Asian Futures:

- Australia's ASX 200 futures are up 10 points (0.14%), the cash market is currently estimated to open at 7,499.90

- Japan's Nikkei 225 futures are up 100 points (0.36%), the cash market is currently estimated to open at 27,594.24

- Hong Kong's Hang Seng futures are up 258 points (1.03%), the cash market is currently estimated to open at 25,367.59

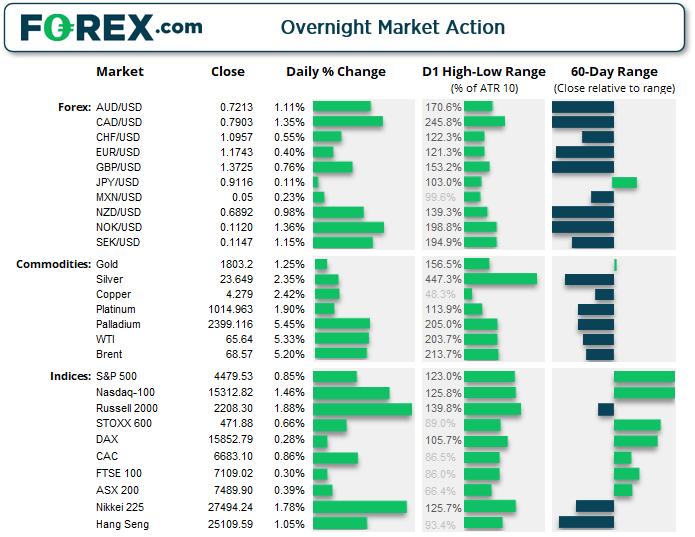

UK and Europe:

- UK's FTSE 100 index rose 21.12 points (0.3%) to close at 7,109.02

- Europe's Euro STOXX 50 index rose 28.92 points (0.7%) to close at 4,176.42

- Germany's DAX index rose 44.75 points (0.28%) to close at 15,852.79

- France's CAC 40 index rose 56.99 points (0.86%) to close at 6,683.10

Monday US Close:

- The Dow Jones Industrial rose 215.63 points (0.61%) to close at 35,335.71

- The S&P 500 index rose 37.86 points (0.86%) to close at 4,479.53

- The Nasdaq 100 index rose 220.248 points (1.46%) to close at 15,312.82

US indices rally for a third day

The FDA’s approval of Pfizer-BioNTech COVID-19 vaccine lifted sprits on Wall Street to help US indices more than erase last week’s losses. The Nasdaq 100 rallied for a third day and rose 1.46%, closing to a new record high. 85% of stocks advanced, led by consumer cyclicals and technology sectors. Moderna was the strongest performer, rising 7.5% as it took advantage of its rival’s FDA approval – even though Moderna’s vaccine is not yet fully approved. The Dow Jones rose 0.61% although remains just beneath its record high, the S&P 500 rose 0.85% to a new record, 7 of its 11 sectors posted gains led by energy and technology sectors. The Russell 200 (small cap index) rallied 1.8%.

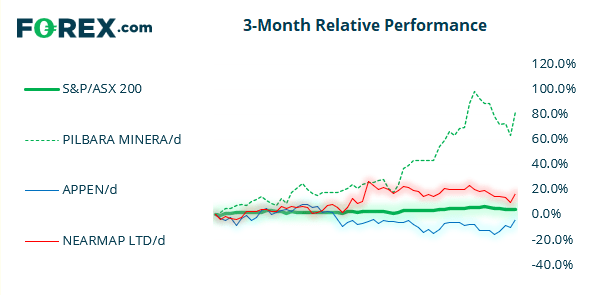

The ASX 200 snapped a 5-day losing streak yesterday, a day after posting an inverted hammer and further suggesting a swing low has formed at 7429.20. Whether it can fully return to its long-term bullish trend and retest its record high remains to be seen, but we suspect an interim low is at least in place and its needs a corrective bounce.

ASX 200 Market Internals:

ASX 200: 7489.9 (0.39%), 23 August 2021

- Information Technology (1.68%) was the strongest sector and Consumer Staples (-0.42%) was the weakest

- 10 out of the 11 sectors closed higher

- 4 out of the 11 sectors outperformed the index

- 127 (63.50%) stocks advanced, 63 (31.50%) stocks declined

- 65.5% of stocks closed above their 200-day average

- 61% of stocks closed above their 50-day average

- 63% of stocks closed above their 20-day average

Outperformers:

- + 11.39% - Pilbara Minerals Ltd (PLS.AX)

- + 7.09% - Appen Ltd (APX.AX)

- + 6.87% - Nearmap Ltd (NEA.AX)

Underperformers:

- -11.03% - NIB Holdings Ltd (NHF.AX)

- -6.41% - Redbubble Ltd (RBL.AX)

- -5.78% - TPG Telecom Ltd (TPG.AX)

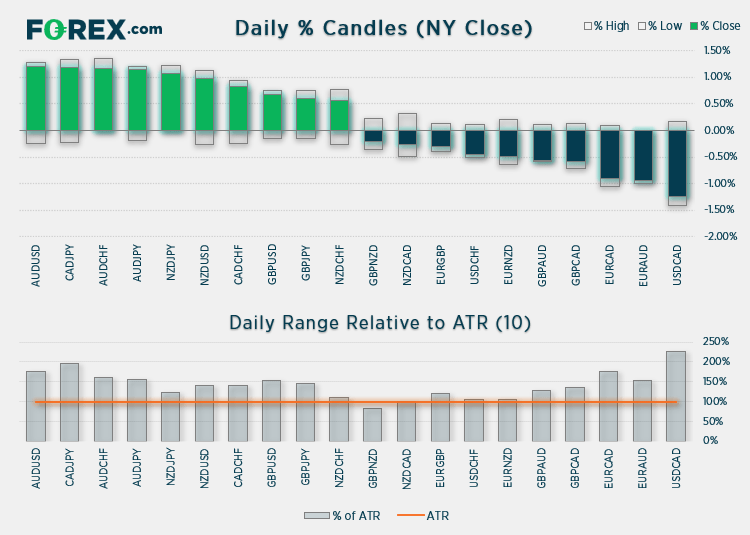

Forex: Dollar drops during risk-on trade

What began as a mild retracement against last week’s risk-off during Asian trade, turned into a risk-on session overnight. Commodity currencies extended their leads to see CAD, AUD and NZD rise between 0.9% to 1.3% whilst USD and JPY remained the weakest major currencies. Month-to-date commodity FX remain the weakest but the bearish moves against them had been looking stretched for a while.

So, it appears to be combination of repositioning before Jerome Powell’s speech at Jackson Hole on Thursday, and dollar-bulls unwinding during a risk-on session. The US dollar index closed below 93.0 during its 2nd most bearish session in two-months, although support is nearby with the lower trendline of a bullish channel around 92.90

GBP/JPY broke above 150 to reach (and trade beyond) our 150.30 target, rising 0.7% by the close. CAD/JPY rallied 1.3% thanks for firmer energy prices, whilst USD/CAD was the weakest pair falling -1.3%. AUD/USD enjoyed its most bullish session since February, rising 1.1% and testing the November low at 0.7220 to form a 3-day bullish reversal pattern (Morning Star).

Commodities take advantage of dollar weakness

We had been waiting for a spell of dollar weakness to allows gold to break higher out of its bull-flag formation. It finally occurred overnight. Whilst metals had generally buckled under the pressure of dollar strength last week, gold remained relatively unharmed and stood up to USD strength which created the flag pattern. Our initial target of 1800 – 1805 has been met, as resistance has been found at the 200-day eMA and monthly pivot point. If the flag breakout is to be believed, gains should be relatively direct (so a retest of the flag channel would not be expected). Therefore, we really need to see a break to new highs sooner than later to keep the flag alive, or the analysis will need to be revised. The trend remains bullish above 1773.20.

Copper futures rose a further 2.4% and tested the broken trendline and monthly S1 pivot. Whilst this is a potential area of interest for bears to consider fading into, momentum is not yet on their side and we’d need to see the dollar regain strength for copper to stand any chance of topping out once more. So, it’s one to watch, but not one to jump into for bears.

Energy prices were broadly higher, with WTI and brent rising 5.3% and 5.2% respectively. It was the most bullish session for oil since March and helped break its 7-day losing streak, all thanks to a weaker US dollar and approval of the Pfizer vaccine, which boosted demand hopes.

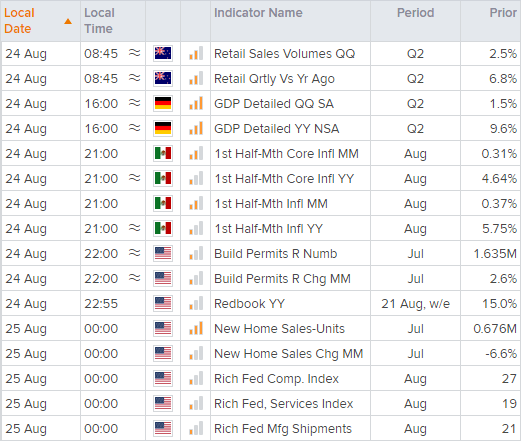

Up Next (Times in AEST)