USD/CAD ahead of BoC rate decision

The BoC reined in its bond purchases by C$1 billion in July, bringing the total to C$2 billion per month.

Since then the situation in Canada has deteriorated amid rising covid cases which have slowed the economic recovery. Political stability is also under the spotlight ahead of the elections on September 20th.

As a result, the BoC are not expected to adjust monetary policy. A further tapering of bond purchases looks unlikely this month. However, the central bank is expected to retain its first-rate hike for H2 2022.

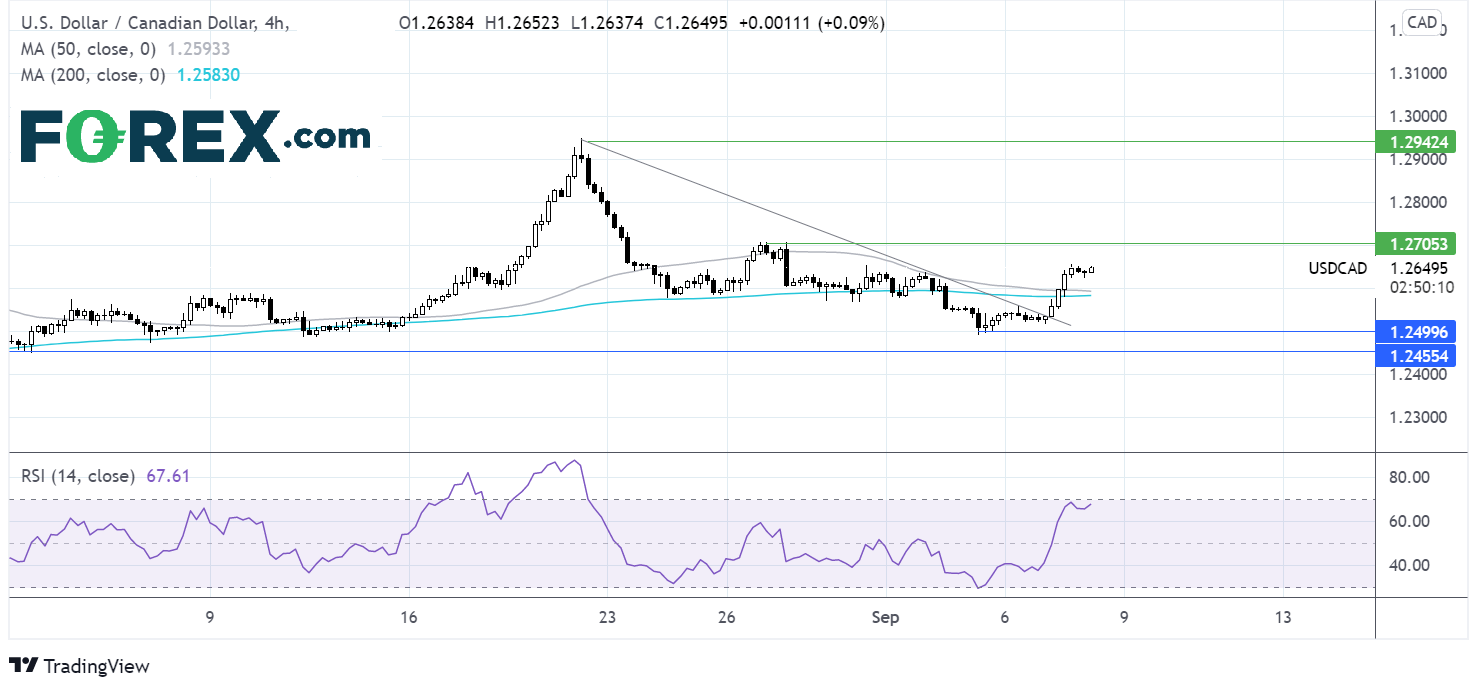

Where next for USD/CAD?

USD/CAD has gained just shy of 1% so far this week. The push higher has seen the pair break above the descending trendline dating back to August 20, the 50 & 200 sma. The rise higher has run into resistance around 1.2650. The RSI is supportive of further gains whilst it remains out of overbought territory.

A meaningful move above 1.2650 is needed for the pair to reclaim 1.27 the late August high and look back towards 1.2940 the August high.

Strong support can be seen around 1.2580 the confluence of the 50 & 200 sma ahead of 1.25 the September low and 1.2450 the August low.

US crude oil prices look to inventory data

Oil prices are edging higher paring losses from the previous session as investors continue weighing up demand concerns, the slow pick up of production in the US Gulf of Mexico and a rising US Dollar.

Producers in the US Gulf of Mexico are struggling to kick start production 9 days after Hurricane Ida. 79% of Gulf production remains offline.

API inventory data today and EIA data tomorrow will be closely watched today for further insight as to how the storm impacted production and refinery output. Expectations are for a draw in inventories of 3.8 million barrels and gasoline stocks a draw of 3.6 million barrels.

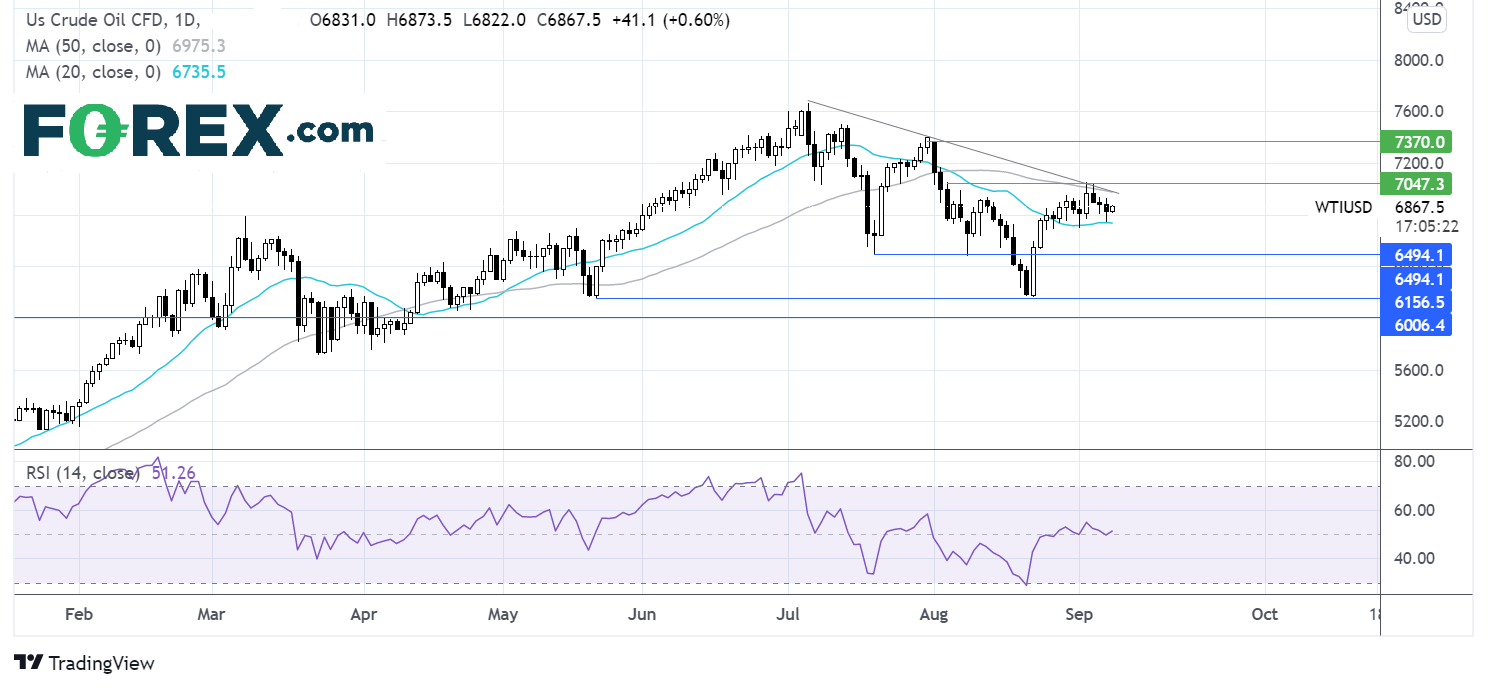

Where next for WTI?

WTI crude oil rebounded off the 20 sma but faced tough resistance from the two-month descending trendline and the 50 sma on the daily chart.

The RSI is offering few clues at 50 and the price remains between the 20 & 50 sma.

Traders might look for a breakout trade here with sellers watching for a move below the 20 sma at 67.45 which could open the door towards 65.10 the July low.

Buyers might wait for a move above 69.75 the 50 sma and descending trendline resistance for a move towards 73.70 the August high.