Asian Indices:

- Australia's ASX 200 index fell by -11.4 points (-0.15%) and currently trades at 7,517.10

- Japan's Nikkei 225 index has risen by 235.03 points (0.79%) and currently trades at 29,894.92

- Hong Kong's Hang Seng index has risen by 143.1 points (0.55%) and currently trades at 26,306.73

UK and Europe:

- UK's FTSE 100 futures are currently down -19 points (-0.26%), the cash market is currently estimated to open at 7,168.18

- Euro STOXX 50 futures are currently down -6.5 points (-0.15%), the cash market is currently estimated to open at 4,239.63

- Germany's DAX futures are currently down -27 points (-0.17%), the cash market is currently estimated to open at 15,905.12

US Futures:

- S&P 500 E-minis are index up 4.75 points (0.1%)

- Nasdaq 100 E-minis are index up 27 points (0.17%)

- Dow Jones E-minis are index up 52 points (0.15%)

View today’s video: European Indices Rise Ahead of Thursday’s ECB Meeting

Indices

Exports from China rose by 25.6% YoY in August, beating estimates of 17.1% and up from 19.3% in July. Imports also rose 33.1%, up from 28.1% despite lockdowns across the region. Separately analysts also expect China to cut their RRR (Reserve Ratio Requirement) for banks in a bid to lift growth which is also lifting sentiment for Asian equity markets. Yet stimulus is also expected from Japan.

Japan’s equity markets continued to soar following the sudden resignation of PM Suga on Friday, with reports that a strong contender to success him has called for a $30 trillion yen stimulus package. The Nikkei 225 rose above 30k for the first time in April, although is now on track to close the day with a bearish hammer which warns of near-term exhaustion to the rally. The TOPIX was the next performer and hit a new 30-year high, rising around d0.9% on the day. The Hang Seng also posted strong gains of around 0.85%, although the 200-day eMA looms nearby at 9540 and makes a likely resistance level.

A bullish engulfing candle rallied from the 20-day eMA on the FTSE yesterday, although attention turns to the 7200 – 7225 range to see if prices will roll over from that yet zone like it did back in August.

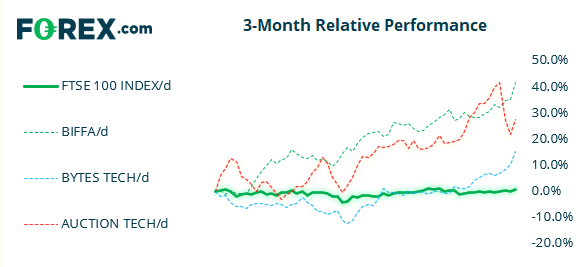

FTSE 350: Market Internals

FTSE 350: 4159.94 (0.68%) 06 September 2021

- 220 (62.68%) stocks advanced and 119 (33.90%) declined

- 51 stocks rose to a new 52-week high, 4 fell to new lows

- 76.64% of stocks closed above their 200-day average

- 76.92% of stocks closed above their 50-day average

- 25.07% of stocks closed above their 20-day average

Outperformers:

- + 4.79% - Biffa PLC (BIFF.L)

- + 4.58% - Bytes Technology Group PLC (BYIT.L)

- + 4.53% - Auction Technology Group PLC (ATG.L)

Underperformers:

- -4.32% - Discoverie Group PLC (DSCV.L)

- -3.96% - Hammerson PLC (HMSO.L)

- -3.56% - Syncona Ltd (SYNCS.L)

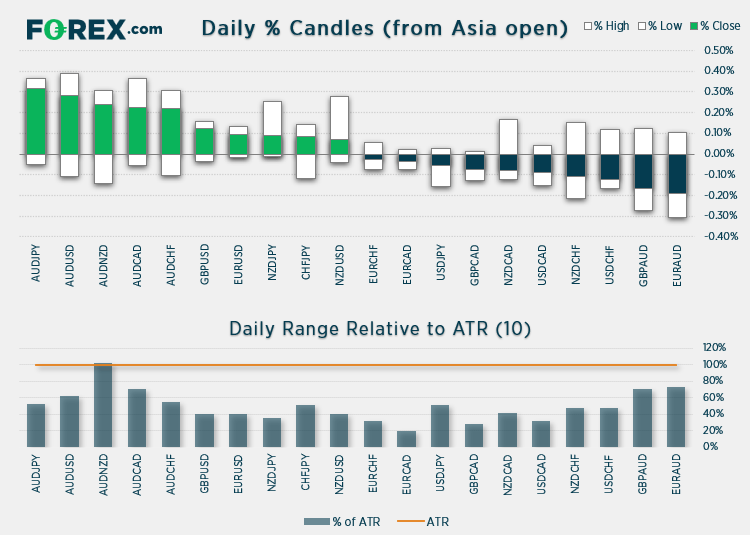

Forex:

The RBA held rates as widely expected, although decided to persist with tapering their asset purchases, despite extended lockdowns in New South Wales and Victoria.

The RBA held rates as widely expected, although decided to hold off from tapering their asset purchases due to the concerns extended lockdowns in New South Wales and Victoria will have on the economy.

The US dollar index (DXY) continues to meander around its 200-day eMA, but we may need to wait for data to pick up before we see any significant moves.

On Friday GBP/USD broke above trend resistance which was projected for the June high. It gave back some gains yesterday but still shows the potential to produce another leg higher, should key support levels hold.

We can see on the four-hour chart that the trend structure remains firmly bullish and an ascending channel and has found support at its 20-day eMA. Two small Doji’s closed above the weekly pivot point and prices have broken above their highs to hint at a potential swing low. Our bias remains bullish above 1.3800 but, if momentum moves higher earlier in the session we could raise this threshold closer to the 1.3815 low.

Learn how to trade forex

Commodities:

Gold prices continue to trade in a tight range, just beneath Friday’s high. Support has been found around 1820 where the weekly pivot point and 20-bar eMA on the four-hour chart reside. A break above 1835 is now required before we can assume resumption of its bullish trend.

Palladium continues to coil up near last week’s lows, so we’re waiting to see if bears can relinquish control and force prices below 2380 and extend losses form the August high.

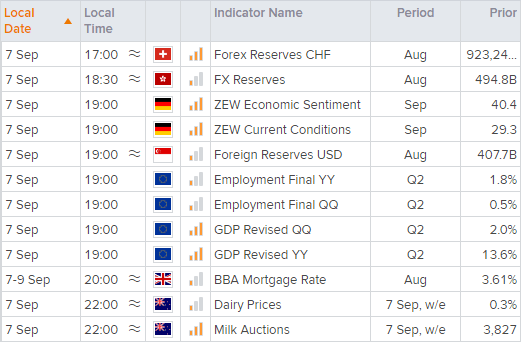

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log-in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.