Asian Indices:

- Australia's ASX 200 index rose by 20.7 points (0.28%) and currently trades at 7,495.20

- Japan's Nikkei 225 index has fallen by -53.91 points (-0.2%) and currently trades at 37,589.59

- Hong Kong's Hang Seng index has risen by 427.89 points (1.63%) and currently trades at 26,622.71

UK and Europe:

- UK's FTSE 100 futures are currently up 12.5 points (0.18%), the cash market is currently estimated to open at 7,118.22

- Euro STOXX 50 futures are currently up 9 points (0.22%), the cash market is currently estimated to open at 4,126.95

- Germany's DAX futures are currently up 34 points (0.22%), the cash market is currently estimated to open at 15,589.08

US Futures:

- DJI futures are currently up 278.24 points (0.8%)

- S&P 500 futures are currently down -2.5 points (-0.02%)

- Nasdaq 100 futures are currently down -4.75 points (-0.11%)

China service PMI softens the blow, ISM services up next

China’s service PMI expanded at a 2-month high of 54.90 in July, softening the blow from the underwhelming (and barely expansive) manufacturing print over the weekend. Yet with covid cases rising across cities in China and signs appearing that tourism is already under pressure, then there are no assurances that either the service or manufacturing PMI’s won’t be under water by the next report.

Share markets in Hong Kong and mainland China led gains with the Hang Seng rising 1.5% and CSI300 currently up 0.4%. The ASX 200 briefly touched a new record high before trading back below 7500. Japan’s share markets remained under pressure as the spread of the Delta variant prompted the head of the Medical Association to call for a nationwide state of emergency.

ISM services PMI is the main calendar event at 15:00 BST. Given the negative response from markets when manufacturing PMI disappointed, it would serve as a double blow to sentiment should the service also fall short of the 60.4 expected (and fall below the 60.1 prior).

View today’s video: Bulls Look Aggressive At the S&P 500 highs (FBHS, PNR)

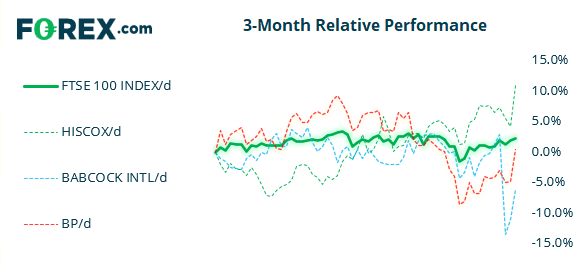

FTSE 350: Market Internals

FTSE 350: 4091.24 (0.34%) 03 August 2021

- 184 (52.42%) stocks advanced and 153 (43.59%) declined

- 41 stocks rose to a new 52-week high, 1 fell to new lows

- 76.07% of stocks closed above their 200-day average

- 62.39% of stocks closed above their 50-day average

- 25.93% of stocks closed above their 20-day average

Outperformers:

- + 6.56% - Hiscox Ltd (HSX.L)

- + 5.66% - Babcock International Group PLC (BAB.L)

- + 5.64% - BP PLC (BP.L)

Underperformers:

- -10.02% - Smiths Group PLC (SMIN.L)

- -6.95% - Rotork PLC (ROR.L)

- -3.77% - Flutter Entertainment PLC (FLTRF.I)

Forex:

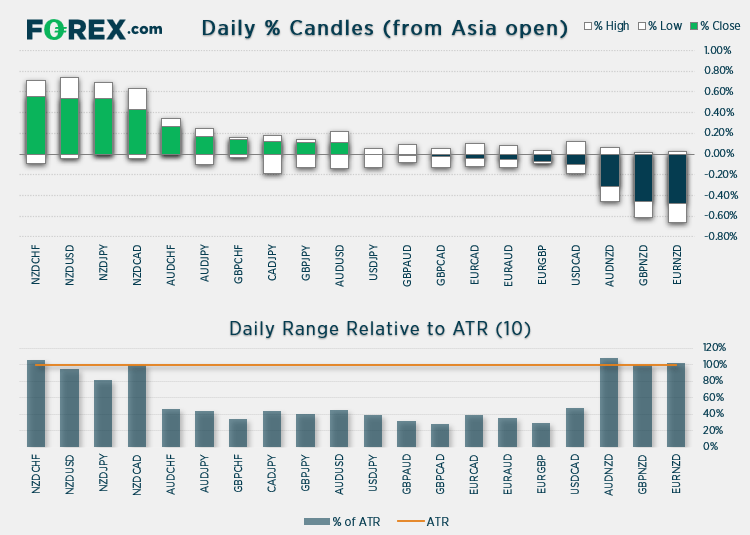

The New Zealand dollar dominated the overnight session after a strong employment report brought forward expectation of rate hike from RBNZ, with some calls for them to rise to 1% (from 0.25%) by the year end. This currently puts them on track for the first central bank from a developed economy to raise rates – after already having halted their QE program.

The Kiwi dollar is up around 0.6% against the yen and 0.5% against USD, although NZD/USD appears to have less in the way of obvious resistance levels nearby.

NZD/USD made hard work of holding below 0.7000 throughout July before eventually finding its low at 0.6900. Whilst the 200-day eMA capped as resistance ahead of today’s employment report, it quickly turned it into support today and prices now trade above the 50-day eMA. Over the near-term we remain bullish above 0.7000 with 0.7100 in sight, although it’s possible prices may not re-test today’s low / 200-day eMA as Europe and US respond to the employment report.

Commodities:

The Thomson Reuters CRB commodity basket declined for a third day after reaching a fresh four-year high last week. We see this as a wobble in a strong trend as opposed to a reversal, and yesterday’s bullish hammer which closed above the 20-day eMA shows bearish momentum is already waning. We may be a little premature but we’re monitoring for signs that a higher low has formed. Oil prices will likely play a large part in this.

WTI has stabilised back above $70 although found resistance at its 50-day eMA. Whilst we remain uncertain the corrective low is in place, yesterday’s lower wick accounts for around half of yesterday’s range, so we may not be too far from one. Perhaps Friday’s NFP print could be the deciding factor on this.

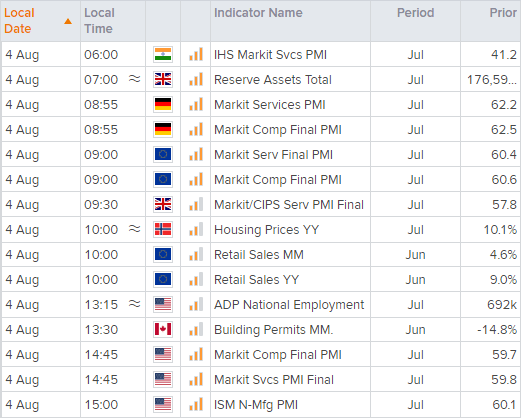

Up Next (Times in BST)