Cryptocurrency CFD trading

-

Go long or short on crypto CFDs

-

Trade on margin with low deposits

-

A wealth of risk management tools

Our cryptocurrency CFDs

-

Trading cryptocurrency CFDsSpeculate on cryptocurrency prices without the need for a virtual wallet, so no waits on exchanges – just instant trading.

-

Profit from both rising and falling pricesWhen you trade digital coin CFDs with us, you can profit from both rising and falling markets.

-

Take advantage of leverageYou only have to put up a fraction of the Bitcoin – or other crypto – price to start trading. Leverage can magnify your profits and your losses.

What are cryptocurrencies?

Get the latest crypto news

Cryptocurrency news and analysis

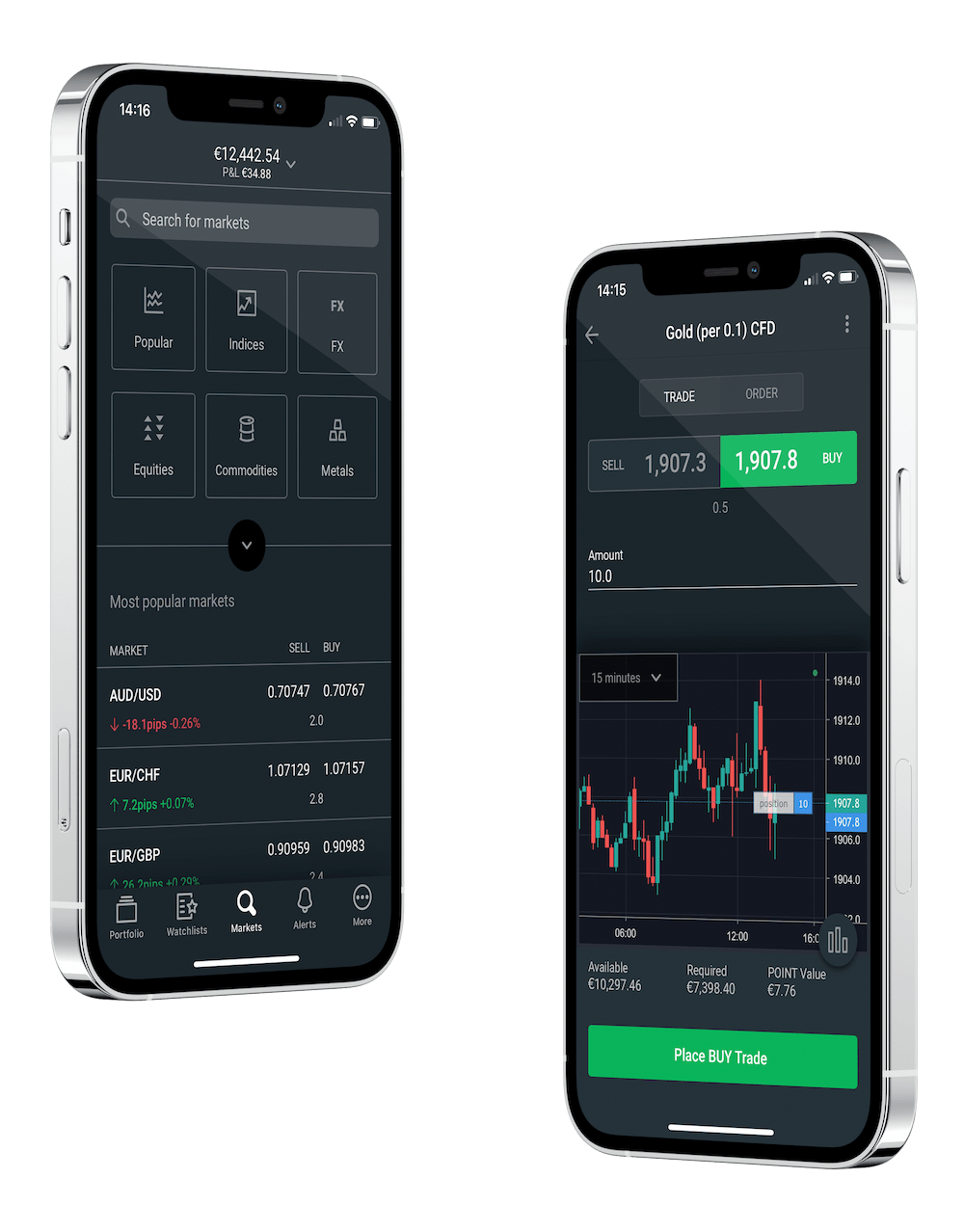

Award-winning mobile apps

Designed for instant control wherever you are, enjoy one-tap trading, intelligent market tools and a customisable layout to suit your trading style.

TradingView Charts

80 indicators, 11 chart types and 14 timeframes.

Trading Central

A research portal that uses technical analysis to scan the markets.

Performance Analytics

Analyse your decision making with the latest behavioural science technology.

Cryptocurrency FAQ

What is Bitcoin?

Bitcoin was the first decentralized cryptocurrency. Created in 2009, Bitcoin uses blockchain verification technology to secure and protect peer-to-peer transactions. Like other cryptocurrencies, Bitcoin is decentralized and not regulated by a central bank or any one government.

Can I short cryptos at FOREX.com?

You can go short on our Bitcoin and Ethereum CFDs. Shorting is not currently available on our other crypto assets.

What are cryptocurrencies?

Cryptocurrencies, or cryptos, are forms of digital, decentralized money not regulated by a government or central bank. Instead, cryptos use encryption techniques to generate, regulate and transfer their units. Cryptocurrencies are often held in virtual online wallets and used for peer-to-peer transactions or online stores that accept them.

Cryptocurrency Trading:

Cryptocurrency CFDs are complex, extremely risky and usually highly speculative. Trading in Cryptocurrency CFDs involves a high risk of loss of funds over a short period of time due to high market volatility, execution issues and industry-specific disruptive events, including, but not limited to, discontinuation, regulatory bans and other malicious actors within cryptocurrency ecosystems. The pricing of Cryptocurrency CFDs might be derived from specific cryptocurrency exchanges, which means that the market depth is limited to what is available in the order books of such exchanges. These markets are relatively new and thus might be volatile and limited in terms of liquidity. The pricing engines of cryptocurrency exchanges may experience delays and/or interruptions which can be caused by numerous potential issues. Cryptocurrency CFD trading is not appropriate for all investors and therefore, any person wishing to trade in Cryptocurrency CFDs should have detailed and updated knowledge and expertise in these specific products. Clients should always be fully aware and understand the specific characteristics and risks related to these products as laid down in this section.