Asian Indices:

- Australia's ASX 200 index was close due to a public holiday in New South Wales

- Japan's Nikkei 225 index has risen by 167.04 points (0.58%) and currently trades at 29,115.63

- Hong Kong's Hang Seng index has risen by 103.25 points (0.36%) and currently trades at 28,842.13

UK and Europe:

- UK's FTSE 100 futures are currently up 21.5 points (0.3%), the cash market is currently estimated to open at 7,155.56

- Euro STOXX 50 futures are currently up 13 points (0.31%), the cash market is currently estimated to open at 4,139.70

- Germany's DAX futures are currently up 32 points (0.2%), the cash market is currently estimated to open at 15,725.27

US Futures:

- DJI futures are currently up 13.4 points (0.04%)

- S&P 500 futures are currently up 27.75 points (0.2%)

- Nasdaq 100 futures are currently up 4.5 points (0.11%)

View today’s video: Platinum Shorts Rise, Bears Circle Gold and MS

Future point to a higher open for European indices

It was a strong close for European indices last week and futures market suggest that strength is to continue. FTSE 100 futures are currently up by 0.3%, which is not bad considering the UK is set to have its lockdown extended by four weeks. Let’s see how the cash market reacts after the open.

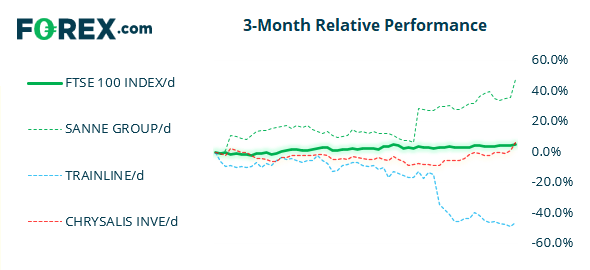

The FTSE 100 enjoyed its bet week in over a month, led higher by mining and financial stocks last week. Metal miners rose 1.8%, insurance stocks rallied 1.3% and precious metal miners were up by 0.7%. Still, we expected to see metal mining stocks come under pressure today as gold prices rolled over from 1900 on Friday and broke a key trendline support level overnight in Asian trade.

FTSE 100 S/R Levels

- R3: 7164

- R2: 7150

- R1: 7138 – 7140.70

- S1: 7129

- S2: 7117 - 7123

- S3: 7100

- S4: 7081.22

FTSE 350: Market Internals

FTSE 350: 7134.06 (0.65%) 11 June 2021

- 256 (72.93%) stocks advanced and 77 (21.94%) declined

- 20 stocks rose to a new 52-week high, 2 fell to new lows

- 85.75% of stocks closed above their 200-day average

- 19.94% of stocks closed above their 20-day average

Outperformers:

- + 8.81% - Sanne Group PLC (SNNS.L)

- + 5.44% - Trainline PLC (TRNT.L)

- + 5.24% - Chrysalis Investments Ltd (CHRY.L)

Underperformers:

- -3.46% - Workspace Group PLC (WKP.L)

- -3.19% - Volution Group PLC (FAN.L)

- -3.15% - Restaurant Group PLC (RTN.L)

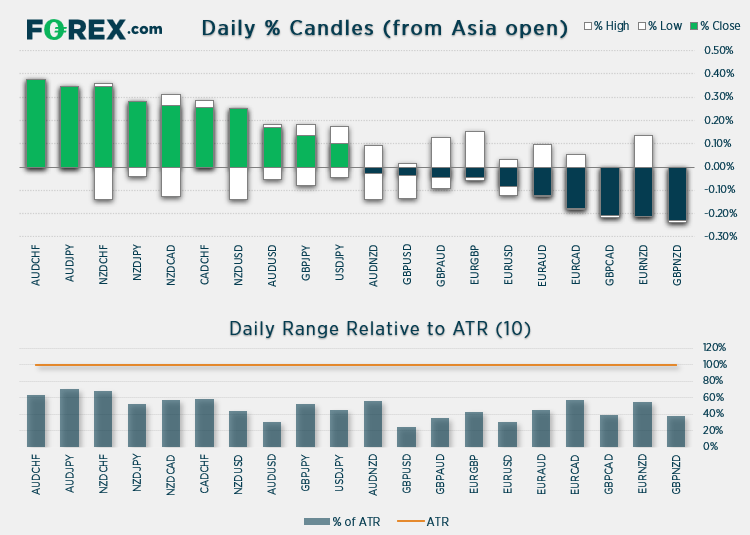

Tight ranges for forex pairs, USD/CAD in focus

With the exception of NZD, major currencies remained in tight ranges of less than 0.1%. The New Zealand dollar is currently the strongest currency, rising 0.2% against the greenback.

AUD/JPY is currently the strongest cross, with prices remaining above trendline support mentioned in today’s Asian open report. As mentioned we need to see a risk-off catalyst to drive it lower, but its inability to hold above 85.0 has not gone unnoticed.

GBP/JPY is yet to resume its uptrend with a break above 155.32, but it has found support at its 20-day eMA so, as things stand, we continue to suspect the corrective low has been seen at 154.13.

USD/CAD has fallen over 18% since its March high, and retracements have been few and far between. But after holding above 1.2000 for several weeks, bullish volatility finally returned to break prices to out of its 4-week sideways range. In fact, prices appear to have formed a rounding bottom pattern which suggests a target sits just below 1.2300.

Prices gapped higher at the open and have retraced to its breakout level and a potential bullish flag is forming. Such levels aren’t always perfect so we can allow for some noise around it but, hopefully, prices will continue to coil in a tight range / flag pattern before its next leg higher. The initial target is the 1.2200 high, although the 38.2% Fibonacci ratio sits just above 1.2250 should prices continue higher, ahead of the eventual 1.2290 / 1.2300 target.

If prices instead close back beneath the breakout level today it warns of a bull-trap and the analysis will be reassessed.

Metals feel the weight of a strong US dollar

Gold prices continued lower during overnight trade, falling a further 0.62% and breaking the 1869.60 swing low after its -1.14% loss on Friday. It’s now broken its March trendline and our bias remains bearish beneath the trendline, although we’d like to see 880 hold as resistance if it is to move to 1850 sooner than later.

Price action on silver remains choppy and indecisive as ever. Friday’s break above $28 on Friday was short-lived, with its reversal failing to test the Feb 23rd high and closing the day with a bearish pinbar. This is now the third bearish pinbar that has formed around the Fed 23rd high since its May high. Silver is currently trading -0.37% lower and at a two-day low.

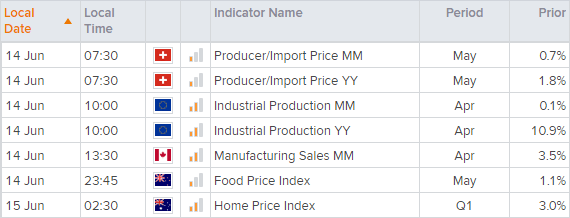

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.