Also in today’s video we look at Netflix (NFLX) as it clings onto a cluster of support levels, yet lacks the ambition to rise from them. This leaves two contrasting setups should volatility return, one way or another.

Updates to previous videos:

- Albemarle (ALB) is trading in a tight consolidation near this week’s high. We remain bullish above 162 should prices retrace, although a break above Monday’s high assumes bullish continuation.

- Morgan Stanley (MS) held above 76 support and a new bullish leg has resumed. Key support levels reside at 81.30, 80.0 and 78.29

- Brent rose to a six-day high in line with our bias form yesterday’s video. The US dollar index also printed a large bearish engulfing candle to strongly suggest a key swing high is in place and its bearish trend is now trying to resume.

- CAD/JPY has reached our initial target at 88.30. Whilst this favours the odds of a minor pullback, the trend remains firmly bullish, so our bias is for an eventual breakout.

S&P 500: Market Internals

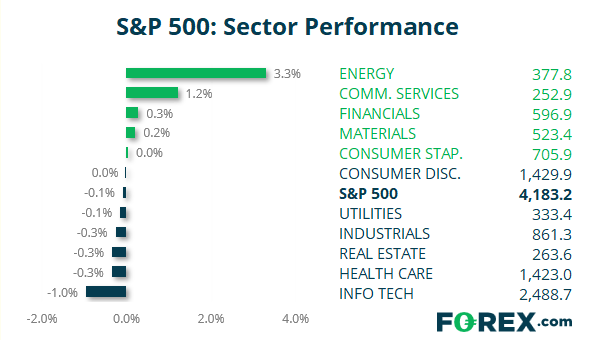

S&P 500: 4183.18 (-0.08%), 28 April 2021

- Energy (3.3%) was the strongest sector and Information Technology (-0.96%) was the weakest

- 6 out of the 11 sectors traded lower on the S&P 500

- 232 (45.94%) stocks advanced and 272 (53.86%) declined

- 94.46% of stocks closed above their 200-day average

- 72.67% of stocks closed above their 20-day average

Outperformers

- + 9.57% - Nov Inc (NOV.N)

- + 8.54% - Devon Energy Corp (DVN.N)

- + 7.79% - Hess Corp (HES.N)

Underperformers:

- -14.2% - Enphase Energy Inc (ENPH.OQ)

- -9.08% - F5 Networks Inc (FFIV.OQ)

- -7.22% - Amgen Inc (AMGN.OQ)

Últimas noticias

enero 16, 2025 08:21 p. m.

enero 16, 2025 03:34 p. m.

enero 15, 2025 10:29 p. m.

enero 15, 2025 03:01 p. m.

enero 14, 2025 05:35 p. m.

enero 13, 2025 10:15 p. m.