For example, should we be treated to a more-hawkish (or less-dovish) than expected ECB meeting, coupled with a weak inflation report then EUR/USD could easily rally. Yet it could just as easily roll over from current levels should the ECB remain dovish/be more dovish than expected with a stronger-than-expected inflation report for the US.

So, in today’s video we highlight key levels for EUR/USD and EUR/JPY ahead of the ECB meeting, and update our analysis on platinum futures.

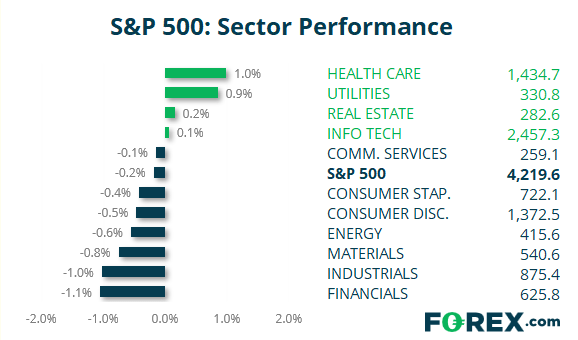

S&P 500: Market Internals

S&P 500: 4219.55 (-0.18%), 09 June 2021

- Healthcare (0.99%) was the strongest sector and Financials (-1.05%) was the weakest

- 4 out of the 11 S&P 500 sectors closed higher

- 5 out of the 11 sectors outperformed the S&P 500

- 170 (33.66%) stocks advanced and 332 (65.74%) declined

- 89.31% of stocks closed above their 200-day average

- 63.37% of stocks closed above their 50-day average

- 54.46% of stocks closed above their 20-day average

Outperformers:

- + 3.05% - Catalent Inc (CTLT.N)

- + 3.05% - Regeneron Pharmaceuticals Inc (REGN.OQ)

- + 2.95% - Sempra Energy (SRE.N)

Underperformers:

- -7.21% - DISH Network Corp (DISH.OQ)

- -6.51% - Campbell Soup Co (CPB.N)

- -5.65% - Brown-Forman Corp (BFb.N)

Últimas noticias

Ayer 08:14 p. m.

enero 2, 2025 01:30 a. m.

diciembre 29, 2024 08:30 p. m.

diciembre 20, 2024 04:29 p. m.

diciembre 12, 2024 09:30 p. m.

diciembre 10, 2024 09:00 p. m.