US futures

Dow futures -0.24% at 35119

S&P futures -0.1% at 4431

Nasdaq futures +0.05% at 15119

In Europe

FTSE -0.07% at 7120

Dax -0.2% at 15727

Euro Stoxx +0.3% at 4173

Jobs data and covid cases in focus

US stocks are trading mildly lower on the open but remain close to all time highs as investors continue to digest Friday’s impressive jobs report and concerns grow over the spread of the delta variant COVID variant, particularly in China and the US.

Virus fears are predominantly being played out in the oil market, but that naturally leads to oil majors coming under pressure. Firms such as ChevroN, Exxon Mobile and Halliburton traded under pressure.

Stocks are being under pinned by a strong earnings season which saw a record number of companies beat on earnings. Whilst comparisons will last year were broadly flattering, guidance has also been strong boding well for the bull market to continue.

Today there is little in the way of fresh data to drive trading, investors will look ahead to the release of CPI data on Wednesday for further clues as to whether the Fed is likely to make an announcement on tapering support at the Jackson Hole economic forum later this month.

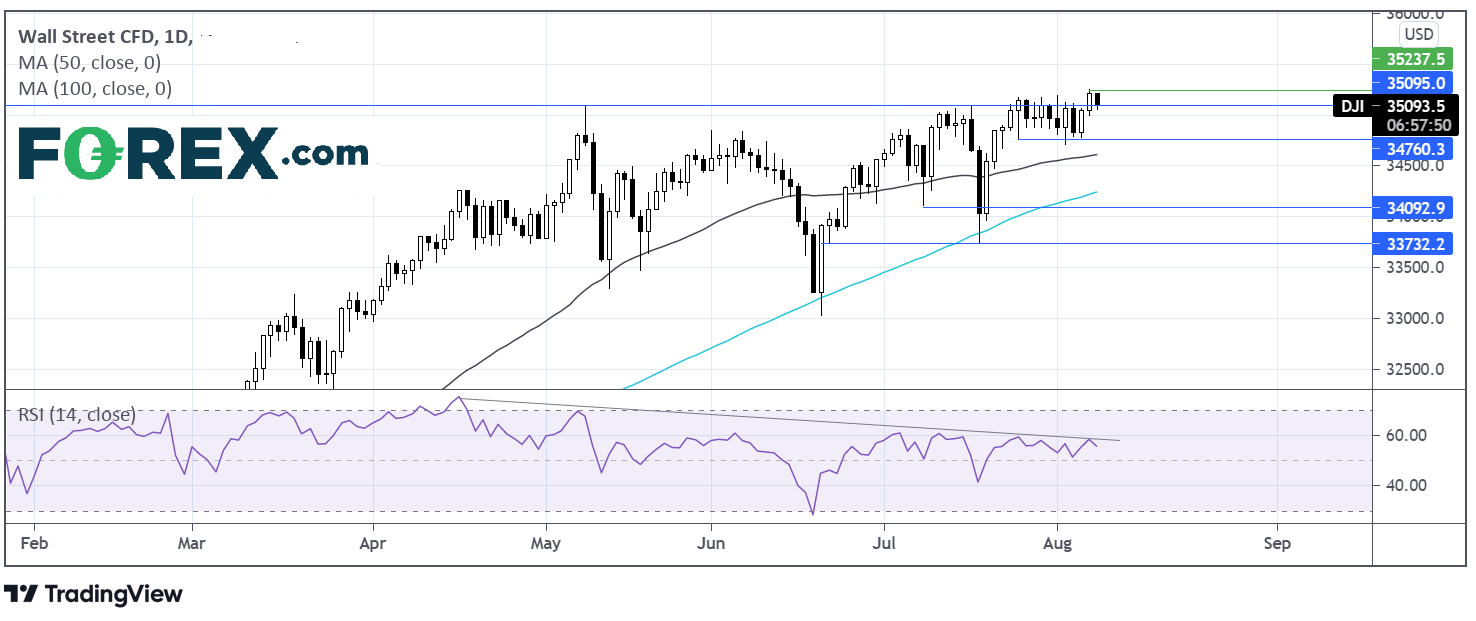

Where next for the Dow Jones?

The Dow Jones closed at a new record high on Friday after breaking through resistance at 34760 – 35000. The price is consolidating gains today between 35000 and the new all time high at 35250. It worth noting the RSI bearish divergence in play since late April which often suggests that momentum is slowing. It would take a move below 34760 for sellers to gain traction.

FX – USD consolidates gains, EUR shrugs off decline in confidence

Broadly speaking the FX markets are quiet today after a volatile end to last week.

USD is consolidating gains from Friday. The greenback trades flat after booking strong gains on Friday following the better than forecast NFP. The all-round strong report boosted bets that the Fed could taper bond purchases sooner rather than later.

EUR/USD has trades roughly flat even as Sentix investor confidence drops sharply in August. The index dropped to 22.2, down from 29.2 in July, whilst marking the third straight month of declines. Concerns over more lockdown restrictions in the Autumn are unnerving investors.

GBP/USD +0.02% at 1.3875

EUR/USD +0.02% at 1.1760

Oil skids a further 4% lower

Oil prices are tumbling lower at the start of the week. After falling over 7% last week, both oil benchmarks are down over 4% at the start of the week. Chinese covid restrictions and a dire UN climate warning have sent oil sliding.

Demand expectations are once again taking a hit after China imposes travel curbs in 46 cities amid the spread of delta COVID. The second largest oil consumer is seeing covid cases rise quickly which is becoming an important factor in the clouding of the oil demand outlook.

The UN gave a dire warning over climate change as global warming nears its limit.

US crude trades -3.7% at $6561

Brent trades -3.6% at $6803

Looking ahead

No major releases

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.