US futures

Dow futures +0.46% at 35038

S&P futures +0.39% at 4511

Nasdaq futures +0.42% at 15630

In Europe

FTSE +0.4% at 7050

Dax +0.33% at 15680

Euro Stoxx +0.38% at 4190

Stocks snap four day losing streak

After falling across the week US stocks are picking up on Friday. Investors have been assessing rising covid cases, slowing growth elevated levels of inflation and uncertainty over when the Fed could start tapering bond purchases.

The data has been mixed and the messages from the Fed have been mixed leaving little clarity for the markets, which traditionally struggle with uncertainty.

Whilst Friday’s NFP data was shockingly weak, today’s PPI inflation data is stronger than forecast. PPI came in at 0.7% MoM vs 0.6% forecast. On an annual basis PPI rise 8.3%, up from 7.8% and above forecasts of 8.2%.

Given that PPI often trickles in CPI, elevated consumer prices could be hanging around for a while longer. Yesterday's the Fed's Beige book noted a moderate deterioration in conditions easing the risk of tapering bond purchases sooner.

The PPI data hasn’t managed to hurt today’s rebound, suggesting that the selloff across the week was overdone.

The market could well remain restless until there is further clarity from the Fed over its tapering timeline.

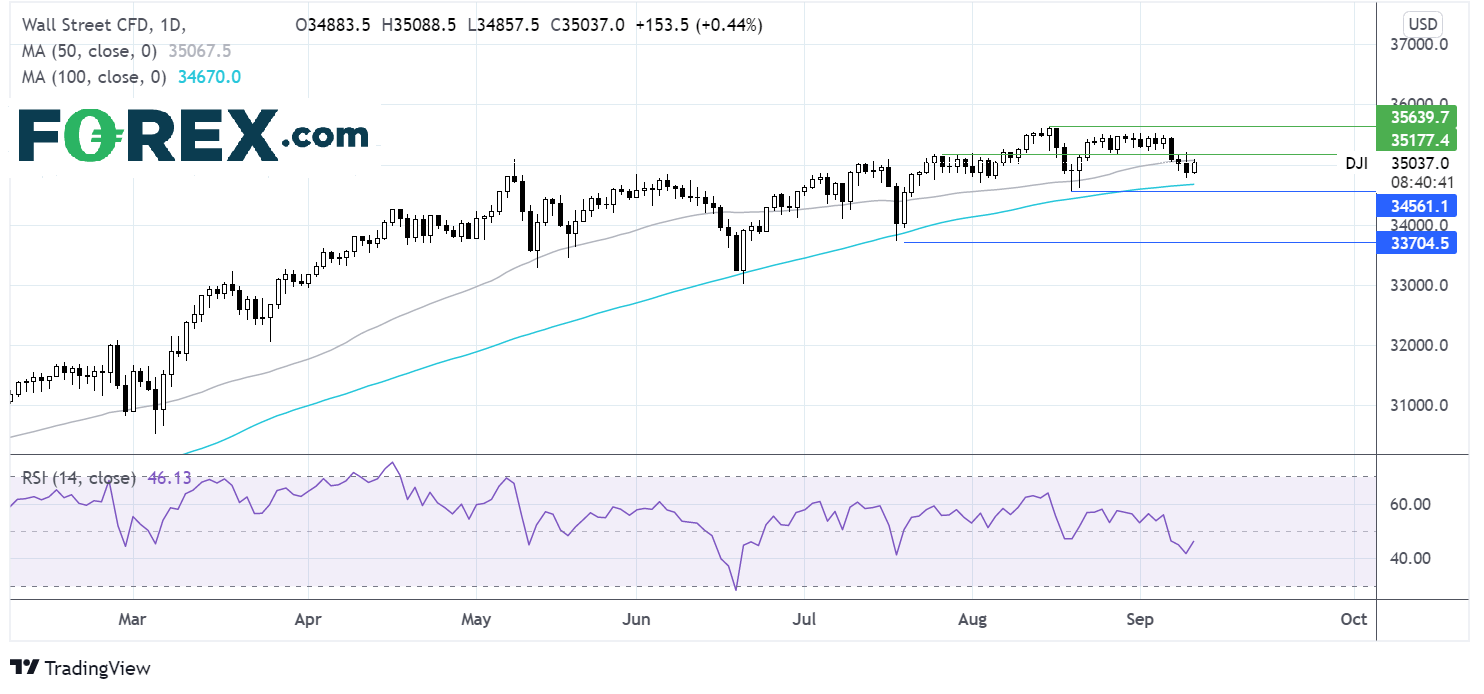

Where next for the Dow Jones?

The Dow Jones is pushig higher after falling across the week. The index is attempting to retake the 50 sma, a level which has acted as a key support over the year. The Dow continues to trades above the 100 sma. It would take a move below this level at 34670 and the August 19 low at 34360 for the bias to turn bearish and 33700 to move into target. Meanwhile a move back over the 50 sma at 35065 and resistance at 35150 could see the index make a fresh bid towards the all time high.

FX – USD set for weekly gain, GBP rallies on signs of life at the BoE

The US Dollar is edging lower but is still set for weekly gains as investors reassess the likelihood of a sooner move by the Fed. Whilst last Friday’s NFP was shockingly weak, since then we have seen JOLTS job openings remind us that there are 10 million vacancies and initial jobless claims fall to the lowest level since the start of the pandemic.

GBP/USD – The pound is powering higher despite data revealing that UK economic growth stalled in July. UK GDP in July rose +0.1%, down from 1% in June and short of the 0.6% growth forecast. Still the pound has brushed off the data instead focusing on hawkish comments from BoE Governor Andrew Bailey. Andrew Baily said that he considers that the conditions for a rate hike have been met. Whilst recently the focus had been very much on the Fed and the ECB tapering, the BoE has jumped out of the shadows boosting the Pound.