In today’s video we look at Euro STOXX 50 index which endured its worse session in two months. We also look at key levels for gold and update our WTI analysis.

Updates to previous videos:

- Albemarle Corp (ALB) was dragged lower with the general market yesterday, falling -5.7% by the close. It requires a break above 162.00 to confirm our bullish bias so it remains on the watchlist. But, if sentiment remains sour and prices cut below 141.90, it will be removed.

- In similar vein to Albemarle, Fortune Brands (FHBS) was dragged lower during a risk-off session. Given it had nearly reached target and cut below 101.70 (to confirm its dark cloud cover reversal) we’re happy with its performance overall, so it’s off the watchlist for now.

- Newmont (NEM) saw an intraday break above 54.78 resistance yet closed more or less on it. Ideally prices will continue to hold above 63.63 support (breakout level) and resume its trend.

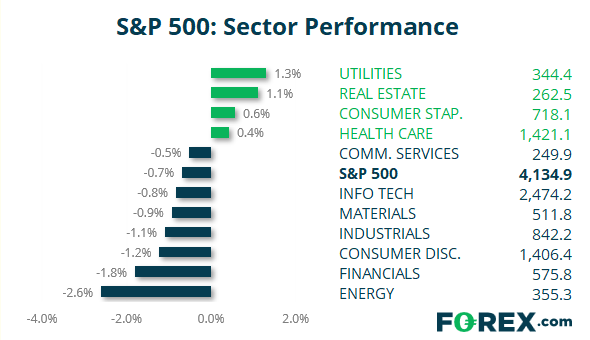

S&P 500: Market Internals

S&P 500: 4134.94 (-0.68%), 20 April 2021

- Real Estate (1.12%) was the strongest sector and Consumer Discretionary (-1.22%) was the weakest

- 5 out of the 11 sectors outperformed the S&P 500

- 7 out of the 11 sectors traded lower on the S&P 500

- 187 (37.03%) stocks advanced and 314 (62.18%) declined

- 96.63% of stocks closed above their 200-day average

- 79.01% of stocks closed above their 50-day average

- 69.11% of stocks closed above their 20-day average

Outperformers:

- + 15.2% - Kansas City Southern (KSU.N)

- + 4.15% - Enphase Energy Inc (ENPH.OQ)

- + 3.79% - International Business Machines Corp (IBM.N)

Underperformers:

- -8.53% - United Airlines Holdings Inc (UAL.OQ)

- -6.52% - Zions Bancorporation NA (ZION.OQ)

- -5.92% - APA Corp (US) (APA.OQ)

Últimas noticias

enero 16, 2025 08:21 p. m.

enero 16, 2025 03:34 p. m.

enero 15, 2025 10:29 p. m.

enero 15, 2025 03:01 p. m.

enero 14, 2025 05:35 p. m.

enero 13, 2025 10:15 p. m.