100k full-time jobs were shed

What to look out for in February 2024

|

Event |

AEDT (GMT 11) |

|

Producer price indices |

11:30, 2nd Feb |

|

US Nonfarm payrolls report |

00:30, 4th Feb |

|

International goods in trade |

11:30, 5th Feb |

|

RBA cash rate decision |

14:30, 6th Feb |

|

Houeshold spending |

11:30, 9th Feb |

|

Labour force report |

11:30, 15th Feb |

|

Wage price index |

11:30, 21st Feb |

|

Monthly CPI report |

11:30, 28th Feb |

|

Retail trade, capex report |

11:30, 29th Feb |

RBA cash rate decision – 14:30 AEDT, February 6th

“Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks”.

RBA statement, December 2023

It seems highly unlikely that the RBA would cut their interest rate next week, even if that is what many want to see. Sure, retail sales, inflation and full-time employment were lower, yet unemployment remains low by historical standards. It is also too soon to tell whether soft retail sales are trending lower, or if it was that shoppers scaled back purchases after big spending over the Black Friday sales. Furthermore, the Fed (who the RBA tend to mimic) have a higher interest rate of 5.25 – 5.5% and continue to push back on imminent rate cuts.

However, the soft inflation report for Q4 could get a mention in the RBA’s statement, and that could spark a bout of AUD selling if traders suspect the RBA are nearing a dovish ‘pivot’.

Labour force report – 11:30 AEDT, February 15th

If the RBA meeting reveals no clues for policy, we’d next look to the employment report. The -106.6k full-time jobs lost in December was its fastest pace since the pandemic. Or to put it another way, a very large drop considering there was no global shutdown. We likely don’t need to see another -100k print on full-time jobs to spark panic of a slowdown and renewed bets of an RBA cut in H1. However, if full-time jobs were to rebound then it underscores the strength of the relatively low 3.9% unemployment rate. And that could push back bets of an RBA cut.

Monthly inflation report - 11:30 AEDT, February 28th

The RBA have just been gifted a notably softer set of quarterly inflation prints. And whilst the quarterly report is considered to be more robust (and therefore favoured by the RBA), the monthly report can sway expectations of the Q1 CPI report to be released in April.

Ultimately, the faster headline CPI numbers fall towards and ideally within the RBA’s 2-3% CPI target band, the stronger the case is for cut/s to begin sooner than later. The ideal scenario for a lower cash rate is for retail sales, household spending, employment and inflation to weaken. And that could even spark bets of a March cut and would surely weigh on the Australian dollar to send it closer towards towards 60c.

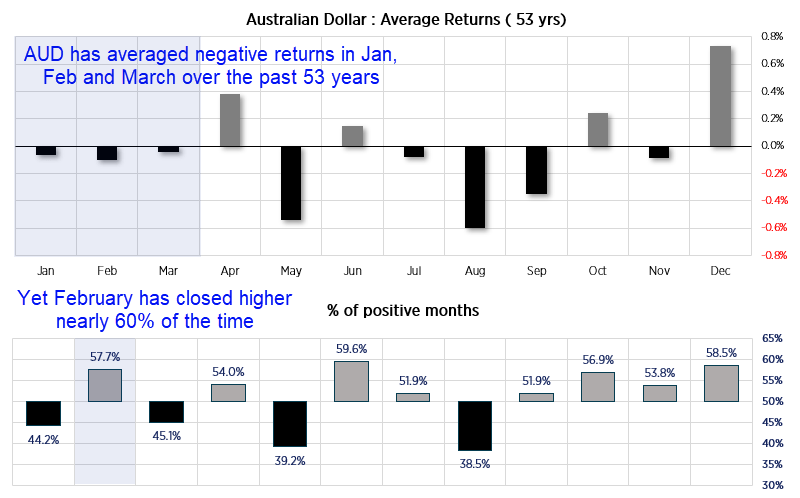

AUD/USD seasonality:

The Australian dollar has been tracking its seasonal pattern well, having posted strong gains in December (thanks Santa’s rally) before switching lower in January. Over the past 53 years, AUD/USD has delivered negative average returns in January, February and March, and has closed lower ~58% of the time in January and March.

However, whilst February has averaged negative returns, it has actually closed higher nearly 58% of the time to show the bearish months outweighed the positive.

- The average up month in February is 1.9%

- The average down month in February is -2.8%.

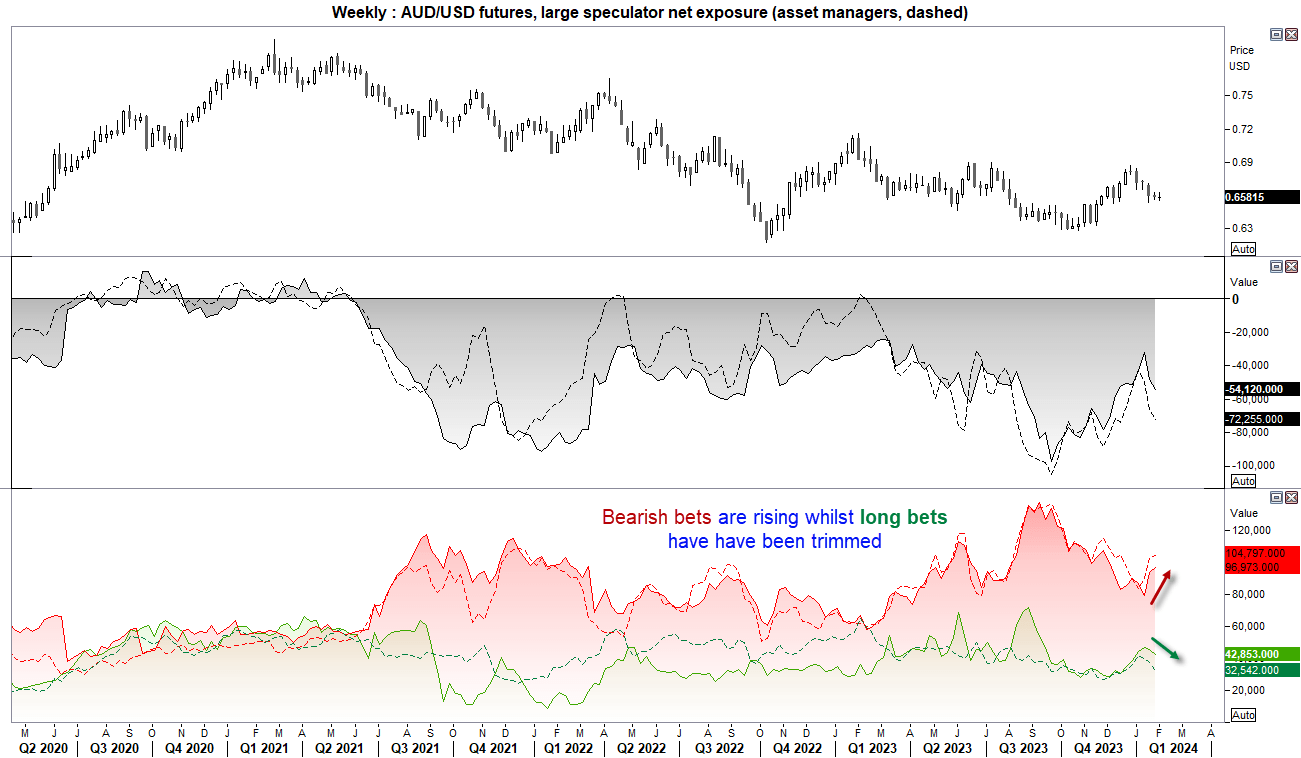

AUD/USD futures: Market positioning from the COT report

Shorting AUD/USD is not a new idea, with large speculators being net-short Aussie futures since June 2021. Yet the closure of short bets in recent months looks set to reverse, with bears stepping back in and long exposure being reduced. Given net-short exposure does not seem to be around a sentiment extreme, it suggests further downside potential for AUD/USD over the coming weeks.

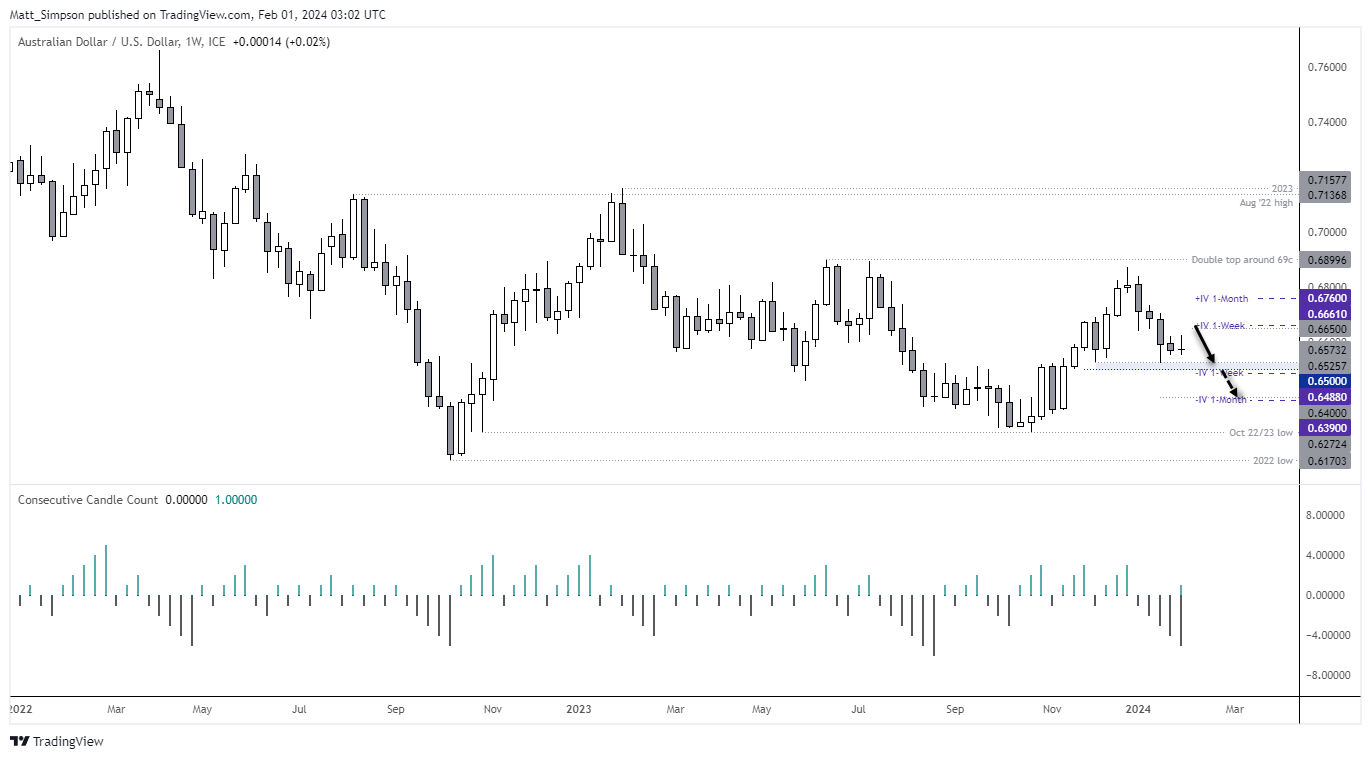

AUD/USD weekly/monthly chart:

AUD/USD has traded lower for four consecutive weeks and is considering trading lower for a fifth. Statistically, this could raises the risk of a minor bounce, given that bearish sequences tend to peter out around the fourth of fifth week. Also note the bearish inside week which formed last week, and AUD/USD has held above cycle lows despite the less-dovish0than-hoped FOMC meeting.

The bias is to sell into minor rallies given the relative hawkishness of the Fed compare with the RBA. Another soft employment and inflation report could help send AUD/USD below 65c. Take note that the 1-month implied volatility band suggests ~68% chance of prices landing between 0.6390 – 0.6760 at the end of Feb.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge