The outcome of the OPEC+ meeting was a bit of a surprise! Given the rise in oil prices, particularly since February 1st, WTI prices have risen over 20%! Many analysts had forecasted that the rise in crude prices, combined with the decreased supply and the increase in expected demand, would be enough for members to raise output anywhere from 1.2 million barrels per day to 1.5 million barrels per day. Anything less, and the markets would be disappointed. However, at the conclusion of today’s OPEC+ meeting, ministers decided that it would be best to leave current output UNCHANGED! As a result, WTI crude prices rose 6% at one point today to its highest levels January 9th, 2020, near 64.785 (and completed its flag pattern target!). The January 9th, 2020 highs acts as first resistance at 65.66.

Source: Tradingview, FOREX.com

Don’t miss Matt Weller’s special webinar reviewing the OPEC meeting and outlining the key factors for oil traders to watch over the rest of 2021 – register for FREE here!

EUR/CAD has been highly negatively correlated to the price of WTI oil since the beginning of the year. (With Fed Chairman Powell’s comments regarding monetary policy today, it’s best not to use USD/CAD for Canadian Dollar analysis, due to today’s volatility in the US Dollar). Notice that the correlation coefficient between EUR/CAD and WTI flipped from positive to negative on January 8th. Although the negative correlation has weakened a bit since February (-0.86 lows), it is currently strengthening again, currently at -0.62. EUR/CAD has been in a downward sloping channel since late July 2020. With the move higher today in Crude prices, EUR/CAD moved aggressively lower. The pair is currently testing the bottom, downward sloping trendline of the channel near 1.5150. Horizontal support from May 2020 below the channel crosses at 1.5050.

Source: Tradingview, FOREX.com

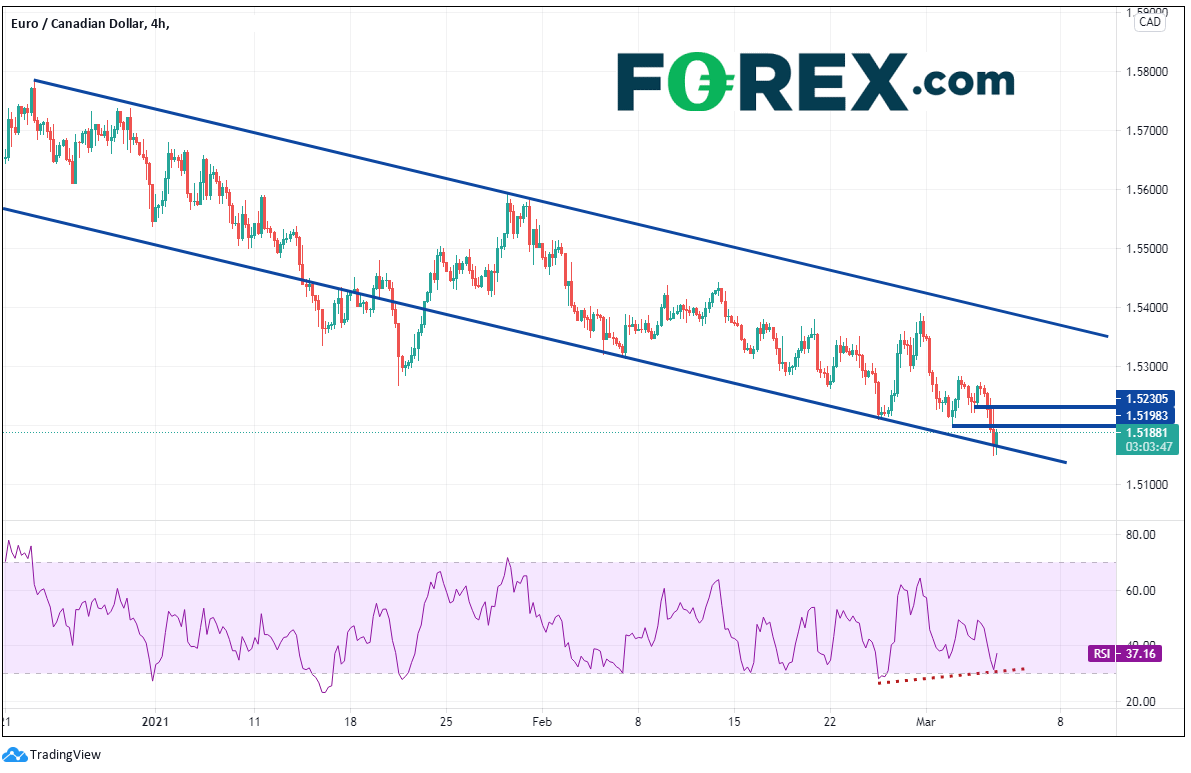

On a 240- minute timeframe, EUR/CAD has formed a shorter-term downward channel of its own, briefly breaking below in mid-January. The pair is currently testing the bottom of this channel as well. Notice that the RSI is diverging with price, indicating that the pair maybe ready to bounce (and that the bottom trendline may hold). Horizontal resistance is above near 1.5200 and 1.5230. Watch for bears to add to short position near these levels, in hopes of taking out weak longs below today’s lows.

Source: Tradingview, FOREX.com

Click here to learn everything you need to know to trade the oil markets

The result of no change in supply from OPEC will result in markets focusing on the demand side of the equation for the next month. If the vaccine rollout continues to be strong, expected demand will pick up and prices should continue higher.

OPEC+ will meet again in April to discuss output.

Learn more about oil trading opportunities.