US futures

Dow futures -0.54% at 35423

S&P futures -0.36% at 4459

Nasdaq futures -0.45% at 15078

In Europe

FTSE +0.27% at 7168

Dax +0.02% at 15900

Euro Stoxx -0.28% at 4190

Covid woes and economic growth concerns drag on sentiment

US stocks are set to open lower after reaching record high in the previous session. However, the mood has deteriorated amid the geopolitical crisis in Afghanistan, rising global COVID cases and amid concerns of slowing economic growth in China and the US.

US retail sales came in softer than expected falling -1.1% month on month in July, down from a 0.6% rise in June and well below the -0.2% decline forecast. The data comes as COVID cases continue to rise in the US with records levels being reached in some states. Retail sales are notoriously volatile and one very weak performance by no means constitutes a new trend. However, given rising covid cases and falling consumer confidence it certainly looks possible to join some dots. The consumer picture in the US is looking weaker.

Consumer spending will remain in focus as quarterly reports from Walmart and Home Depot are also in focus. These retail giants are up against tough comparisons from the year ago COVID boost.

China’s assault on the tech sector continues with regulators issuing new rules intended to prevent unfair competition on the internet. The likes of Alibaba, Tencent and JD.com are trading sharply lower pre-market.

Looking ahead attention will shift to Federal Reserve Chair Powell’s speech. Investors will be watching out for clues over when the Fed could start tapering bond purchases.

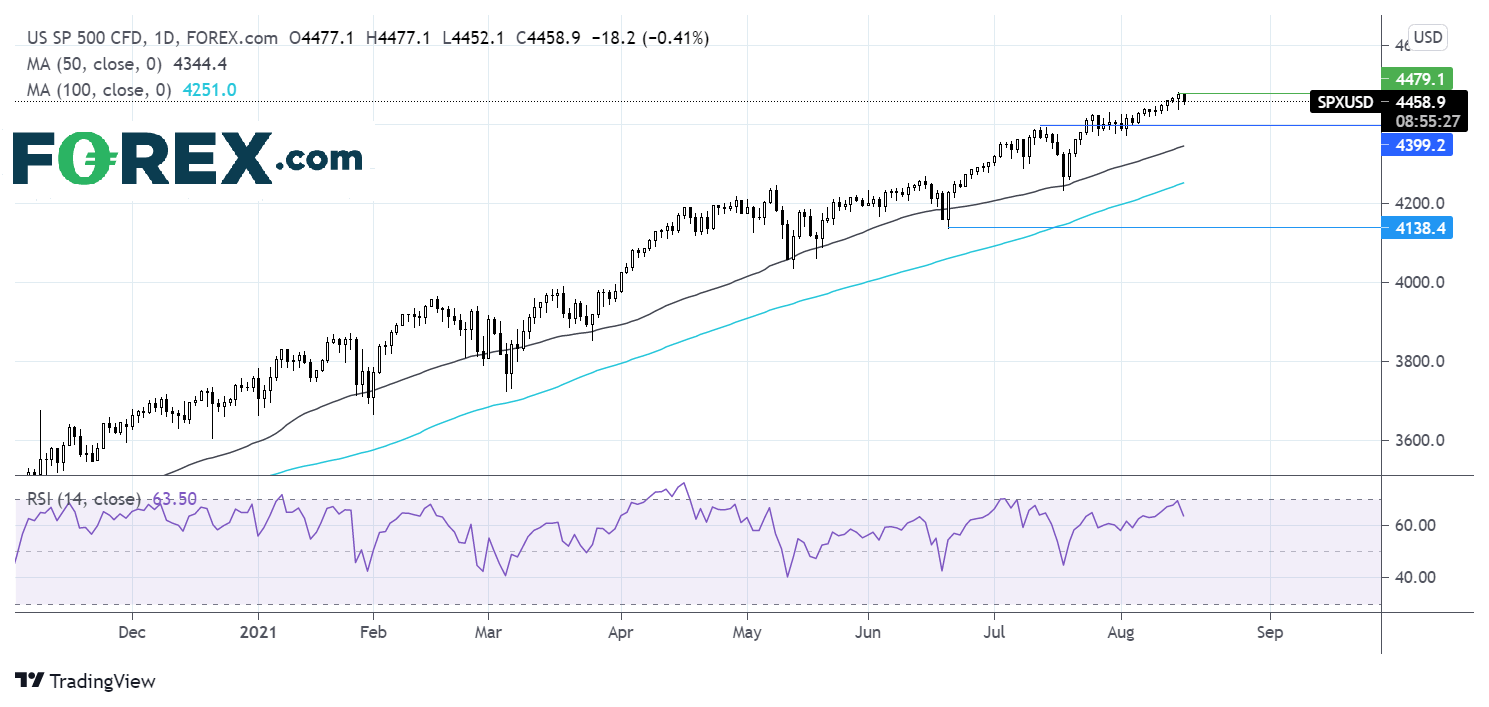

Where next for the SP500?

After another record high of 4481 in the previous session S&P500 futures are edging lower, pausing for breath in the phenomenal rally. The small move lower this morning hardly registers on the strongly bullish chart. However, buyers could be cautious after such a solid run higher. Today’s move lower is bringing the RSI out of overbought territory. It would take a move below 4390 July 13 high to negate the near term uptrend. Below here the 50 sma at 4345 could offer support. Buyers need to push over 4481 for new all time highs.

FX – USD extends gains, GBP shrugs off strong data

Broadly speaking the FX markets are quiet today after a volatile end to last week.

USD is advancing adding to gains in the previous session thanks to safe haven inflows. Attention will now shift to Fed Chair Powell.

GBP/USD – the Pound trades under pressure despite encouraging UK labour market data. UK payrolls rose by 95k, up from 25k and well ahead of the 75k forecast moving closer to pre-pandemic levels. Pay growth also hit a record high, although distorted by the year ago pandemic comparison. Unemployment fell to 4.7%.

GBP/USD +0.4% at 1.3787

EUR/USD -0.09% at 1.1765

Oil moves lower for a fourth straight session

Oil prices are extending losses for a fourth straight session on Tuesday as COVID concerns and slowing growth fears weigh on the demand outlook.

China’s Zero tolerance to COVID and recent imposition of strict pandemic restrictions to prevent the spread of Delta is unnerving investors. The latest data from China highlights the impact that such restrictions are having on the economy and on oil demand.

Japan and Australia are also tightening lockdown restrictions hurting the demand outlook and adding pressure to the oil price.

US crude trades -1.0% at $66.50

Brent trades -0.85% at $68.86

Looking ahead

14:15 US industrial production

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.