Bond trading

-

Access competitive bond pricing

-

Go long or short on our range of bonds

-

Trade bonds on leverage to do more with your capital

Bonds with FOREX.com

-

Key marketsBuy and sell Euro Bunds, US T-Bonds and UK Long Gilts via CFDs.

-

DiversificationBonds are a popular market for diversifying your portfolio away from indices, shares or FX.

-

Trade bonds with CFDsWith FOREX.com, you’ll be trading bond CFDs, so you can buy and sell bonds alongside our full range of markets.

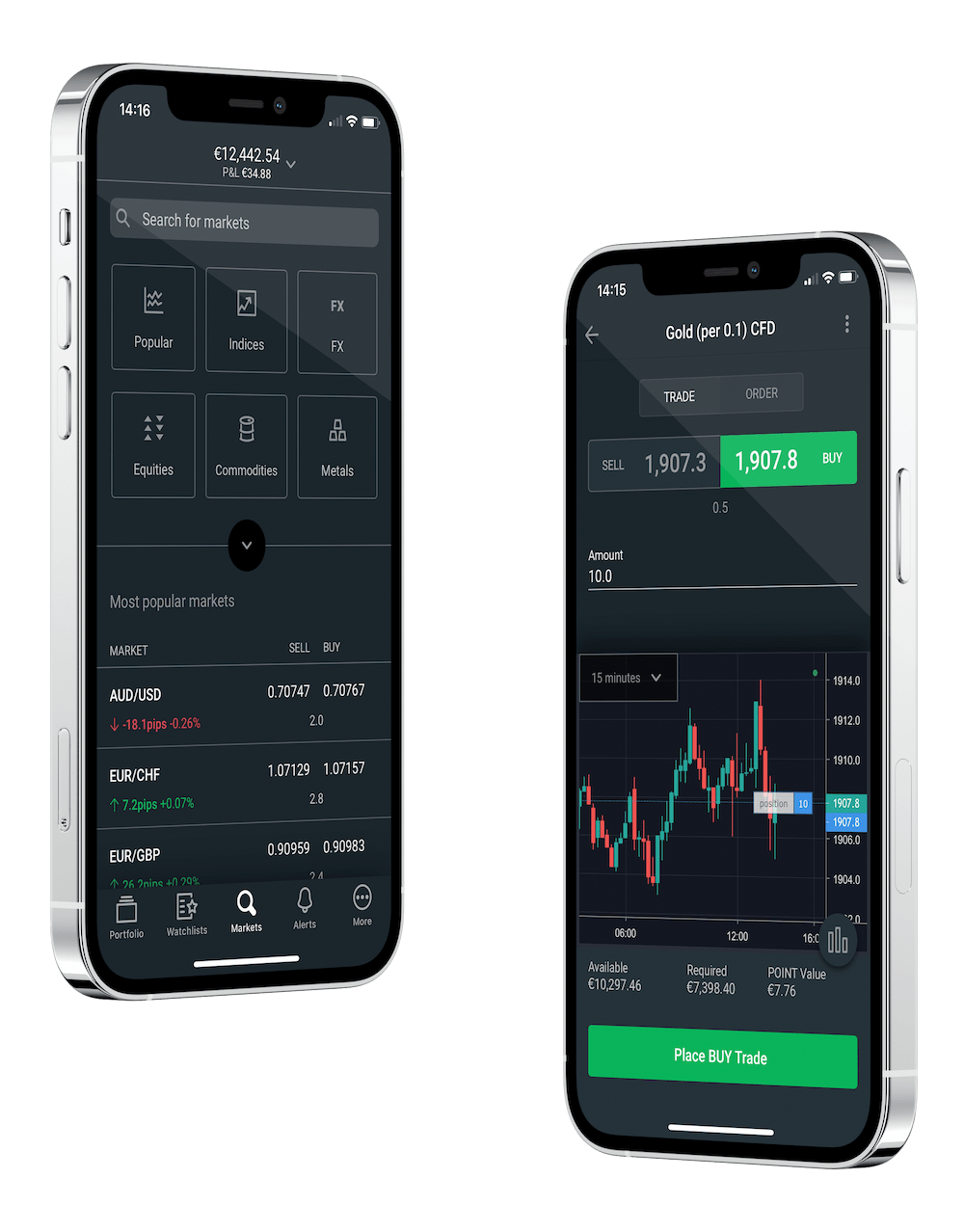

Award-winning mobile apps

Designed for instant control wherever you are, enjoy one-tap trading, intelligent market tools and a customisable layout to suit your trading style.

TradingView Charts

80 indicators, 11 chart types and 14 timeframes.

Trading Central

A research portal that uses technical analysis to scan the markets.

Performance Analytics

Analyse your decision making with the latest behavioural science technology.

What is bond trading?

Bond trading is the buying and selling of government bonds – debt securities that are popular among investors. Generally, when you trade a bond instead of investing in it you’re taking a shorter term view on its price action.

With FOREX.com, you can trade on bond prices using CFDs. This can give you exposure to interest rate movements, or help diversify your portfolio. And because you’re trading a CFD instead of the underlying, you won’t be locked into a long-term position.

To start trading bonds, open a FOREX.com demo trading account. Or follow the link below to trade with real funds.

Latest bonds research

Bonds news and analysis

Bonds FAQ

How can I start trading bonds?

You can start trading bonds by opening a FOREX.com account. You'll get access to our full range of quarterly, monthly or weekly bond CFDs, alongside thousands of other markets.

Or if you're not ready for live trading, you can test out bonds with virtual funds by opening a free FOREX.com demo account.

What is the difference between equity and bond trading?

Equity trading is the buying and selling of stocks and shares; bond trading is the buying and selling of of bonds. While there are some similarities between these markets, they work in very different ways.

When you buy a share, you get a portion of the ownership of a company – called equity. With bonds, you don't get equity. Instead, you get regular interest and your capital back at the end of the investment.

How does bond trading work?

Bond trading works by enabling you to buy and sell government bonds, typically via a leveraged derivative such as a CFD. This means you can take a position on bond price volatility without investing in the bond itself.

Trading bonds brings several benefits – you aren't locked into a long-term position, you can take advantage of leverage and you can go long or short.