This is an excerpt from our full 2025 Gold Outlook report, one of nine detailed reports about what to expect in the coming year.

Gold technical analysis and key levels to watch

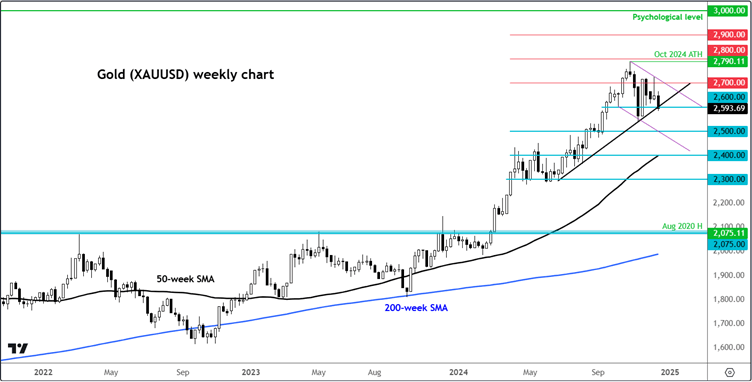

There is little doubt in our minds about the long-term gold outlook, even if the short-term direction looks somewhat murky. In fact, a short-term correction will make gold more attractive again after its big rally in 2024. A correction or continued consolidation will also help some of the longer-term momentum indicators such as the monthly Relative Strength Index (RSI) to work off their “overbought” conditions. Once some froth is removed, we will then be on the lookout for a strong bullish signal to emerge as prices near some of the potentially key support levels that we are monitoring.

Source: TradingView.com

Key levels and trades to monitor on gold

- $2,075-$2,080: This range marks a key support zone on multiple long-term time frames, which served as major resistance between 2020 and 2023 and could act as a strong floor if prices retreat significantly. A drop to around this area would likely attract buyers who missed out on gold’s 2024 rally, reinforcing its long-term bullish outlook.

- Of course, gold may not dip that deep to reach the abovementioned $2,075-$2,080 range, before it starts it next leg up. If we instead witness only a modest retracement, which is what we expect, followed by some consolidative price action, such that gold forms a long-term continuation pattern, then in that case we would look for a breakout strategy to turn tactically bullish on gold again.

- $2,500: This is an additional support area we are monitoring with the 200-day moving average sitting about $25 below it.

- $2,700 is the most significant near-term resistance level to watch in 2025, where the resistance trend of the potential bull flag pattern meets prior resistance. A clean break above here could target the 2024 high of $2,790.

- $3,000 is the next big psychological level to watch should prices break to a new high in 2025. Expect at least some profit-taking around here.

Putting it all together

The 2025 gold outlook is shaped by a complex interplay of macroeconomic, geopolitical, and technical factors. While the early part of the year may present challenges, the metal’s long-term fundamentals remain strong. Inflationary pressures, central bank buying, and geopolitical uncertainties continue to support gold’s role as a strategic asset in diversified portfolios.

For professional investors and retail traders alike, navigating the gold market in 2025 will require a balanced approach. Monitoring key economic indicators, currency movements, and geopolitical developments will be essential for identifying opportunities and managing risks. With a cautious start expected, patient investors could see gold regain its shine, ultimately pushing toward the coveted $3,000 mark.

This is an excerpt from our full 2025 Gold Outlook report, one of nine detailed reports about what to expect in the coming year.