We also take a look at Nvidia (NVDA) after it announced a stock split on Friday, plus platinum futures which closed firmly beneath trendline support.

Updates from prior videos:

- Silver took another dip lower on Friday, closing the day with a bearish outside day and piercing support nearby. Still, it remains within its bullish channel and we can’t help but suspect Friday’s volatile candle could be a shakeout before bulls regain control. A break beneath its daily trendline shakes that belief, and a break below 26.63 would be a significant victory for bears.

- NZD/JPY still looks good for a potential short after it closed beneath trendline support last week. A break beneath the 77.90 low assumes bearish continuation.

- WTI failed to break beneath Thursday’s low and, instead, probed its high. Given prices gapped up to Friday’s high in early Asian trade, further downside appears unlikely at this stage so we’ll opt to step aside.

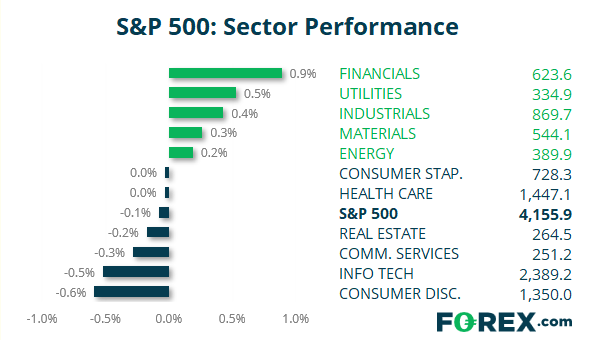

S&P 500: Market Internals

S&P 500: 4155.86 (-0.08%), 21 May 2021

- Financials (0.89%) was the strongest sector and Consumer Discretionary (-0.58%) was the weakest

- 7 out of the 11 sectors outperformed the S&P 500

- 6 out of the 11 sectors traded lower on the S&P 500

- 283 (56.04%) stocks advanced and 218 (43.17%) declined

- 90.89% of stocks closed above their 200-day average

- 68.51% of stocks closed above their 50-day average

- 50.89% of stocks closed above their 20-day average

Outperformers:

- + 6.73% - Ford Motor Co (F.N)

- + 3.46% - Lamb Weston Holdings Inc (LW.N)

- + 3.15% - Boeing Co (BA.N)

Underperformers:

- -8.94% - VF Corp (VFC.N)

- -3.00% - Seagate Technology Holdings PLC (STX.OQ)

- -2.84% - Progressive Corp (PGR.N)

Últimas noticias

enero 16, 2025 08:21 p. m.

enero 16, 2025 03:34 p. m.

enero 15, 2025 10:29 p. m.

enero 15, 2025 03:01 p. m.

enero 14, 2025 05:35 p. m.

enero 13, 2025 10:15 p. m.