In today’s video we also take a look at Tesla (TSLA) and Apple (AAPL), for a closer look ‘inside the index’. Of course, these markets are likely to be highly correlated, especially if sentiment has truly soured. But we can use a combination of such markets to assess the likelihood of a larger sell-off, or bullish reversal. And, as its inflationary fears that has weighed on the tech sector, then its also prone to a bounce should those fears quickly recede (and we should emphasise the word ’if’ on that one).

S&P 500: Market Internals

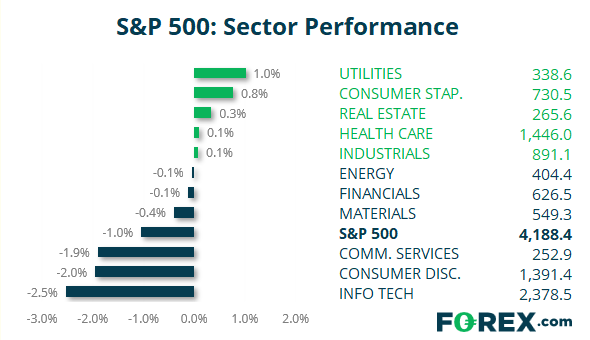

S&P 500: 4188.43 (-1.04%), 10 May 2021

- Utilities (1.013%) was the strongest sector and Information Technology (-2.53%) was the weakest

- 8 out of the 11 sectors outperformed the S&P 500

- 6 out of the 11 sectors traded lower on the S&P 500

- 226 (44.75%) stocks advanced and 274 (54.26%) declined

- 91.29% of stocks closed above their 200-day average

- 77.82% of stocks closed above their 50-day average

- 68.91% of stocks closed above their 20-day average

Outperformers:

- + 6.82% - Viatris Inc (VTRS.OQ)

- + 3.88% - Live Nation Entertainment Inc (LYV.N)

- + 3.02% - Becton Dickinson and Co (BDX.N)

Underperformers:

- -7.33% - Align Technology Inc (ALGN.OQ)

- -6.99% - Lam Research Corp (LRCX.OQ)

- -6.90% - Qorvo Inc (QRVO.OQ)

Últimas noticias

enero 16, 2025 08:21 p. m.

enero 16, 2025 03:34 p. m.

enero 15, 2025 10:29 p. m.

enero 15, 2025 03:01 p. m.

enero 14, 2025 05:35 p. m.

enero 13, 2025 10:15 p. m.