Platinum is close to breaching our invalidation point from Monday’s video, yet it is still a potential short candidate should sentiment turn against metals, as it has been an underperformer these past few months and lacks the bullish qualities of gold and silver. So, we check out all three metals in today’s video to highlight key levels for each market.

As for yesterday’s video, Morgan Stanley (MS) failed to hold onto earlier gains, after gapping to fresh multi-year highs at yesterday’s open. Closing the day near the 88.88 breakout level it is touch and go as to whether 88.32 support can hold, given the two-bar reversal (dark cloud cover pattern) at the highs. Yet whilst the near-term bias is under siege, technically the daily chart remains bullish above the 84.32 swing low, so it really comes down to timeframe as to how one manages their risk from here.

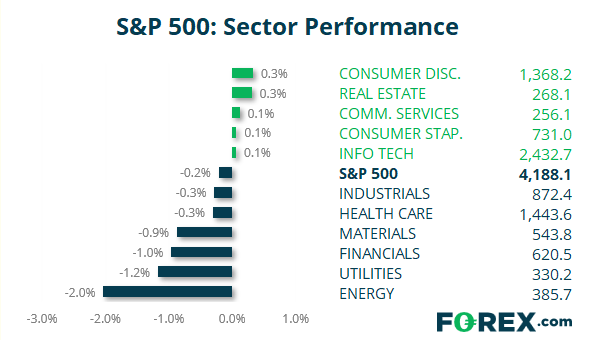

S&P 500: Market Internals

S&P 500: 4188.13 (-0.21%), 25 May 2021

- Consumer Discretionary (0.33%) was the strongest sector and Energy (-2.03%) was the weakest

- 5 out of the 11 S&P 500 sectors closed higher

- 6 out of the 11 sectors traded lower on the S&P 500

- 169 (33.47%) stocks advanced and 334 (66.14%) declined

Outperformers:

- + 3.95% - NVR Inc (NVR.N)

- + 3.65% - Royal Caribbean Cruises Ltd (RCL.N)

- + 3.56% - Norwegian Cruise Line Holdings Ltd (NCLH.N)

Underperformers:

- -4.74% - Seagate Technology Holdings PLC (STX.OQ)

- -4.5% - APA Corp (US) (APA.OQ)

- -4.49% - Edison International (EIX.N)