In today’s video we take a brief look at the Thomson Reuters Commodity index and reassess gold after a volatile session. We then finish on CAD/CHF which is showing signs of a turning point after its meteoric rise in Q1.

Updates from prior videos:

The Nasdaq gapped lower to our initial target around 13,000 before fully closing the gap by the session closed – so unless traders were already short it was an opportunity sadly missed. Yet our bias remains bearish beneath gap resistance around 13,420, so perhaps a new opportunity will arrive for bears. Still, the US 10-year yield rose, which was a prerequisite for a weaker Nasdaq argument, so perhaps there is still chance for tech stocks to roll over once more.

Silver is indeed within a corrective phase after printing a bearish hammer back beneath a breakout level. Yesterday’s strong bearish close puts bears behind the wheel for now but, as prices remain within the bullish channel, we’ll continue to monitor for a level of support to build before seeking fresh bullish opportunities. Copper (also in the same video) has been removed from our bullish watchlist for now after breaking beneath 4.60.

Tesla (TSLA) reached our first target around the 550 lows which leave the potential for a minor bounce. The bias remains bearish beneath 267.61 but we’ll see if minor corrective phase plays out, or a break beneath 541 assumes bearish continuation.

Newmont (NEM) has rallied over 16% since our video last month and recently hit its highest level since 1987. Rising gold prices has been the obvious catalyst and, as we’d hoped, momentum has indeed reverted to its long-term uptrend having broken a multi-month retracement line back in March. However, given the gold has formed a wide indecision candle at key resistance and Newmont (NEM) produced a bearish pinbar / outside data just below its record highs, bulls may want may be looking to lock in profits or tighten stops to avoid giving back too much. This is not to say the move is over but, over the near-term, we’d prefer not to be greedy.

S&P 500: Market Internals

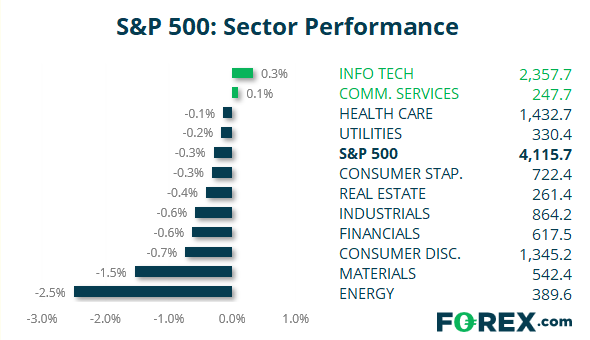

S&P 500: 4115.68 (-0.29%), 19 May 2021

- Information Technology (0.33%) was the strongest sector and Energy (-2.5%) was the weakest

- 4 out of the 11 sectors outperformed the S&P 500

- 9 out of the 11 sectors traded lower on the S&P 500

- 145 (28.71%) stocks advanced and 358 (70.89%) declined

- 89.11% of stocks closed above their 200-day average

- 65.54% of stocks closed above their 50-day average

- 39.8% of stocks closed above their 20-day average

Outperformers:

- + 6.95% - Take-Two Interactive Software Inc (TTWO.OQ)

- + 6.66% - Enphase Energy Inc (ENPH.OQ)

- + 6.09% - Target Corp (TGT.N)

Underperformers:

- -6.67% - Freeport-McMoRan Inc (FCX.N)

- -5.34% - Nov Inc (NOV.N)

- -5.29% - TJX Companies Inc (TJX.N)