Asian Indices:

- Australia's ASX 200 index fell by -35.4 points (-0.5%) and currently trades at 7,060.40

- Japan's Nikkei 225 index has risen by 481.01 points (1.67%) and currently trades at 29,294.46

- Hong Kong's Hang Seng index has risen by 48.91 points (0.17%) and currently trades at 28,466.89

UK and Europe:

- UK's FTSE 100 futures are currently up 5 points (0.07%), the cash market is currently estimated to open at 7,044.30

- Euro STOXX 50 futures are currently down -1 points (-0.03%), the cash market is currently estimated to open at 4,001.79

- Germany's DAX futures are currently down -11 points (-0.07%), the cash market is currently estimated to open at 15,159.78

Wednesday US Close:

- The Dow Jones Industrial rose 97.34 points (0.29%) to close at 34,230.34

- The S&P 500 index rose 2.93 points (0.070354%) to close at 4,167.59

- The Nasdaq 100 index fell -41.297 points (-0.3%) to close at 13,503.37

Learn how to trade indices

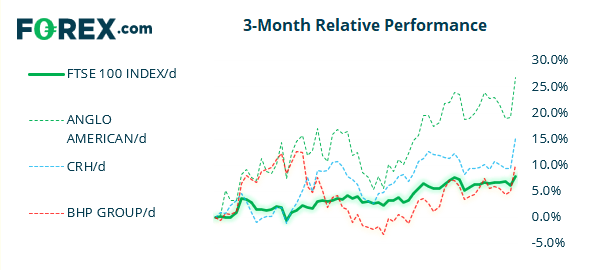

Mining Stocks Lead the FTSE 100

The FTSE rose at it most bullish pace in two months yesterday, as bullish sentiment made light work of annihilating the bearish key reversal day that had us convinced the market had topped. That said, the market rallied from the open and did not technically confirm Tuesday’s elongated bearish candle, but it was a tease one the less. Moving forward, the daily trend remains bullish above 6912 and a break above 7050 assumes bullish continuation on the daily chart.

FTSE 350: 7039.3 (1.68%) 05 May 2021

- 208 (59.26%) stocks advanced and 130 (37.04%) declined

- 14 stocks rose to a new 52-week high, 5 fell to new lows

- 84.62% of stocks closed above their 200-day average

- 20.23% of stocks closed above their 20-day average

Outperformers

- + 6.29% - Anglo American PLC (AAL.L)

- + 5.35% - CRH PLC (CRH.I)

- + 4.99% - BHP Group PLC (BHPB.L)

Underperformers:

- -3.54% - C&C Group PLC (GCC.L)

- -3.38% - PZ Cussons PLC (PZC.L)

- -3.35% - Oxford BioMedica PLC (OXB.L)

Beijing puts high level economic talks with Australia On Ice (indefinitely)

With an economy that has been so reliant upon China for economic growth over the years, it came as a surprise when it was Australia who spearheaded a call for an international inquiry into the Covid-19 origins last year (at a time many blamed the outbreak on China). Unsurprisingly, relations between Australia and China have been strained ever since. More recently, Australia cancelled two deals with China surrounding the Belt Road Initiative, to which Beijing warned trade ties ‘may’ deteriorate further. So, today’s announcement by China’s state economic planner is simply China turning the screw on an already fragile relationship. Assuming China always held the cards (which they most certainly do), today’s move from Beijing puts Australia in a very bad negotiating position. And that will weigh on growth during Australia’s recovery, hence why traders were quick to sell AUD across the board. It also weighed on the ASX 200, just as we though it may break above 7100 with conviction.

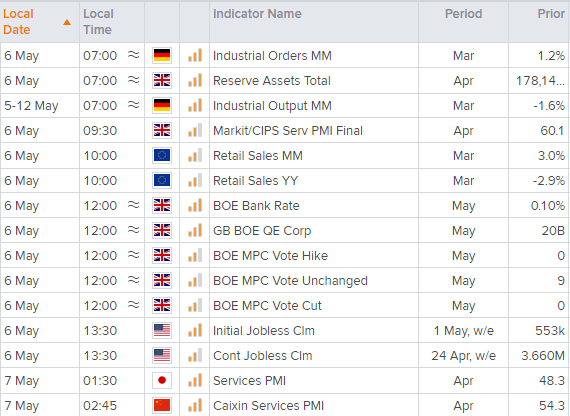

GBP holds steady ahead of today’s BOE meeting

With economic data not coming in as bad as feared in Q1 overall, there is a chance of cautious optimism from today’s BOE meeting. Taken alongside the reopening plans which is now in full swing, dare we say there could be some upward revisions to BOE’s forecasts and begin tapering their QE program.

- Our bias on GBP/JPY remains bullish above 150.73 on the daily chart and for a run towards 153.00/72.

- Given the deteriorating ties between China and Australia, GBP/AUD should appeal to bulls should today’s BOE meeting be more hawkish than expected. A break above 1.0800 is one to watch.

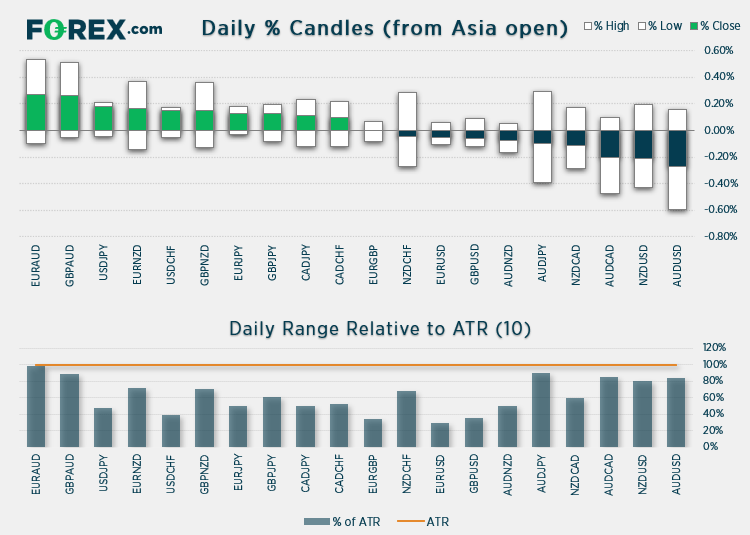

The US dollar index (DXY) hovers just below 91.40, a pivotal level for the session/s ahead. EUR/USD sits around 1.2000 and is coiling up within a bullish wedge on the four-hour chart. Clearly, should DXY hold below resistance then we could see a bullish breakout on the euro, yet if DXY breaks higher then EUR/USD should break below 1.2000 and weigh further on metal prices.

CAD/JPY continues to look strong and is considering a break above key resistance at 89.22. We first identified its potential to rally on the 23rd of March, ahead of the breakout from trendline resistance, and the pair has not disappointed. After rising to 89.22 in a near straight line, a small retracement saw prices pull back to 88.41 before breaking higher. With the swing low now in place, an upside breakout could be imminent.

- The bias remains bullish above 88.42, although a cluster of lows around 88.85 could also be used to aid with risk management.

- A break above 89.22 brings 90.00 into focus.

- Given the strength of the trend overall, a move towards the 91 high could also be considered further out.

Learn how to trade forex

Copper retreats from its highs

Gold prices were 0.2% higher overnight, after finding support at the 20-day eMA and 1769.6 level yesterday. The jury is still out as to whether gold can break above 1800 sooner or later, but the fact remains that, regardless of the dollar’s strength, buyers keep on stepping in around 1760 to keep gold prices higher. Should real rates (interest rates adjusted for inflation) fall, then it could be game on for a breakout above 1800.

Copper prices remain anchored around the August 2011 after a cute attempt to break above it. Whilst the trend remains bullish overall, do not discount the potential for a retracement whilst the dollar index teases traders with a break above 91.40.

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.