Another possible explanation, Arbitrum ( A Layer 2 protocol that seeks to scale and lower the gas fees on Ethereum by carrying transactions off-chain ), went live on mainnet yesterday. Leaving the market caught underweight Ethereum after rotation into other Layer 1s, including Solana.

Finally, surging demand for Non-Fungible Tokens (NFTS) and Defi apps remain supportive of Ether, the cryptocurrency of the Ethereum network and a reason why advocates of Ethereum prefer it over Bitcoin.

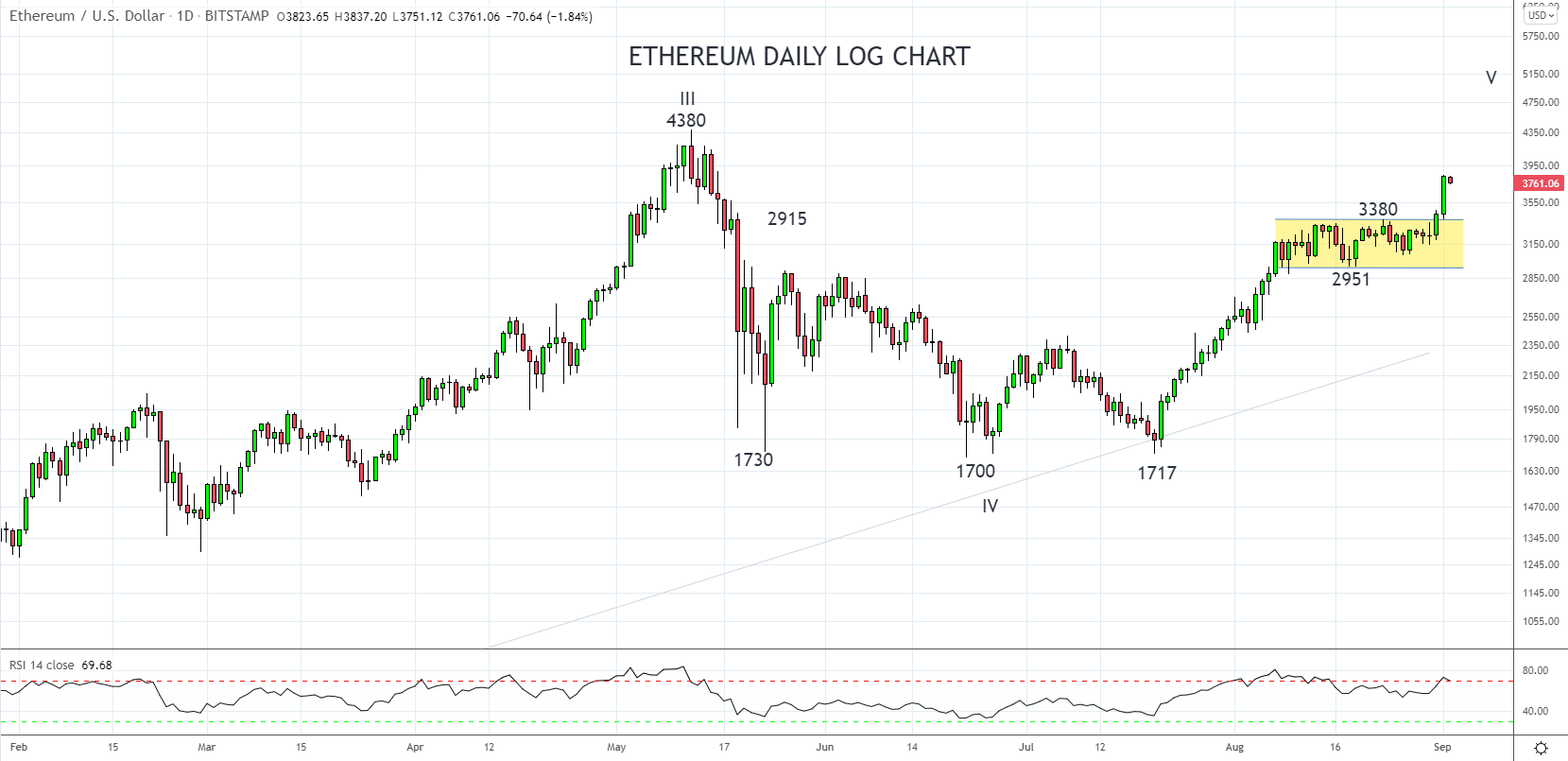

Regardless of the fundamental reasons, the rally in Ethereum hasn't come as a surprise to traders who incorporate technical analysis into trading cryptocurrencies.

As noted in yesterday's City Index Morning Brief, following the breakout of the top of its recent range (when Ethereum was trading at $3415), it was suggested: "opening long Ethereum positions in expectation of a push towards $3700 and then $4000. Stops should be placed below $3200 on a closing basis". After reaching the first profit target, the next objectives are $4000 before a retest/break of the May $4380 high.

Turning to Bitcoin. Yesterday's test and bounce from the support provided by the 200-day moving average at $46,000 is encouraging. Should Bitcoin now break above the band of resistance between $50,500 and $52,000, it would indicate the Bitcoin is set to follow Ethereum's lead and trade higher towards $61,000.

Source Tradingview. The figures stated areas of September 2nd of September, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation