IPO trading

What is an IPO?

An IPO stands for initial public offering, which is the first time a private company sells shares of its stock to the public. The process is often referred to as ‘going public’.

For companies, listing their shares on a stock exchange gives them the chance to raise capital for growth initiatives and to raise their profile. For traders and investors, an IPO is an opportunity to get in on the ground floor of growing companies or take a position on volatility. However, trading IPO shares can be riskier than gaining exposure to established stocks, due to the unpredictability of the new listing.

Learn more about what an IPO is and how the process works.

What is a SPAC?

During 2020 and 2021, we saw an increase in companies choosing to go public via a SPAC – or special purpose acquisition company. By merging with another company, private firms can ‘go public’ without the need for a traditional IPO. SPACs became popular as they’re quicker and less regulated than the normal IPO process. However, due to several factors including reduced interest for high-risk investments and tougher rules, the popularity of SPACs fell off heavily in 2023 and early 2024.

Find out more about SPACs.

How to trade IPOs

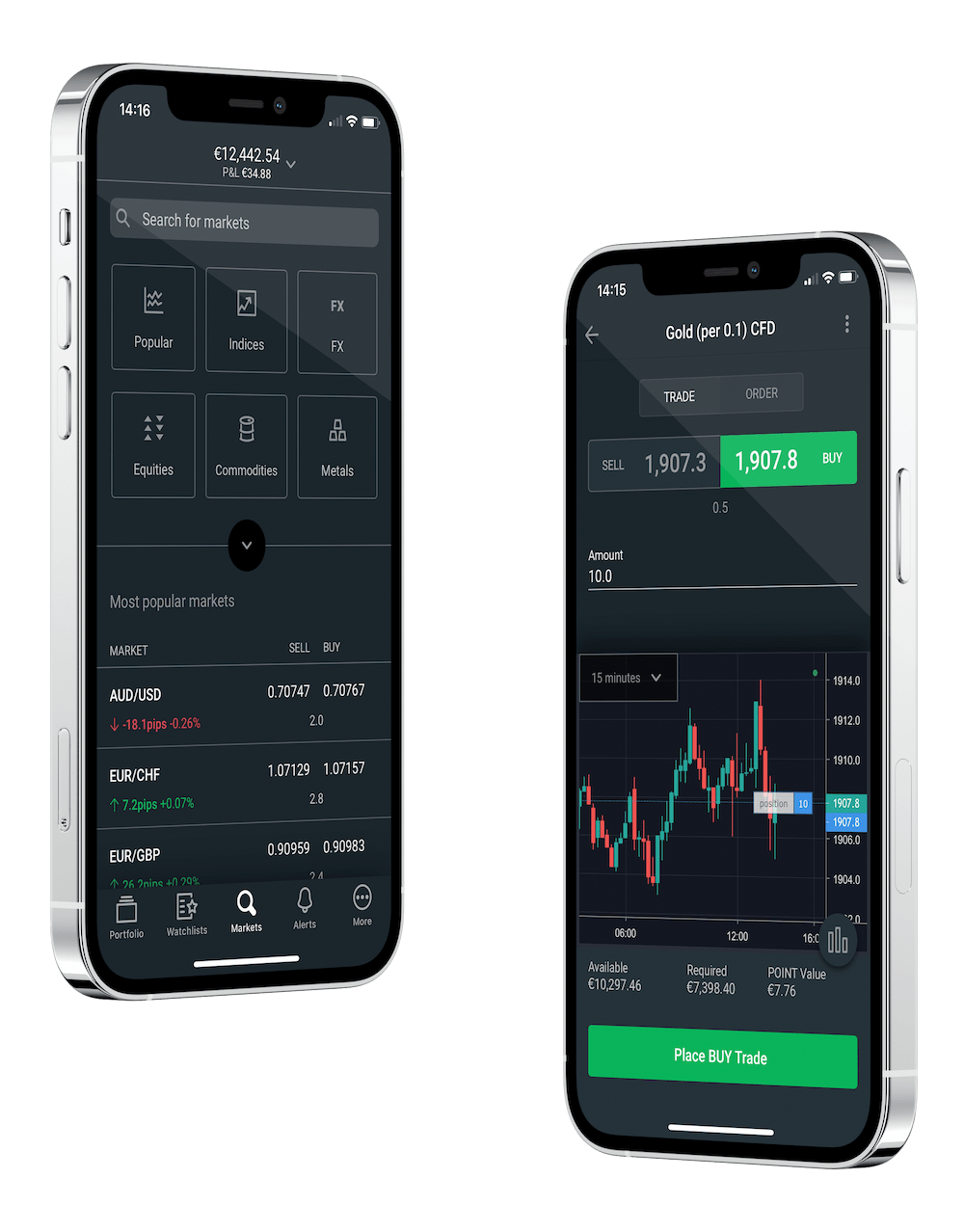

Take a position on popular IPOs as soon as the shares list in four simple steps:

- Open an account, or log in if you’re already a customer

- Search for the company you want to trade

- Choose your position and size, and your stop and limit levels

- Place the trade and monitor the market

Upcoming IPOs

Following a challenging period of geopolitical uncertainty and raised interest rates, 2024’s IPO market looks promising. Here are some of the most anticipated listings for traders to keep an eye on.

-

RevolutRevolut’s potential listing has long been anticipated – and it may finally be on the horizon. Discover everything we know about the upcoming Revolut IPO.

RevolutRevolut’s potential listing has long been anticipated – and it may finally be on the horizon. Discover everything we know about the upcoming Revolut IPO. -

MonzoPopular UK challenger bank Monzo is expected to go public this year, with the company potentially hitting a $5 billion valuation. Find out everything you need to know about the Monzo IPO.

MonzoPopular UK challenger bank Monzo is expected to go public this year, with the company potentially hitting a $5 billion valuation. Find out everything you need to know about the Monzo IPO. -

StripeOnline payments company Stripe started its IPO process in 2019, could it finally list this year? Discover everything we know about the potential $65 billion listing.

StripeOnline payments company Stripe started its IPO process in 2019, could it finally list this year? Discover everything we know about the potential $65 billion listing. -

BrewDogWill beer brand BrewDog complement its IPA with an IPO in 2024? Find out more about the company ahead of its potential listing.

BrewDogWill beer brand BrewDog complement its IPA with an IPO in 2024? Find out more about the company ahead of its potential listing. -

DatabricksUS software company Databricks could go public this year, after raising even more money at a $43 billion valuation. Find out everything you need to know about a Databricks IPO.

DatabricksUS software company Databricks could go public this year, after raising even more money at a $43 billion valuation. Find out everything you need to know about a Databricks IPO. -

SkimsKim Kardashian’s shapewear brand Skims is expected to explore an IPO this year, after being valued at $4 billion in 2023. Learn all you need to know about the Skims IPO.

SkimsKim Kardashian’s shapewear brand Skims is expected to explore an IPO this year, after being valued at $4 billion in 2023. Learn all you need to know about the Skims IPO. -

SheinFast fashion retailer Shein is flirting with a potential listing at an anticipated $90 billion valuation. Find out more about the company ahead of its expected IPO.

SheinFast fashion retailer Shein is flirting with a potential listing at an anticipated $90 billion valuation. Find out more about the company ahead of its expected IPO. -

NorthvoltSwedish battery maker Northvolt is planning a $20 billion Stockholm listing this year. Discover what we know about the Northvolt IPO.

NorthvoltSwedish battery maker Northvolt is planning a $20 billion Stockholm listing this year. Discover what we know about the Northvolt IPO. -

StarlingUK challenger bank Starling will hope to be flying high if it decides to list in 2024. Learn everything you should know about the Starling IPO.

StarlingUK challenger bank Starling will hope to be flying high if it decides to list in 2024. Learn everything you should know about the Starling IPO.

Past IPOs

Last year was one of the biggest years for IPOs and SPACs. The US market alone has raised more than $229 billion in listings with just 90 companies’ IPOs. Take a look at some previous IPOs and start speculating on the shares.

-

CVC CapitalPrivate equity firm CVC Capital is seeking a valuation of over $15 billion as it looks to list on the Amsterdam stock exchange. Learn everything you need to know about the CVC Capital IPO.

CVC CapitalPrivate equity firm CVC Capital is seeking a valuation of over $15 billion as it looks to list on the Amsterdam stock exchange. Learn everything you need to know about the CVC Capital IPO. -

BirkenstockGlobal lifestyle and footwear brand Birkenstock listed at $46 in its October 2023 IPO. Learn everything you should know about Birkenstock before you take a position.

BirkenstockGlobal lifestyle and footwear brand Birkenstock listed at $46 in its October 2023 IPO. Learn everything you should know about Birkenstock before you take a position. -

RedditSocial media platform Reddit opened at $47 in its March 2024 IPO. Find out more about the Reddit IPO.

RedditSocial media platform Reddit opened at $47 in its March 2024 IPO. Find out more about the Reddit IPO. -

PorschePorsche became the largest IPO in terms of market cap ever in Europe after a landmark $72 billion listing. Discover everything you need to know about the Porsche IPO.

PorschePorsche became the largest IPO in terms of market cap ever in Europe after a landmark $72 billion listing. Discover everything you need to know about the Porsche IPO. -

RobinhoodFinancial services firm Robinhood raised almost $2 billion in its market debut in July 2021. Learn all you should know about Robinhood before taking a position.

RobinhoodFinancial services firm Robinhood raised almost $2 billion in its market debut in July 2021. Learn all you should know about Robinhood before taking a position. -

ARMSoftBank Group spun off its ARM segment in a $65 billion market debut. Find out everything we know about the British semiconductor chip manufacturer.

ARMSoftBank Group spun off its ARM segment in a $65 billion market debut. Find out everything we know about the British semiconductor chip manufacturer.

Upcoming IPOs

Latest IPO news

Our suite of powerful trading platforms helps traders gain an edge on the currency markets.