US futures

Dow futures -1.04% at 34588

S&P futures -0.96% at 4357

Nasdaq futures -0.75% at 14747

In Europe

FTSE -1.72% at 7022

Dax -1.97% at 15650

Euro Stoxx -2.18% at 4098

Risk off dominates

US stocks are pointing to a sharply lower start on the open, extending losses from the previous session after the FOMC minutes revealed that the Fed was looking at an earlier start to tapering bond purchases, as soon as this year if the economy continued to improve.

The July FOMC meeting was before the stellar US non-farm payroll report which would further support a move towards tapering. Weekly jobless claims release today revealed 348k initial claims below the 363k forecast, and an improvement from 377k last week. The data points to a gradual improvement in the labor market.

However, covid cases are also on the rise. Recent consumer confidence and retail sales data have surprised to the downside recently as concerns over rising COVID numbers are starting to be reflected in macro data.

In addition to Fed taper concerns, COVID concerns are also on the rise. With US COVID cases on the rise fears surrounding the virus are hanging around much longer than most would have expected.

Commodities are under pressure amid the stronger US Dollar and weaker demand outlook which is hurting resource stocks.

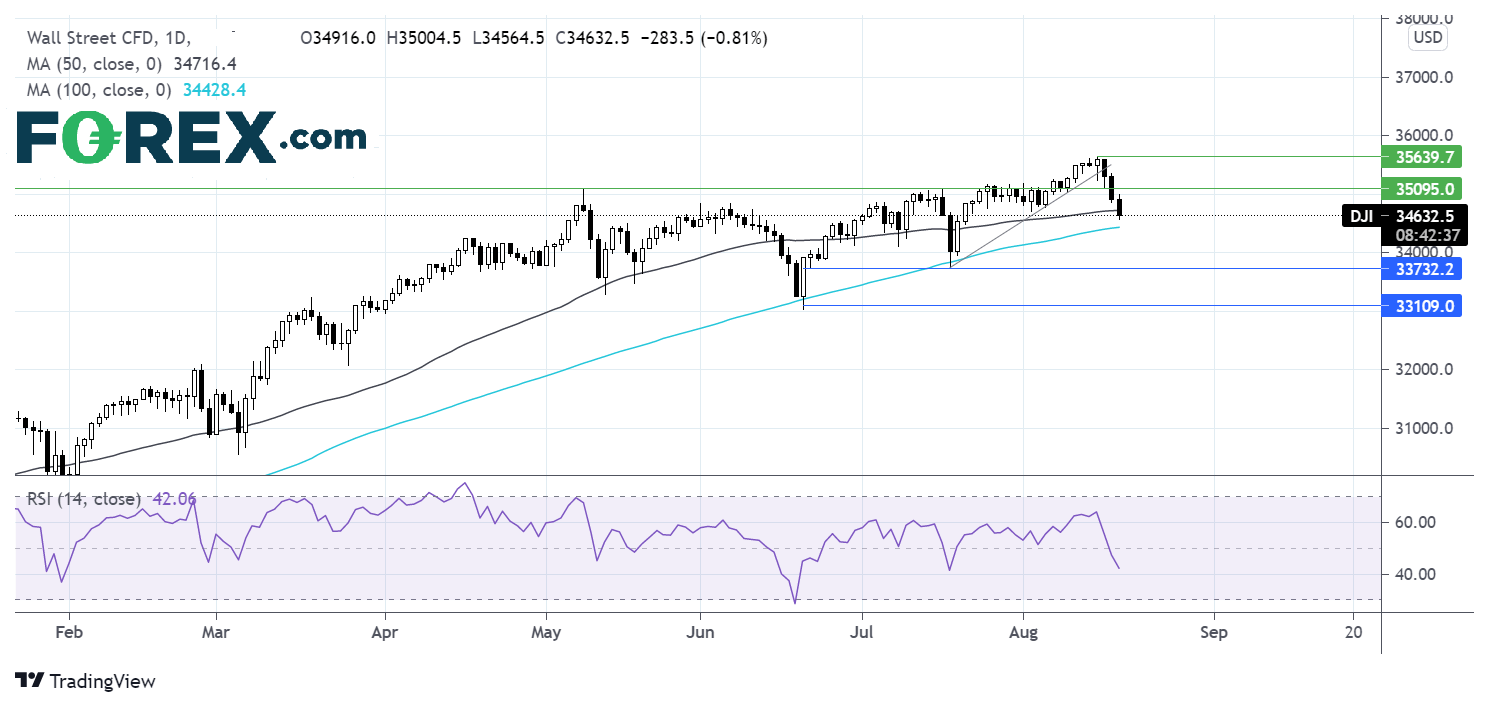

Where next for the Dow Jones?

The Dow Jones is extending losses and could be vulnerable to further downside. Prices have formed 3 black crows candle stick pattern which is a bearish reversal pattern and so could predict the reversal of the uptrend. The RSI is in bearish territory and pointing lower suggesting that there could be more downside to be had. The price has broken through the 50 sma which exposes the 100 sma at 34430. A break below here could open the door toward 33750 the July low and 33000 the June low. Any move higher would need to retake 35000 to negate the near term down trend.

FX – USD extends gains, AUD tanks

The US Dollar is extending gains into a fourth straight session following the release of the minutes from the from the July Federal Reserve monetary policy. The hawkish minutes prompted bets that the Fed will taper bond purchases by the end of the year. Safe haven flows are also boosting the greenback.

AUD/USD underperforming its peers amid COVID and Chinese related risks. The Chinese outlook has weakened dragging on prices of the Aussie export commodities and the Aussie. Lockdown restrictions in Australia have been unable to curb new infections dragging on the currency.

AUD/USD -0.9% at 0.7166

GBP/USD -0.5% at 1.3676

EUR/USD -0.09% at 1.1700

Oil moves lower for a fifth straight session

Oil prices are moving lower for a fifth straight day. Oil has dropped sharply today amid stronger US Dollar post FOMC minutes and on demand concerns as COVID cases rise. Areas of low covid vaccination rates are seeing the virus spread rapidly and tighter restrictions are being implemented which is hurting the demand outlook. Last week the IEA reduced its oil demand outlook owing to the Delta variant.

An unexpected rise in US gasoline inventories added to the demand concerns.

US crude trades -3.25% at $63.10

Brent trades -2.9% at $65.93

Looking ahead

No data is due

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.