US futures

Dow futures +0.17% at 35434

S&P futures +0.35% at 4537

Nasdaq futures +0.31% at 15634

In Europe

FTSE +0.63% at 7151

Dax +0.31% at 15855

Euro Stoxx +0.90% at 4292

Stocks set for fresh record highs

US stocks are set to open on the front adding to strong gains across August. Optimism surrounding supportive central banks continues to overshadow any concerns over rising covid cases.

The S&P 500 has been notably buoyant since Federal Reserve Chair Jerome Powell adopted a less dovish than expected stance at the Jackson Hole Symposium, rallying over 1.2% across two sessions. Yesterday we saw the bulls pause for breath with the S&P 500 ending -0.1% lower; losses which will be quickly recouped on today’s open.

Still as we enter the new month of September at all-time highs it is worth keeping in mind that historically September is a poor month for gains.

Datawise ADP private payrolls miss forecasts in August increasing by just 374k against 613k forecast. This was also roughly in line with last month’s 330k. The weaker data supports the view of a more accommodative Fed for longer reflected in rising stocks and a falling greenback.

The data comes ahead of Friday’s non farm payroll and doesn’t bode well for Friday’s NFP which is expected to show 750,000 jobs added in August down from 943k.

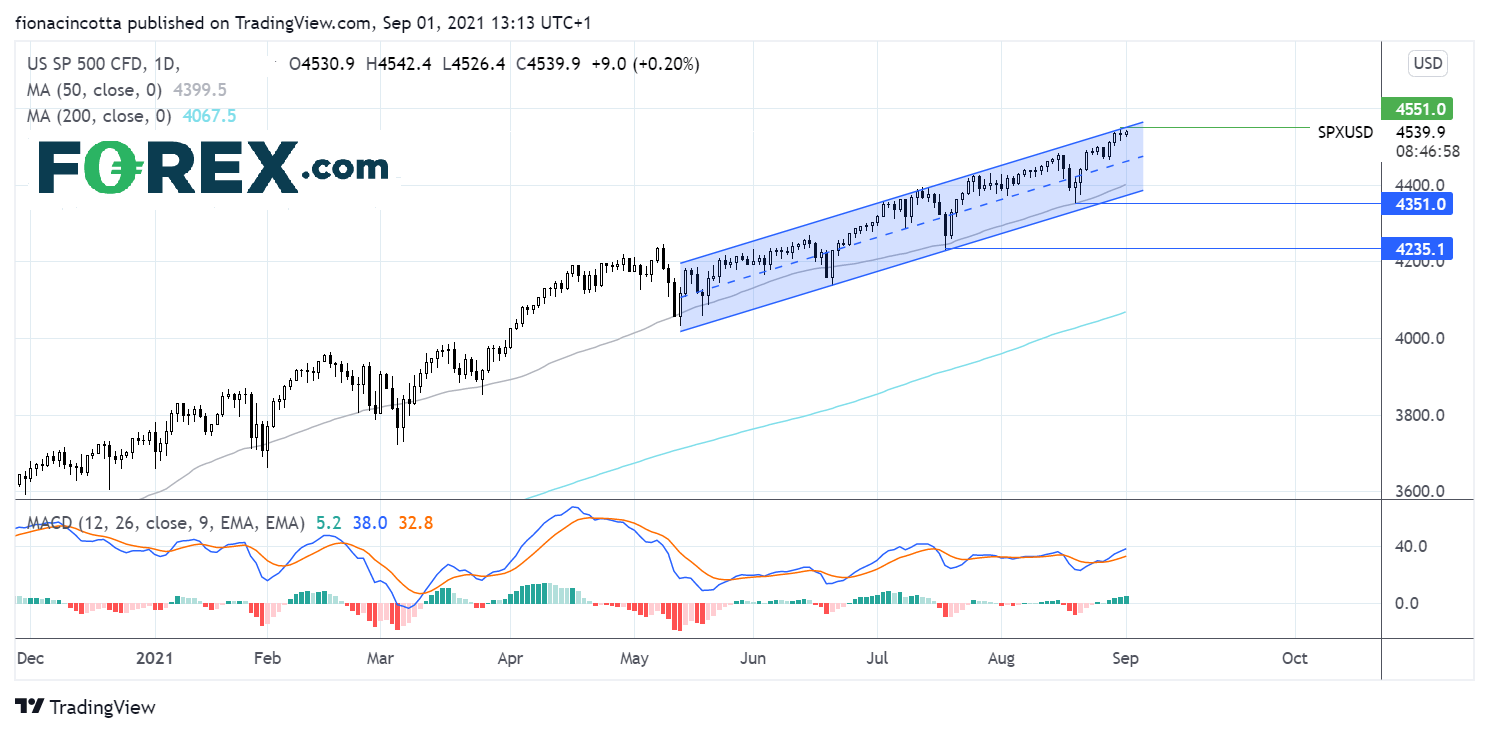

Where next for S&P share price?

The S&P500 trades within its ascending channel dating back to mid-May. The index is trading at fresh record highs at the top end of the channel. The bullish MACD is supportive of further gains. A break above and close over 4545 the all-time high and the upper band of the ascending channel could see the price find fresh legs for further upside. A move below 4380 the lower band of the channel and the 50 sma could see sellers gain traction.

FX – EUR shrugs off weak data

The US Dollar is trading around 3 week lows a after disappointing consumer confidence data and ADP payroll data today. Bets are cooling of a sooner move by the Fed.

EURUSD has shrugged off disappointing data. German retail sales came in lower than expected at -5.1% decline MoM in July, following a 4.2% jump in June. The data could suggest that the consumer driven recovery could lose steam in the third quarter after a strong first half to the year. German and Eurozone manufacturing PMIs were also downgraded.