The ECB is slowing the pace of bond buying under its Pandemic Emergency Purchase Program (PEPP) to “a moderately lower pace” than in the previous two quarters. However, in the press conference, Christine Lagarde said that “We are not tapering, we are recalibrating PEPP”. Until this meeting, the ECB has been buying roughly 80 billion euros worth of bonds. By not putting a hard number on the amount of bonds the ECB will buy, it allows them the flexibility to change the amount as needed. The ECB felt that the spread of the delta variant and supply constraints are still a risk, which therefore, allows them to continue with current financing conditions. Christine Lagarde also said that there is still some way to go before the pandemic damage to the economy is offset.

Everything you need to know about the ECB!

As far as the outlook for GDP, the ECB expects GDP to rise in 2021 to 5.0% vs June’s projection of 4.6%. In addition, they expect 4.6% in 2022 vs 4.7% previous. They also said that they see inflation rising in the near-term, however it will moderate to their target of 2% in the medium term. They forecast inflation at 2.2% vs 1.9% for 2021, 1.7% vs 1.5% for 2022 and 1.5% for 2023 vs 1.4% previous. Note that 2022 and 2023 levels are much lower than the 2% targeted rate. They also currently do not see a rise in wage inflation.

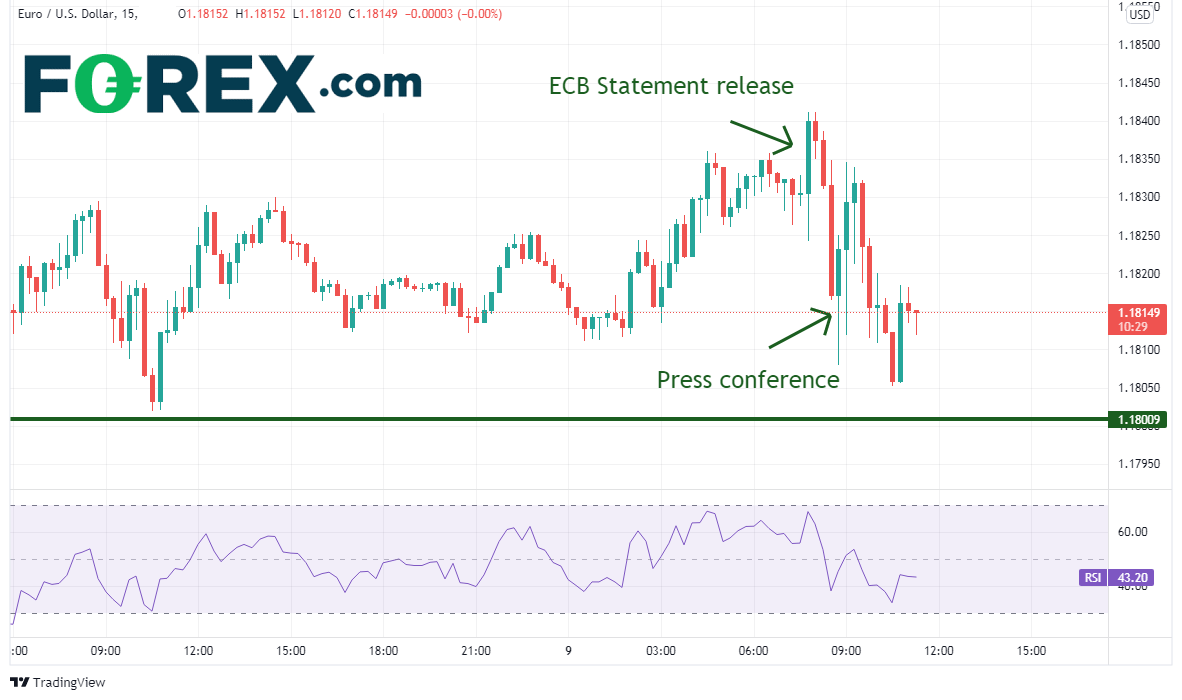

The result of the ECB meeting may have been a disappointment to traders who were looking for a hard number on the amount they would reduce purchases. The initial reaction was for EUR/USD to go bid from 1.1830 to 1.1841 as traders were happy to hear of a moderately lower pace of bond buying, however the bid quickly reversed as traders quickly realized that a hard number would not be set and the statement was more on the dovish side. EUR/USD traded down to 1.1808 as they press conference progressed.

Source: Tradingview, Stone X

Trade EUR/USD now: Login or open a new account!

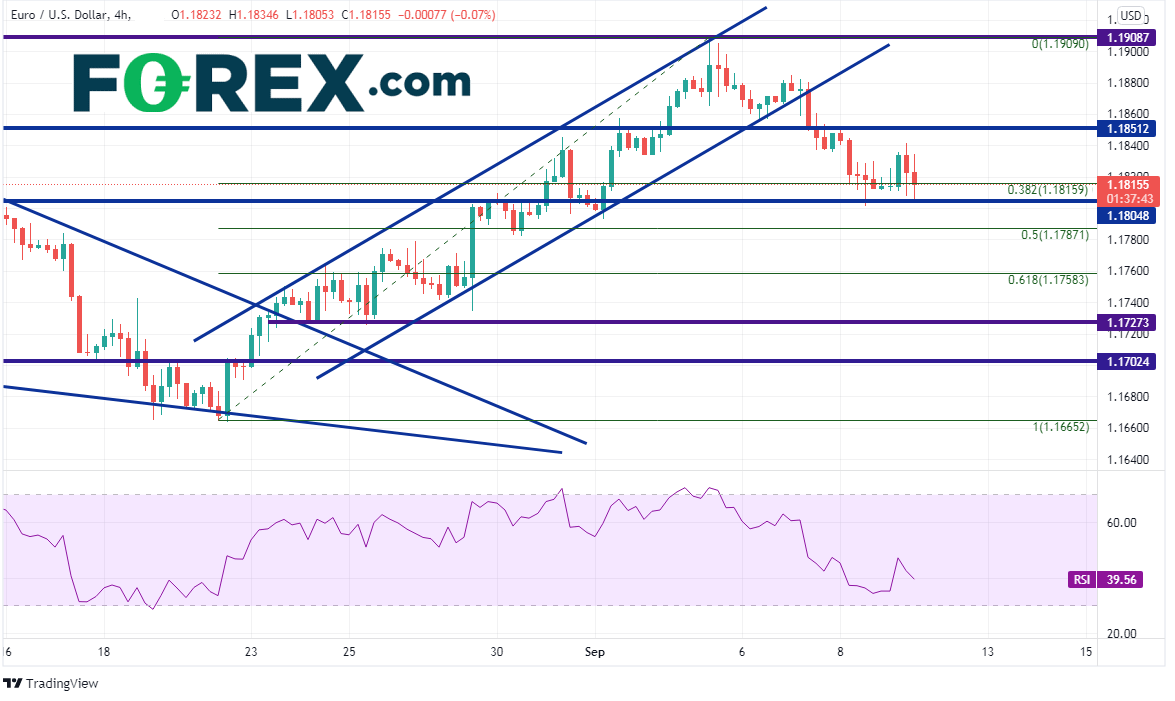

On a 240-minute timeframe, EUR/USD has held support at the 38.2% Fibonacci retracement level from the August 20th lows to the September 3rd highs near 1.1815, as well as horizontal support at 1.1804. The next support level is the 50% retracement level from the same timeframe at 1.1787 and the 61.8% Fibonacci retracement level at 1.1758.

Source: Tradingview, Stone X

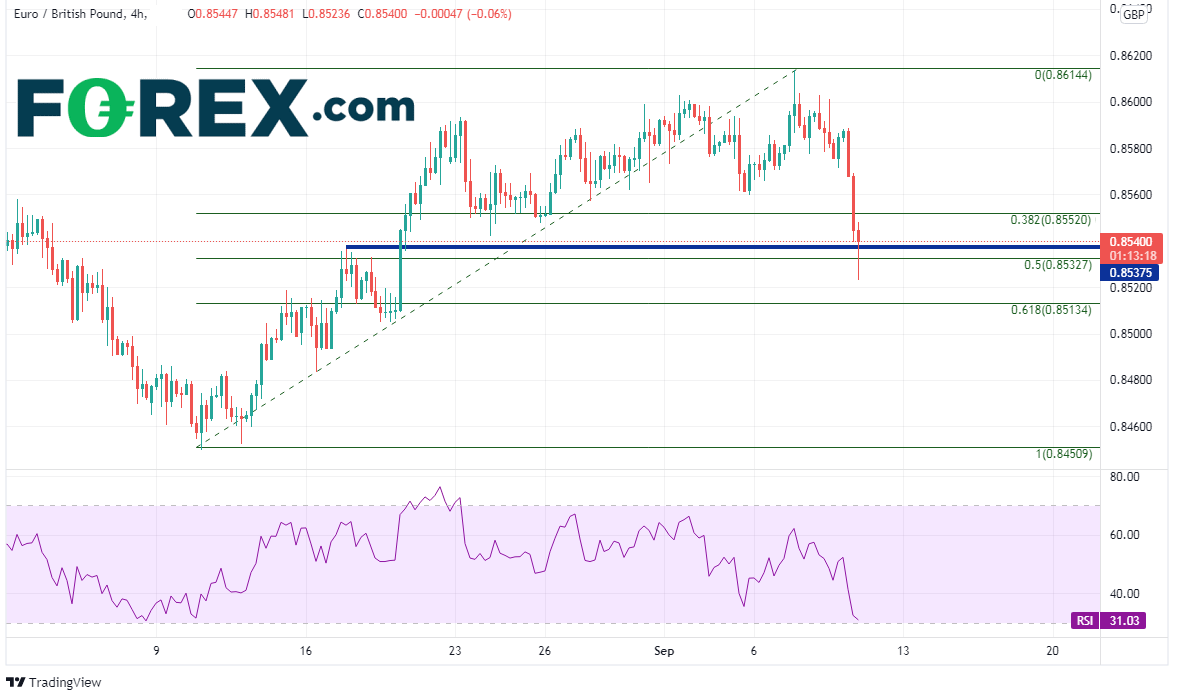

In addition, due to comments earlier from BOE Governor Bailey, as well as the dovish ECB, EUR/GBP has taken a big hit. The pair broke the 38.2% Fibonacci retracement level from the August 10th lows to the September 7th highs near 0.8552, horizonal support, and the 50% retracement level from the same timeframe near 0.8538/0.5832. However, the move is approaching oversold territory on the RSI and may be ready for a bounce. Below there, price can fall to the 61.8% Fibonacci retracement at 0.8513.

Source: Tradingview, Stone X

Trade EUR/GBP now: Login or open a new account!

Given the moves in many of the Euro pairs today, the ECB was taken as more dovish than expected. Christine Lagarde mentioned another review at the December meeting. This may take some of the focus away from the October meeting as a time when the committee may announce more “tapering”. Upcoming economic data, supply constraints, and the path of the virus will drive the focus ECB members.

Learn more about forex trading opportunities.