US futures

Dow futures -0.13% at 35410

S&P futures -0.18% at 4539

Nasdaq futures -0.33% at 15652

In Europe

FTSE -0.2% at 7173

Dax +0.15% at 15907

Euro Stoxx -0.12% at 4240

Futures ease off record highs

On the first day back after the extended holiday weekend US stocks are set for mildly softer open, off recent highs following the weaker than forecast US non farm payroll but still broadly supported following an upwardly revised GDP reading from Europe and stronger than forecast Chinese trade data.

Chine exports and imports grew faster than expected in August easing fears surrounding a slowing of momentum in the economic recovery and over supply bottlenecks.

Meanwhile Eurozone GDP was revised higher to 2.2% QoQ, up from 2%, which rather than sparking gains on indices across Europe instead raised concerns that support could soon by tapered.

Last week’s NFP reported prompted speculation that the Fed could delay winding in its bond purchases. However, in the same breath the meagre 253k jobs added also raised concerns over the health of the US labor market recovery.

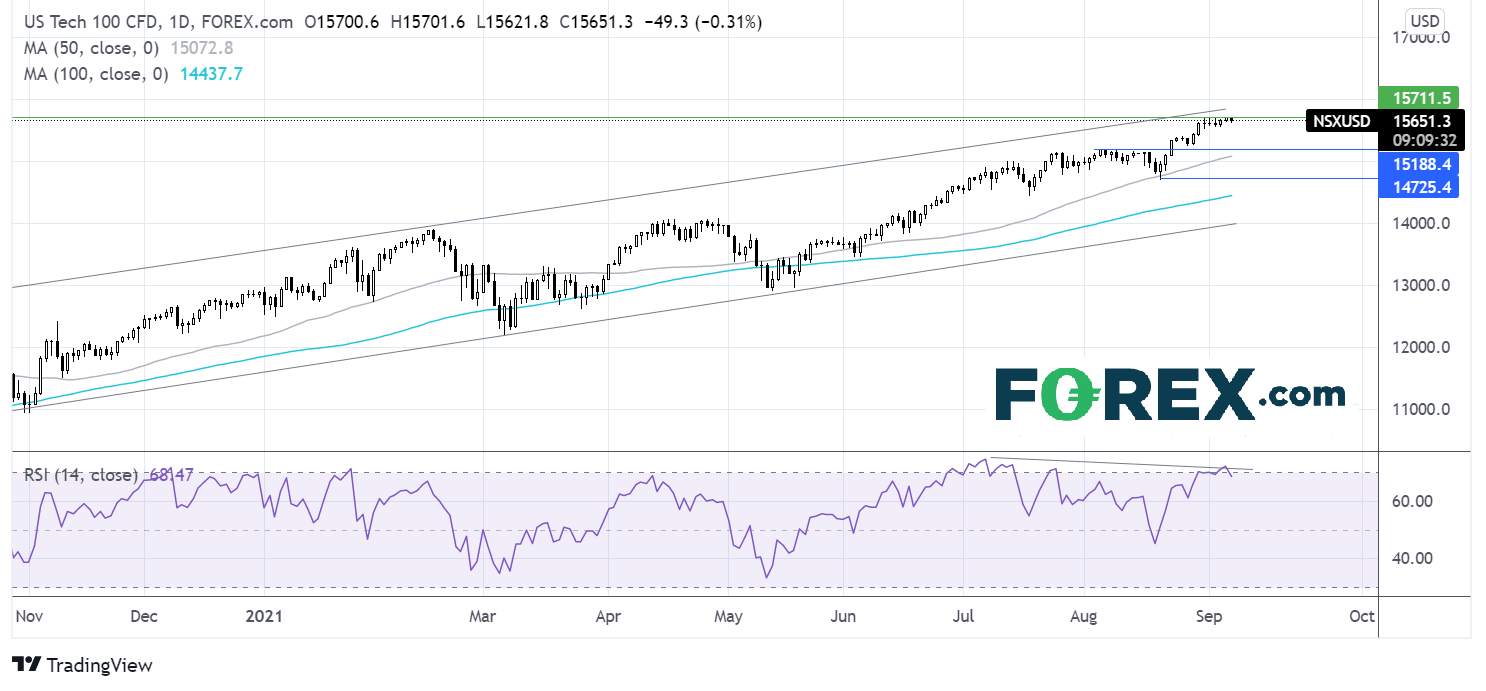

Where next for Nasdaq?

The Nasdaq has been trading in a reining channel pattern since late September. The share price trades around all time highs of 15700. Bearish RSI divergence suggests that momentum is slowing. It would take a move below 15190 horizontal support and 15100 the 50 sma for the near-term uptrend to be negated. It would take a move below 14725 for sellers to gain traction.

FX – USD extends rebound, AUD drops post RBA

The US Dollar is extending gains for a second straight session although continues to trade around monthly lows. The US Dollar lost ground following a more dovish than expected tone from Fed Chair Jerome Powell at the Jackson Hole Summit. The weaker than expected NFP fueled further losses.

AUDUSD is underperforming following the RBA meeting overnight. The RBA announced that it will continue to wind down its bond purchases from A$5 to A$4. However, the market focused on the extension of the programme which will be pushed out o mid-February from mid-November.

AUD/USD -0.5% at 0.7404

GBP/USD -0.42% at 1.3771

EUR/USD -0.09% at 1.1859

Oil searching for direction

Oil is struggling to find direction caught between upbeat data from China and concerns over Saudi Arabia’s sharp price cuts in crude oil prices for Asia.

Deep cuts from Saudi Arabia on Monday and a strengthening USD have dragged on demand, meanwhile strong economic data from China has helped to balance the mood. China’s exports grew at a stronger pace thanks to robust global demand. The data is a welcomed surprise after concerns were rising over the loss of momentum to China’s economic recovery. Chinese crude imports rose 8% in August from a month earlier.

US crude trades -0.50% at $68.39

Brent trades -0.25% at $71.77

Looking ahead

N/A