But if prices do not fall fast enough then bears will have to close out their shorts which could then send prices higher. So, we check out key levels for platinum futures and look at trader positioning from the weekly COT (Commitment of Traders Report).

Gold had a rough day on Friday which quickly invalidated the potential bullish triangle, so we revise our targets for the downside. We also think a counter-trend move may be due for Morgan Stanley (MS) after momentum faltered at its dotcom bubble highs.

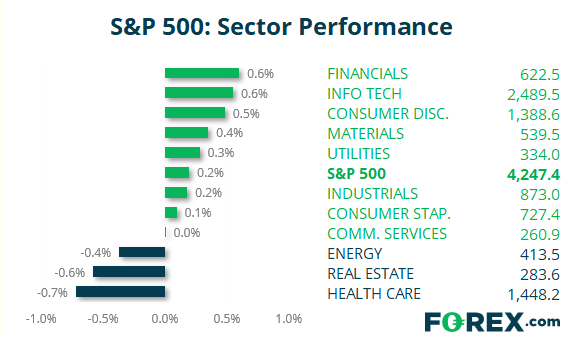

S&P 500: Market Internals

S&P 500: 4247.44 (0.19%), 11 June 2021

- Financials (0.6%) was the strongest sector and Healthcare (-0.72%) was the weakest

- 8 out of the 11 S&P 500 sectors closed higher

- 5 out of the 11 sectors outperformed the S&P 500

- 3 out of the 11 sectors traded lower on the S&P 500

- 352 (69.70%) stocks advanced and 149 (29.50%) declined

- 91.09% of stocks closed above their 200-day average

- 71.68% of stocks closed above their 50-day average

- 60.2% of stocks closed above their 20-day average

Outperformers:

- + 4.56% - VF Corp (VFC.N)

- + 3.97% - PVH Corp (PVH.N)

- + 3.7% - Tapestry Inc (TPR.N)

Underperformers:

- -10.9% - Vertex Pharmaceuticals Inc (VRTX.OQ)

- -5.66% - Incyte Corp (INCY.OQ)

- -4.36% - Biogen Inc (BIIB.OQ)

Últimas noticias

enero 16, 2025 08:21 p. m.

enero 16, 2025 03:34 p. m.

enero 15, 2025 10:29 p. m.

enero 15, 2025 03:01 p. m.

enero 14, 2025 05:35 p. m.

enero 13, 2025 10:15 p. m.