Commodities CFD trading

-

Trade our simplified non-expiring spot contracts

-

Benefit from improved liquidity with variable spreads

-

Trade both long and short across our FOREX.com or MT5 platforms

Why trade commodities with us?

-

No commissionsYou won’t pay a penny on commissions and take advantage of margins from 10%.

-

Go long or shortWhen you trade commodities with us, you can profit from both rising and falling markets.

-

Take advantage of leverageYou only have to put up a fraction of the commodity price to start trading. Leverage can magnify your profits and your losses.

Popular commodities

Market-leading pricing

Major commodity market and news

Commodity news and analysis

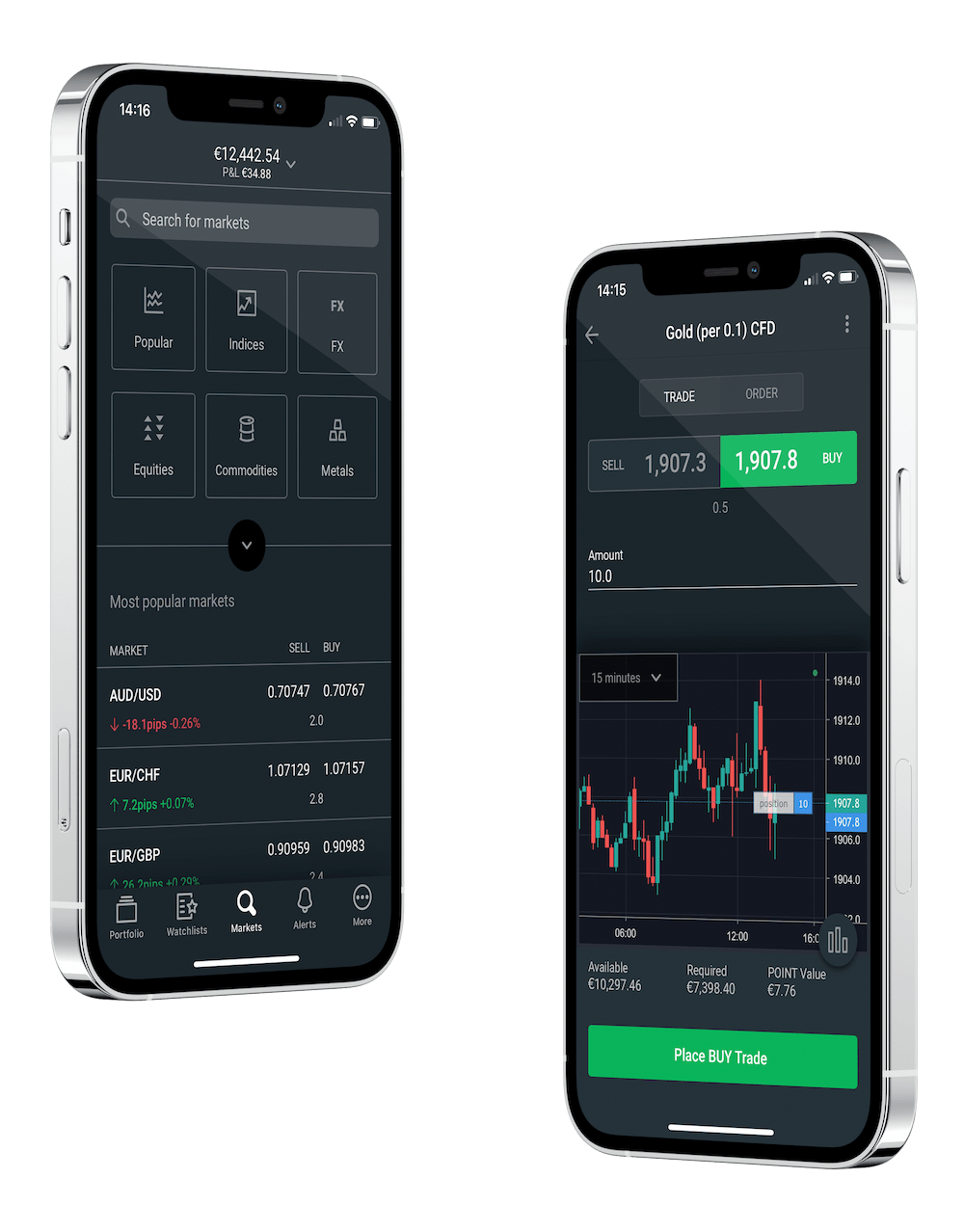

Award-winning mobile apps

Designed for instant control wherever you are, enjoy one-tap trading, intelligent market tools and a customisable layout to suit your trading style.

TradingView Charts

80 indicators, 11 chart types and 14 timeframes.

Trading Central

A research portal that uses technical analysis to scan the markets.

Performance Analytics

Analyse your decision making with the latest behavioural science technology.

Commodities FAQ

How do I calculate how much margin I need to trade a commodity?

The formula to calculate how much margin is required is quantity x price x margin.

When do commodity CFD orders expire?

All of our commodity CFD markets, including markets on MetaTrader, expire. Please note however, that our spot commodity markets do not expire.

The iBox on the trading platform displays the date and time of the next upcoming expiry for a CFD market, and the Market Information Sheets in the trading platform have more details.

When a CFD market expires, we close all open positions based on our most recent prices and all open orders are cancelled. To retain your open positions in a market, you must manually open a new position in the next contract month.