Indices CFD trading

Whether it's the Dow Jones, DAX or one of our sector-themed indices such as the Green Index, get exposure to global markets without relying on the performance of a single company.

-

Access global indices with extended trading hours

-

Trade the S&P500 (US SP 500) from 0.4 pts

-

Trade the FTSE 100 (UK 100) and DAX (Germany 40) from 1 pt

Indices explained

-

Go long or shortWhen you trade indices with us, you can profit from both rising and falling markets.

-

Take advantage of leverageYou only have to put up a fraction of the index price to start trading. Leverage can magnify your profits and your losses.

-

Diversify your portfolioGet exposure to a broad section of the market at once rather than relying on a single stock.

Market-leading pricing

Major index moves and news

Indices news and analysis

December 19, 2024 02:23 PM

December 19, 2024 01:37 AM

December 18, 2024 10:16 PM

December 17, 2024 10:06 PM

December 16, 2024 09:52 PM

December 15, 2024 10:59 PM

December 12, 2024 02:29 PM

December 11, 2024 10:05 PM

December 10, 2024 12:21 AM

No Tweets were found.

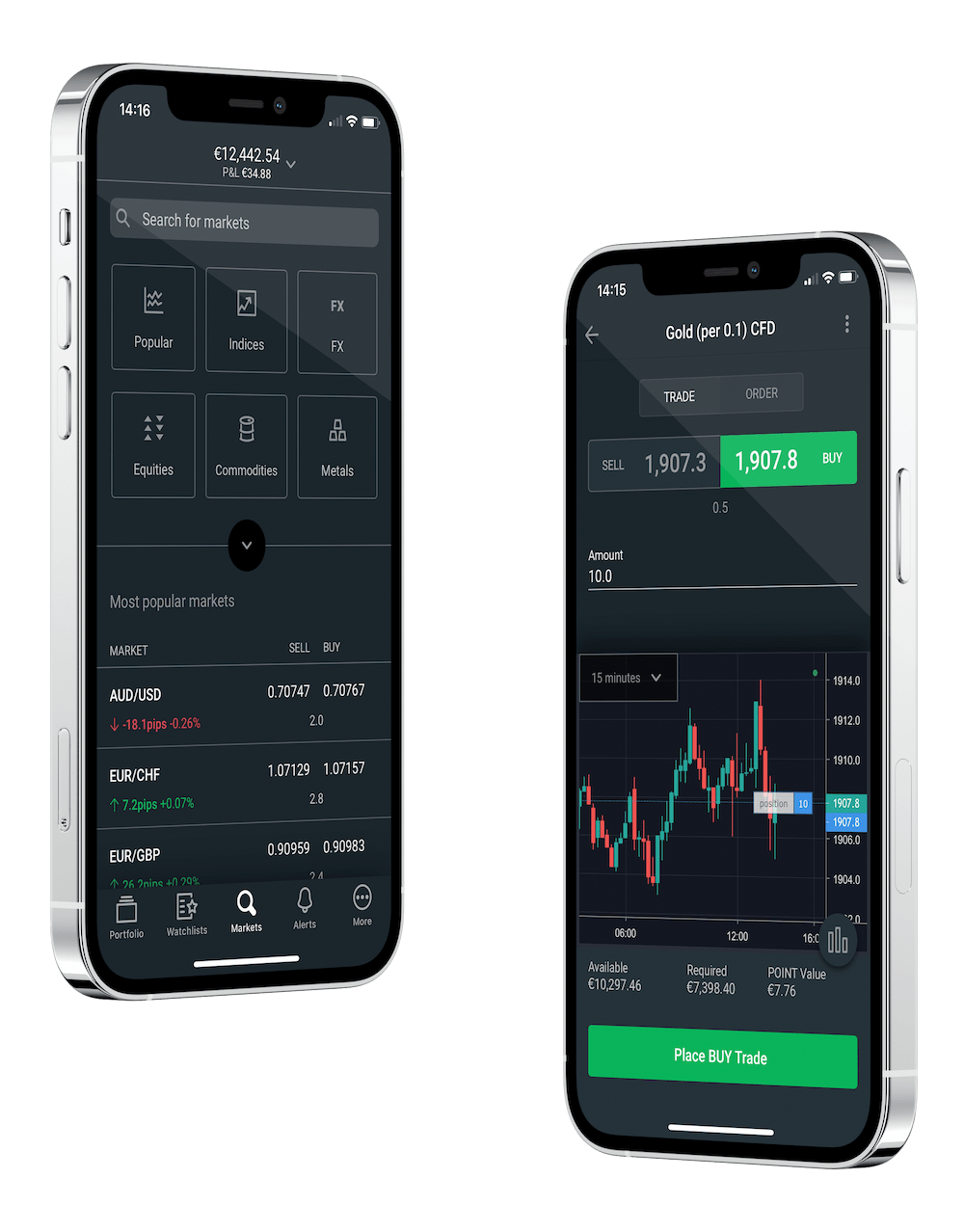

Award-winning mobile apps

Designed for instant control wherever you are, enjoy one-tap trading, intelligent market tools and a customisable layout to suit your trading style.

TradingView Charts

80 indicators, 11 chart types and 14 timeframes.

Trading Central

A research portal that uses technical analysis to scan the markets.

Performance Analytics

Analyse your decision making with the latest behavioural science technology.

Indices FAQ

What moves an index?

A stock index's price is determined by the movements of the shares it tracks. Here are a few factors to watch out for when deciding what might move stock markets:

- The political climate

- Company announcements

- Economic data

- Industry news

Was this answer helpful?

What are the major indices?

Some of the major and most popular indices are:

Was this answer helpful?

What is the index CFD nightly finance charge and how is it calculated?

With most CFDs, financing is debited for long positions or credited for short positions daily if you are in a position at 5pm ET.

These charges are typically calculated as follows:

F=(S x P x R)/D

- F - Daily Financing Charge

- S - Number of CFDs (2500)

- P - Closing Price

- R - Relevant 1-month LIBOR rate, +250 basis points for long positions or -250 basis points for short positions, e.g. (4.50% + 2.50%) = 7.00%

- D - Number of days, i.e. 365 for UK shares and 360 for all others

Was this answer helpful?

If you have more questions visit the indices FAQ section or start a chat with our support.