We also take a look at copper prices which closed below $4.00 yesterday, and then reassess USD/JPY after its noteworthy bullish close.

- The US dollar index closed above its 200-day eMA, sending EUR/USD firmly beneath 1.1800 support. 93.20 is the next major resistance level for bulls to target (or 1.1747 for EUR/USD bears).

- Eli Lilly (LLY) produced a bullish inside candle, although remained beneath 184.00. If it holds as resistance, the bearish target around 176 remain in play, whilst a break above 184 takes it back inside it consolidation range and removes it from the watchlist (at least temporarily). Overall, it has had a good move lower from 192 when we originally covered it.

- Kraft Heinz (KHC) saw an initial break of its trendline support but then promptly reversed higher. Given the strength of the move against the bias this we’ll step aside. A break above 39.71 (year to date high) removes it from the watchlist completely. Until then the potential for it to carve out a top remains, albeit different to the one outlined in yesterday’s video.

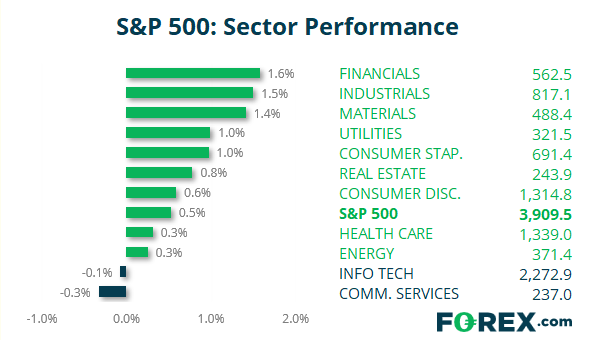

S&P 500 (0.52%) 25 March 2021

- The index closed -1.87% below its 52-week high

- 403 (79.80%) stocks advanced and 101 (20.00%) declined

- Financials (1.575%) was the strongest sector and Communication Services (-0.33%) was the weakest

- 7 out of the 11 sectors outperformed the index

- 88.12% of stocks closed above their 200-day average

- 85.15% of stocks closed above their 50-day average

- 61.39% of stocks closed above their 20-day average

Últimas noticias

enero 16, 2025 08:21 p. m.

enero 16, 2025 03:34 p. m.

enero 15, 2025 10:29 p. m.

enero 15, 2025 03:01 p. m.

enero 14, 2025 05:35 p. m.

enero 13, 2025 10:15 p. m.