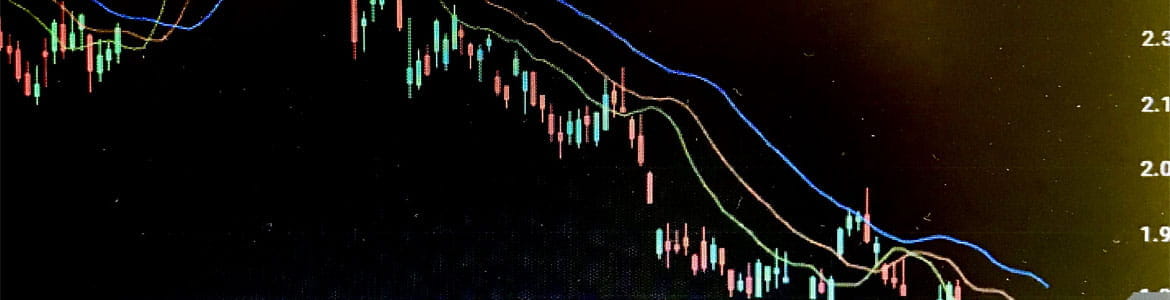

Tomorrow’s Core PCE report is likely to be a pivotal moment for metals. Should inflation come in above consensus it could bring forward expectations of a hike and send the dollar higher (and silver lower). But in all the time the Fed remain insistent that inflation is transitory, it provides headwind for the like of gold being an inflationary hedge and, therefore, silver too. So we update our key levels for silver, then take a look at two potentially bullish setups on Costo (COST) and Ford Motors (F).

S&P 500: Market Internals

S&P 500: 4241.84 (-0.11%), 23 June 2021

- Consumer Discretionary (0.625%) was the strongest sector and Utilities (-1.05%) was the weakest

- 8 out of the 11 sectors traded lower on the S&P 500

- 202 (40.00%) stocks advanced and 299 (59.21%) declined

- 87.52% of stocks closed above their 200-day average

- 52.48% of stocks closed above their 50-day average

- 33.27% of stocks closed above their 20-day average

Outperformers:

- + 5.27% - Tesla Inc (TSLA.OQ)

- + 4.25% - Twitter Inc (TWTR.N)

- + 3.74% - Under Armour Inc (UAA.N)

Underperformers:

- -7.38% - Nov Inc (NOV.N)

- -3.73% - Comcast Corp (CMCSA.OQ)

- -2.67% - Fleetcor Technologies Inc (FLT.N)

Últimas noticias

enero 16, 2025 08:21 p. m.

enero 16, 2025 03:34 p. m.

enero 15, 2025 10:29 p. m.

enero 15, 2025 03:01 p. m.

enero 14, 2025 05:35 p. m.

enero 13, 2025 10:15 p. m.