US futures

Dow futures +0.3% at 34994

S&P futures -0.25% at 4411

Nasdaq futures +0.01% at 15059

In Europe

FTSE +0.2% at 7120

Dax +0.5% at 15633

Euro Stoxx +0.4% at 4133

Private sector jobs growth slows considerably

US stocks are pointing to a mixed start as investors digest more corporate earnings, rising covid cases and a much weaker than forecast ADP jobs report.

The ADP employment report revealed that just 330k private sector jobs were added in July, this was well short of the 695k forecast and well down from the downwardly revised 680k in June.

The data highlights the slowing recovery in the US economy supporting the Fed’s belief that the US economy still has a way to go before the stimulus can be tapered. As a result, cyclicals, those stocks most closely tied to the health of the US economy are trading under pressure, explaining the Dow Jones’ under performance relative to high growth tech.

Covid cases are on the rise in the US. Outbreaks of the more contagious delta variant particularly in states with low vaccination rates is a concern.

Earnings continue with General Motors reporting. Lyft will be in focus after reporting a quarterly profit 3 months ahead of target.

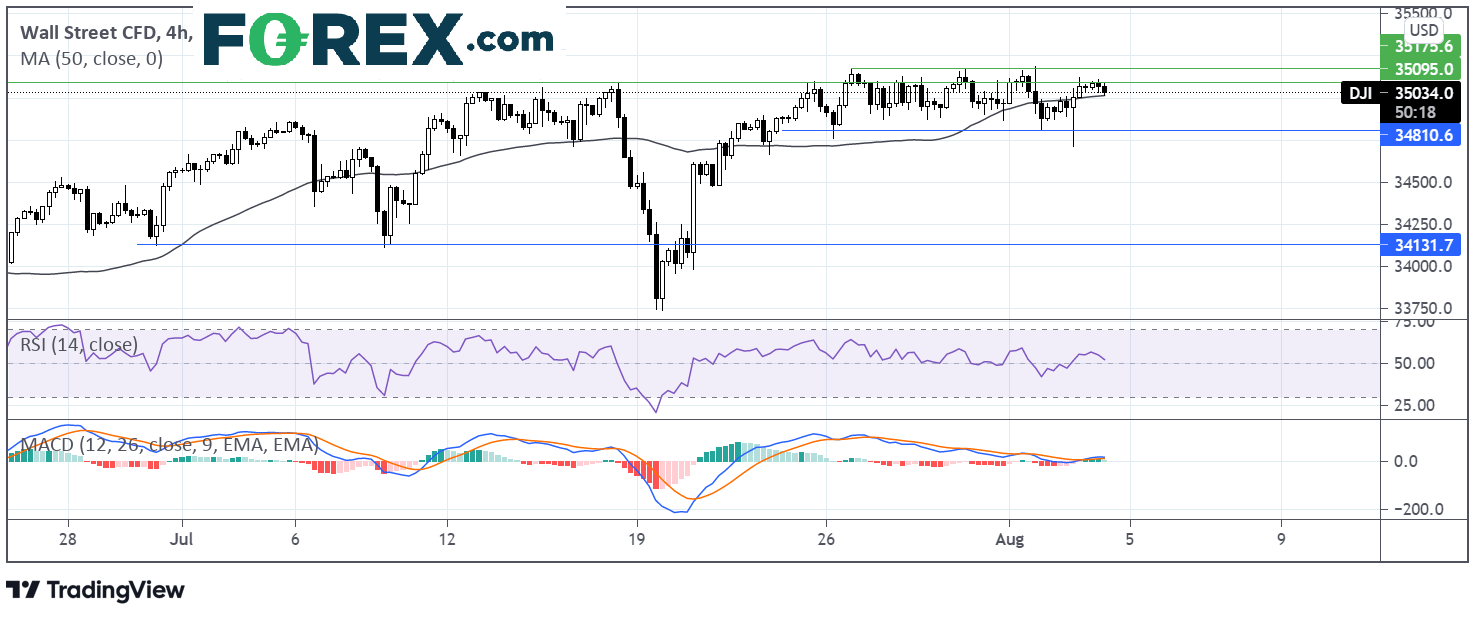

Where next for the Dow Jones?

After briefly spiking below support at 34800 yesterday, the Dow Jones recovered pushing back over the 50 sma on the 4 hour chart. However, the price once again struggled around the 35100 mark. Currently the price is caught between resistance and 35100 and the 50 sma at 35000 in a consolidation phase. Should the 50 sma hold then a move through 35100 could open the door to 35175 and fresh all time highs. Otherwise a break below the 50 sma could see a move back towards 34800 could be on the cards.

FX – USD subdued, EUR underperforms

The US Dollar is subdued as investors look ahead to the ISM services PMI and Friday’s jobs report. The Fed considers that the US economy still has a way to go until the central bank tapers stimulus, investors will be looking for signs of improvement in the economy.

EUR/USD is under performing its major peers after both retail sales and the composite PMI came in softer than forecast. Retail sales rose 1.5% month on month, missing the 1.7% forecast and down from 4.5% recorded in May. The Composite PMI which is often considered a good gauge of business was downwardly revised to 60.2, from 60.6 in the flash estimate a 21 year high.

GBP/USD +0.1% at 1.3925

EUR/USD -0.01% at 1.1865

Oil declines on covid woes

Oil prices are edging lower as covid cases are rising again in top oil consuming countries, outweighing tensions in the Middle East and a decline in US inventories. Covid cases are rising steeply in China and the US as the delta variant takes hold.

These countries struggling to contain the latest wave of covid, at a time when oil demand typically rises and as OPEC ramps up production is unnerving the oil market.

Losses in oil are being capped by a draw in crude oil inventories. According to API data US crude oil inventories fell by 879,000 barrels the week ending July 30.

US crude trades -1.75% at $69.10

Brent trades -1.4% at $71.28

Looking ahead

14:45 US Markit Services PMI

15:00 ISM Services PMI

15:30 EIA Crude Oil Stockpiles

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.