Of course, the deal still needs to be confirmed along with which sanctions on Iran (if any) are removed. But it certainly puts oil markets in focus over the next 24 hours, so we look at two key levels on brent futures.

The Nasdaq 100 and US 10-year treasury yield have also caught our eye as they may be aligning for their next (inversely correlated) move.

After teasing silver bulls with a breakout of 28.32 resistance during Asian trade, momentum reversed and formed a bearish pinbar just beneath this key level – a scenario we mentioned in yesterday’s video. And with gold also below 1875 resistance and the US dollar’s decline halting at the February low, perhaps a correction for silver (and even a pause of trend) could be due. That said, our core bias remains bullish on gold and silver, although gold currently appears to have the bigger appetite to break above its resistance level (1875), given the small bullish candle which formed beneath it yesterday.

S&P 500: Market Internals

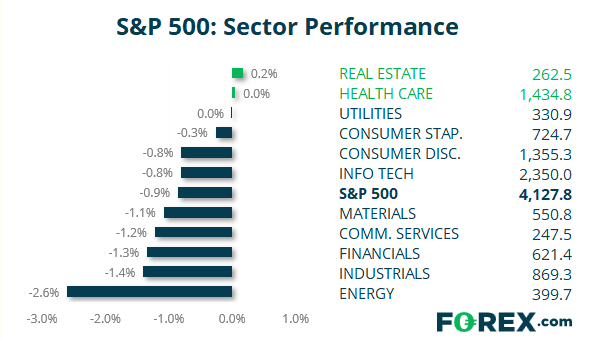

S&P 500: 4127.83 (-0.85%), 18 May 2021

- Real Estate (0.2%) was the strongest sector and Energy (-2.6%) was the weakest

- 9 out of the 11 sectors traded lower on the S&P 500

- 105 (20.79%) stocks advanced and 398 (78.81%) declined

- 89.31% of stocks closed above their 200-day average

- 62.77% of stocks closed above their 50-day average

- 50.3% of stocks closed above their 20-day average

Outperformers:

- + 4.79% - CVS Health Corp (CVS.N)

- + 4.56% - ViacomCBS Inc (VIAC.OQ)

- + 3.45% - Enphase Energy Inc (ENPH.OQ)

Underperformers:

- -5.80% - AT&T Inc (T.N)

- -4.23% - Molson Coors Beverage Co (TAP.N)

- -4.20% - Western Digital Corp (WDC.OQ)