Updates to previous videos:

- Fortune brands is back below 100 after rallying over 8% since the original video. This could just be part of a minor pullback, and the channel target around 105.50 remains. However, if prices fall back below the small consolidation around 97.50 then it invalidates our bullish bias over the near-term. But, further out, we’d still kook for evidence of a higher low to form above the 93.40 breakout level, for future opportunities.

- The DAX retraced from its highs but continues hold above its gap support level (15,110). A break below this level suggests a counter-trend phase has begun, whilst a break above 15,312 assumes bullish continuation on the daily chart.

S&P 500 Market Internals:

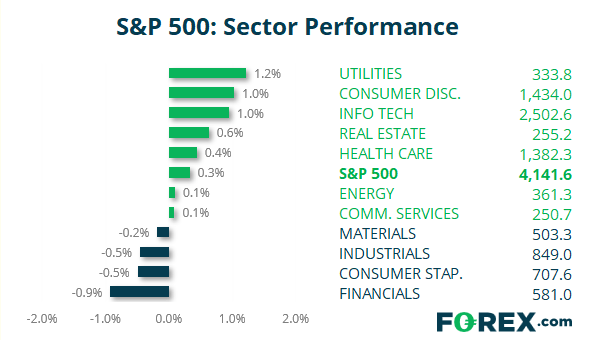

S&P 500: 4141.59 (0.33%), 13 April 2021

- The S&P 500 closed 0.24% below its 52-week high

- 223 (44.16%) stocks advanced and 279 (55.25%) declined

- Utilities (1.22%) was the strongest sector and Financials (-0.92%) was the weakest

- 5 out of the 11 sectors outperformed the S&P 500

- 95.05% of stocks closed above their 200-day average

- 100% of stocks closed above their 50-day average

- 80% of stocks closed above their 20-day average

Outperformers

- + 8.6% - Tesla Inc (TSLA.OQ)

- + 3.41% - Danaher Corp (DHR.N)

- + 3.20% - West Pharmaceutical Services Inc (WST.N)

Underperformers:

- -5.25% - Franklin Resources Inc (BEN.N)

- -4.25% - PVH Corp (PVH.N)

- -3.92% - Synchrony Financial (SYF.N)

Últimas noticias

enero 16, 2025 08:21 p. m.

enero 16, 2025 03:34 p. m.

enero 15, 2025 10:29 p. m.

enero 15, 2025 03:01 p. m.

enero 14, 2025 05:35 p. m.

enero 13, 2025 10:15 p. m.