Asian Indices:

- Australia's ASX 200 index rose by 63.4 points (0.93%) to close at 6,892.10

- Japan's Nikkei 225 index has fallen by -349.29 points (-1.16%) and currently trades at 29,739.96

- Hong Kong's Hang Seng index has risen by 560.39 points (1.97%) and currently trades at 28,938.74

UK and Europe:

- UK's FTSE 100 futures are currently up 29.5 points (0.44%), the cash market is currently estimated to open at 6,766.80

- Euro STOXX 50 futures are currently up 25 points (0.64%), the cash market is currently estimated to open at 3,970.96

- Germany's DAX futures are currently up 133 points (0.88%), the cash market is currently estimated to open at 15,240.17

Monday US Close:

- The Dow Jones Industrial rose 373.98 points (1.13%) to close at 33,527.19

- The S&P 500 index rose 58.04 points (1.45%) to close at 4,077.91

- The Nasdaq 100 index rose 268.65 points (2.02%) to close at 13,598.16

Indices: European and US equities are broadly higher

European indices ended the week on a strong note, just like their US counterparts. The S&P 500 and Dow Jones hit fresh record highs and the Nasdaq now looks like it is on a mission to crack 14,000. The DAX closed above 15k for the first time on Thursday and we are yet to see any worrying signs which could spoil its bullish trend on the daily chart. The CAC closed above 6100 for the first time since January 2020 (which was in fact its pre-pandemic peak). And the STOXX 50 closed to its highest level since February 2020, which remains its record high.

The FTSE 100 will open for the first time since Thursday due to the four-day Easter weekend. Yet unlike its European counterparts, its daily trend remains directionless and closed the week with a small Rikshaw Man Doji, just below its 200-week eMA. Thursday’s trade held above its 20-day eMA yet remains trapped within Wednesday’s bearish engulfing candle, therefore a break beneath the engulfing candle cements our bearish bias for the day.

No surprises from the RBA

The Reserve Bank of Australia (RBA) kept their policy unchanged today, so rates and their 3-year bond target remain at 0.1%. They reiterated their lower for longer approach although said they are “carefully” monitoring trends in property credit due to the latest housing boom. Expectations for macro-prudential tools to return are likely to rise, and perhaps the pressure has been added with RBNZ doing just that in March. There was little reaction form the Australian dollar, although the ASX 200 closed at a 5-week high.

Forex: The dollar is on the back foot

As one would expect following a four-day weekend, trading ranges were small overnight for forex pairs. The US dollar index (DXY) has risen gently from yesterday’s low after printing a noteworthy bearish engulfing candle yesterday. And, as outlined in today’s Asian Open report, we’re waiting for prices to break below 92.50 support.

- GBP/USD: Cable trades around 1.3900 after posting a solid gain yesterday (its most bullish close in nearly two months). Today’s bias remains bullish above 1.3850 and for a move closer towards 1.4000 resistance.

- GBP/CHF: 1.3000 remains a key focal point and, therefore, a pivotal level. Take note that yesterday produced a bearish pinbar at this key level so a break beneath it warns of a retracement.

- EUR/USD: A bullish engulfing candle formed yesterday which has taken prices just beneath the 1.1835 low. Expect this resistance level to be pivotal today, as a break above it brings the 1.1900 handle into focus.

- USD/CAD: A second bearish engulfing candle has formed beneath trendline resistance. The bias remains bearish below yesterday’s high. See today’s video for a closer look: [Video] Is the Nasdaq 100 Headed for 14k?

GBP/NZD shows potential for range expansion

Volatility always oscillates between high and low, so when we see prices ‘compress’ (such as a consolidation or low volatility retracement) we are then on the lookout for ‘range expansion’ where volatility increases and a directional move unfolds.

Given GBP/NZD is in a strong uptrend on the daily chart and we suspect bullish range expansion could be materialising, we are keeping a close look to see if momentum really is about to realign itself with the dominant trend.

The 10-day eMA is providing dynamic support and a small bullish inside candle formed yesterday, following a series of bullish and bearish spikes near recent highs. As prices have broken to a two-day high overnight we suspect the correction may be complete.

- The bias remains bullish above the 1.9591 low, although if this is a bullish range expansion day then Thursday’s low at 1.9629 could also be used to aid with risk management.

- The initial target is just below the 1.9800 high but, given the strength of the underlying trend we suspect bulls will try and break higher towards the 1.9956 – 2.000 zone.

- A break below 1.9510 wars of a counter-trend phase.

Commodities: Copper springs back to life

Copper may have completed its correction after gapping above $4 yesterday and breaking above trendline resistance. The bias is bullish above yesterday’s gap and for a run towards the February highs and potentially beyond. See today’s video for a closer look.

WTI prices remained near yesterday’s bearish engulfing candle low. If we’ve come to expect anything of it late, its to see it remain volatile and choppy on a daily basis as prices ricochet between 57.25 and 62.30. So, until we see a break outside of that range, then range trading strategies may be the best approach. However, given it has broken beneath its bullish trendline on the daily chart and is in the bottom quartile of its range then we’re keeping a close eye for a potential break below 57.25.

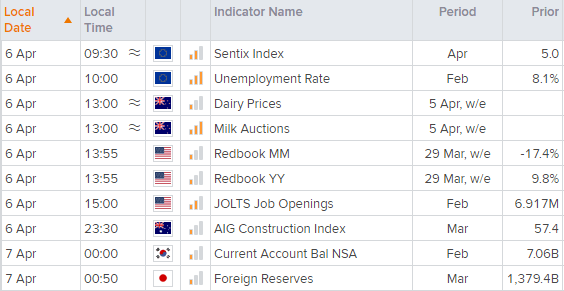

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

- The IMF (International Monetary Fund) release their World Economic Outlook and Global Financial Stability report.

- ECB President Christine Lagarde participates in the IMF/World Bank Sprig Meetings.