In today’s video we take a look at the Nasdaq 100 cash index chart and highlight its next potential target. We also look at the impact a weaker US dollar has made on WTI and gold, as they both now show bullish structures.

The positive sentiment on Wall Street (thanks for the Pfizer-BioNTech vaccine being fully approved) also helped the S&P 500 E-mini futures contract hit our initial target. Yet the marginal close above its previous record high leaves us a little concerned it may be vulnerable to a pullback over the near-term, which is why we now favour the Nasdaq for the time being.

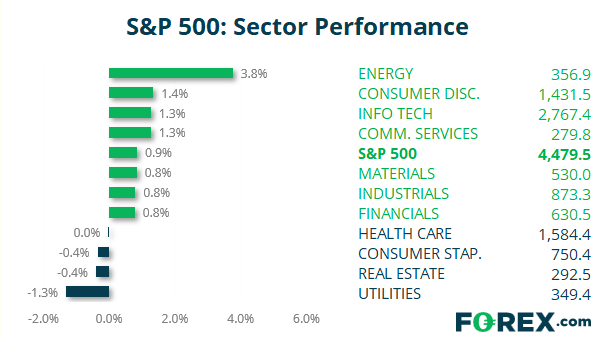

S&P 500: Market Internals

S&P 500: 4479.53 (0.85%), 23 August 2021

- Energy (3.76%) was the strongest sector and Utilities (-1.31%) was the weakest

- 7 out of the 11 S&P 500 sectors closed higher

- 4 out of the 11 sectors outperformed the S&P 500

- 4 out of the 11 sectors traded lower on the S&P 500

- 352 (69.70%) stocks advanced and 151 (29.90%) declined

- 79.21% of stocks closed above their 200-day average

- 62.18% of stocks closed above their 50-day average

- 54.85% of stocks closed above their 20-day average

Outperformers:

- + 7.59% - APA Corp (US) (APA.OQ)

- + 7.55% - Moderna Inc (MRNA.OQ)

- + 6.92% - Occidental Petroleum Corp (OXY.N)

Underperformers:

- -2.62% - Cboe Global Markets Inc (CBOE.Z)

- -2.42% - Rollins Inc (ROL.N)

- -2.37% - Pool Corp (POOL.OQ)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log-in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.