This is an excerpt from our full 2025 GBP/USD Outlook report, one of nine detailed reports about what to expect in the coming year.

GBP/USD showed resilience in 2024, falling just 1% across the year. The pair experienced strong gains between April to September, rising from a low of 1.23 to a high of 1.34. However, GBP/USD fell 5% in the final quarter of the year amid notable USD strength, pulling GBP/USD from 1.34 to the 1.25 level where it trades at the time of writing.

While the pound booked losses against the US dollar in 2024, GBP's performance against other major peers was impressive, rising solidly against EUR, CHF, CAD, AUD, and JPY.

GBP/USD has been supported across 2024 by the BoE cutting rates at a slower pace than the Federal Reserve and by the expectation that this trend would continue in 2025. However, Donald Trump's victory in the US election, combined with the Labour government’s Budget, means that the outlook for both economies has changed, potentially impacting the direction of monetary policy in 2025 for both central banks and GBP/USD.

GBP/USD outlook – UK economic factors

Growth

The UK economy is expected to continue to grow in 2025. However, GDP could be weaker than the 1.5% forecast by the BoE owing to several key factors, including uncertainty surrounding trade and a less expansionary UK budget.

Trump’s second term in the White House brings uncertainty, and UK trade will be under the spotlight. While the UK isn’t directly in the firing line for tariffs, the openness of the UK economy means a global shift towards increased tariffs could hurt growth prospects. However, should the UK pursue and achieve closer ties with the US or the EU, this could help growth but not to the extent of reducing the impact of Brexit.

The extent of the indirect impact of trade tariffs on the UK will depend on their magnitude. The UK is already experiencing depressed growth, which Trump’s action could exasperate.

The BoE forecasts GDP growth of 0% in Q4 2024 and 1.5% in 2025. The OECD forecasts 1.7% growth, and Bloomberg's survey of economists points to growth of 1.3%.

Inflation

In November, inflation in the UK was 2.6% YoY, rising for a second straight month and remaining above the Bank of England's 2% target as wage growth and service sector inflation remain sticky.

The labour market has shown signs of easing, but unemployment remains low by historical standards at 4.2%, and wage growth elevated at 5.2%. We expect some softening in the UK job market following the Labour government’s first Budget.

Chancellor Rachel Reeves placed a major tax burden on employers with a rise in employer National Insurance contributions and an increase in the minimum wage. A broad range of UK labour market indicators point to a weakening outlook, with surveys indicating that UK firms (especially smaller firms) are scaling back hiring plans.

Although wage growth and service sector inflation were slightly firmer than expected at the end of 2024, the disinflationary trend remains intact, with core inflation well below last year's highs.

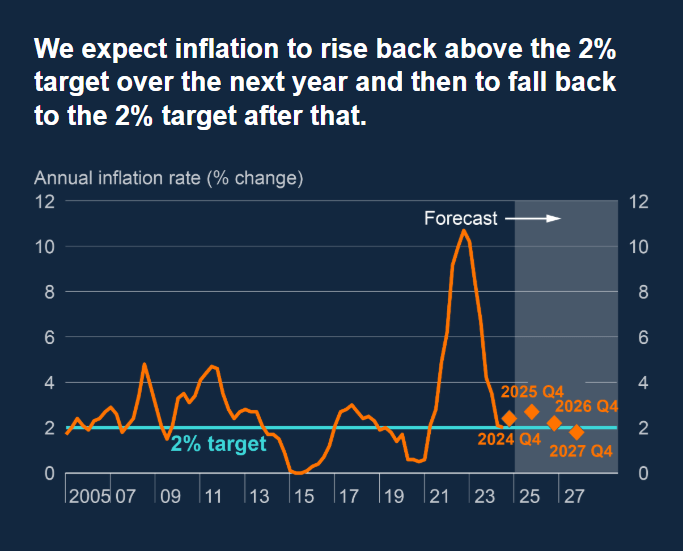

The BoE projections show CPI could reach 2.7% in 2025 before easing to 2.5% in 2026. However, this could be lower if the labour market weakens further and if growth remains lacklustre.

Source: BoE Quarterly Inflation Report November.

Will the BoE cut rates in 2025?

At the final BoE meeting in 2025, the BoE left interest rates unchanged at 4.75%, in line with expectations. However, the vote split was more dovish than expected, at 6-3 compared to the 8-1 forecast. This suggests that dovish momentum is building within the monetary policy committee for a rate cut in February.

The central bank signaled gradual, rare cuts throughout 2025 amid sticky inflation, although policymakers are increasingly concerned over the growth outlook. The market is pricing 50 basis points worth of cuts in 2025, supporting the pound.

However, this could be conservative given that the labour market could weaken considerably following the Budget. A weaker labour market will lower wage growth and impact consumption, potentially cooling inflation faster. Uncertainty surrounding trade could ease inflationary pressures further in 2025, meaning deeper cuts from the BoE than the market is pricing in. As a result, GBP could come under pressure across H1 2025.

GBP/USD outlook - US economic factors

USD strength was nothing short of impressive in Q4. The USD index jumped 5% to reach a two-year high, supported by expectations that the Federal Reserve could cut rates at a slower pace in 2025. Despite the outsized move in Q4, we expect further USD strength in 2025.

At the time of writing, US CPI has risen for the past two months, reaching 2.7% YoY in November. Core PCE is also proving to be sticky, remaining above the Federal Reserve's 2% target. Earlier confidence at the Federal Reserve that inflation would continue falling to the 2% target appears to have faded amid ongoing US economic exceptionalism and a cooling but not collapsing labour market.

Signs of sticky inflation come as the US job market remains resilient. Nonfarm payrolls for November showed 227k jobs were added. Unemployment has ticked higher but is expected to end 2025 at 4.3%, down from 4.4% previously expected.

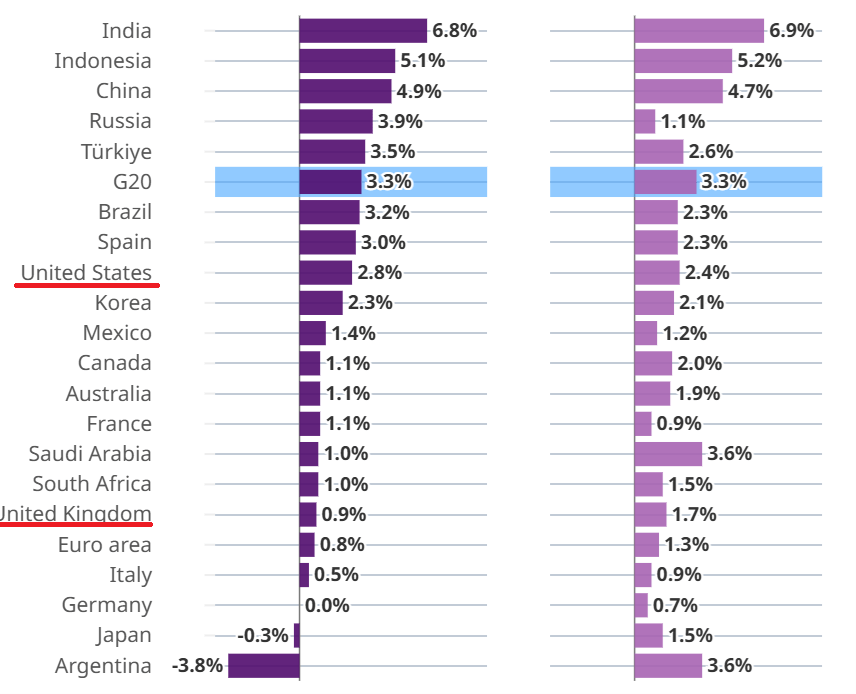

Meanwhile, economic growth in the US remains solid. The US recorded Q3 GDP as 3.1% annually, up from 2.8% in Q2. According to the OECD, the US is expected to see strong growth among the G7 economies, with 2.8% growth expected in 2024 and 2.4% forecast for 2025.

A combination of sticky-than-expected inflation, solid growth, and a resilient jobs market suggests that the US economy is on a strong footing as Trump comes into power.

Source: OECD Economic Outlook

Political factors

Trump is widely expected to implement inflationary measures, including tax cuts and trade tariffs. Inflationary policies at a time when US inflation is starting to heat up again could create more of a headache for the Federal Reserve continuing with its easing cycle.

Will the Federal Reserve cut rates in 2025?

At its last meeting of 2024, the Federal Reserve cut interest rates by 25 basis points, marking the second consecutive 25-basis-point cut and following a 50-basis-point reduction in September, when it kicked off its rate-cutting cycle.

However, the Fed also signaled slower and shallower rate cuts in 2025. Fed Chair Powell’s press conference and policymakers’ updated projections confirm that the Fed will be much more cautious next year.

The Fed increased its inflation forecast to 2.5% YoY, up from 2.1%, and isn’t expected to reach 2% until 2027.

The market is pricing in just 35 basis points worth of cuts next year, and the first rate cut isn’t expected until July.

However, Trump’s policy plans will be the most significant determinant of the Fed's decisions regarding rates next year.

This is an excerpt from our full 2025 GBP/USD Outlook report, one of nine detailed reports about what to expect in the coming year.