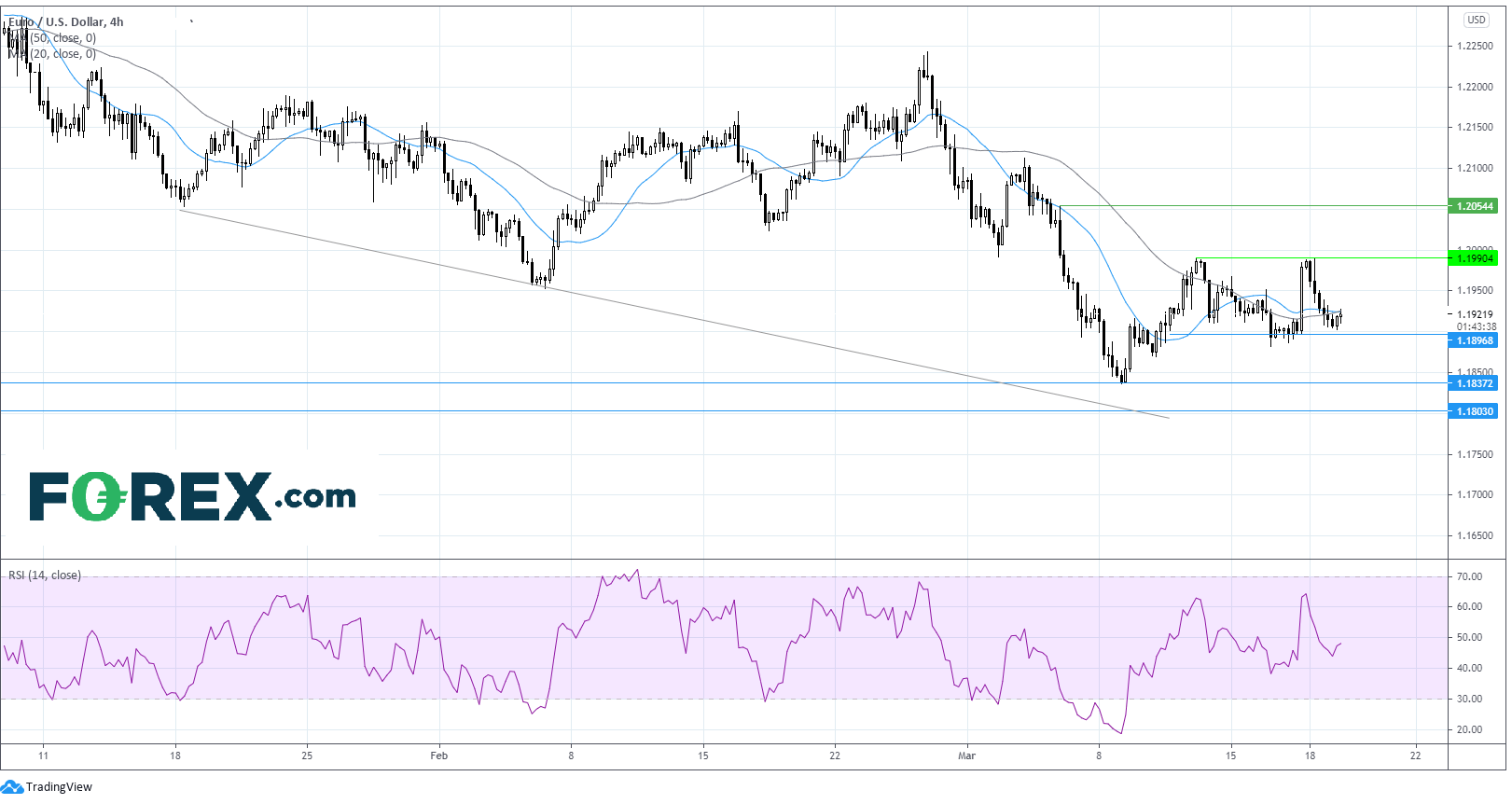

EUR/USD picks up as US yields ease, but still looks vulnerable

US 10 year yields rose to 13 month high of 1.75% yesterday. However, they have eased today to around 1.70%. The US Dollar is also giving back some of Thursday’s gains.

Some European countries plan to resume using the AstraZeneca covid vaccine which is underpinning the common currency. Although France tightening lockdown restrictions adds weight to the Euro

Where next for EUR/USD?

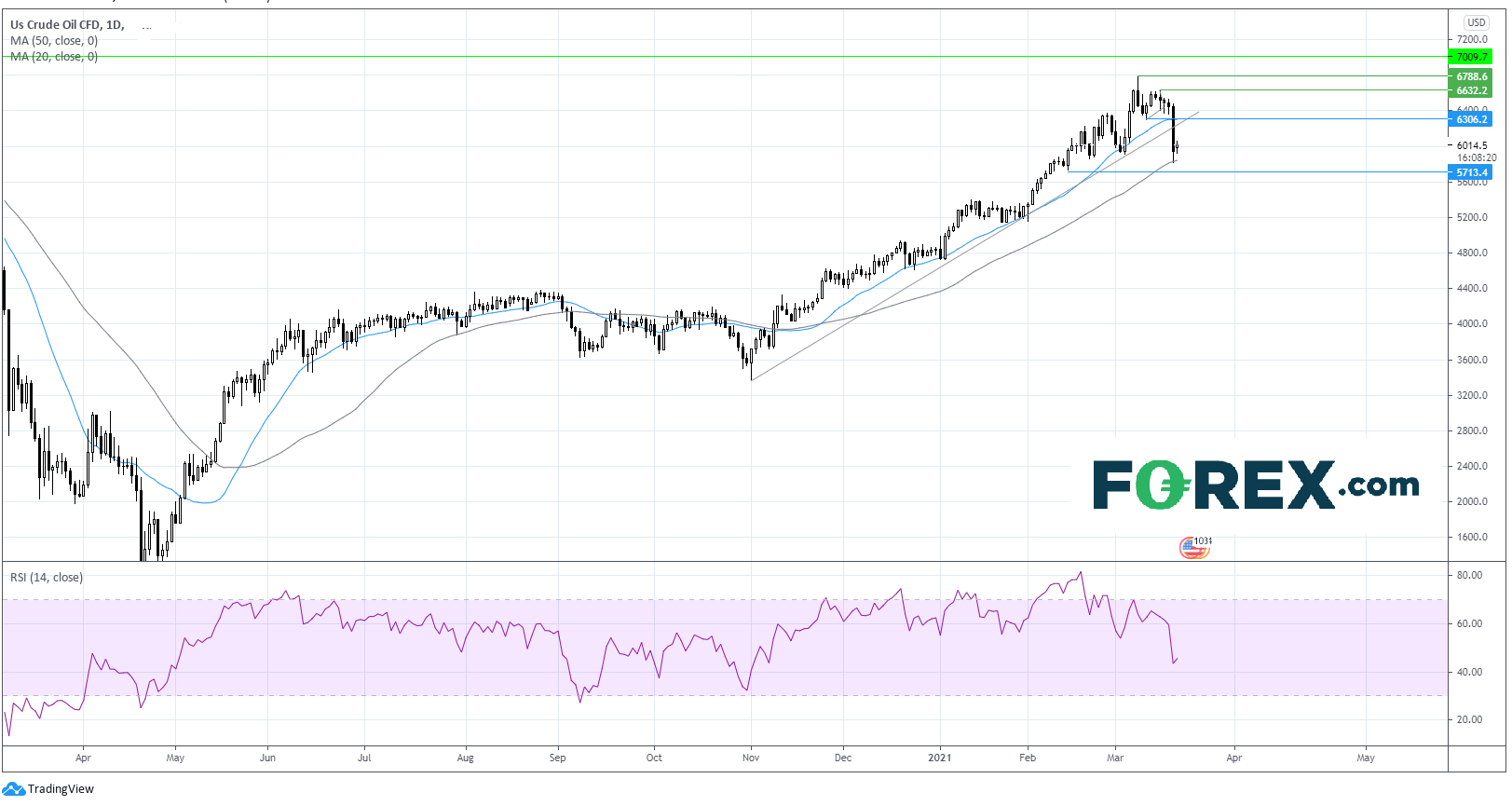

WTI bounces of 50 sma, uptrend still intact for now

WTI dropped by 7.6% yesterday in its worst day since the wild swings back in April. Across the week WTI is looking to shed some 8%

Energy prices faltered this week amid concerns regarding the vaccine rollout in Europe & tighter lockdown restrictions impacting the demand outlook. The stronger US Dollar added pressure to oil.

Today, the US Dollar is easing, tracing yields lower and some European countries have said they will resume the AsatraZeneca vaccine providing a touch of optimism.

The economic calendar is relatively quiet with just the Baker Hughes rig count in focus later today.

Where next for WTI?

Whilst WTI dropped sharply through its ascending trend line dating back to early November. The 50 sma on the daily chart offered support, halting the sell off. Breaking through these two supports could lead to a deeper selloff bringing 57.00 support into focus.

However, the price has pushed higher from the 50 sma and has retaken the key $60.00 sma. To look convinsing the recovery would need to push beyond 62.80 back over the ascending trend line. Beyond here buyers could re-aim for the yearly high of 67.80