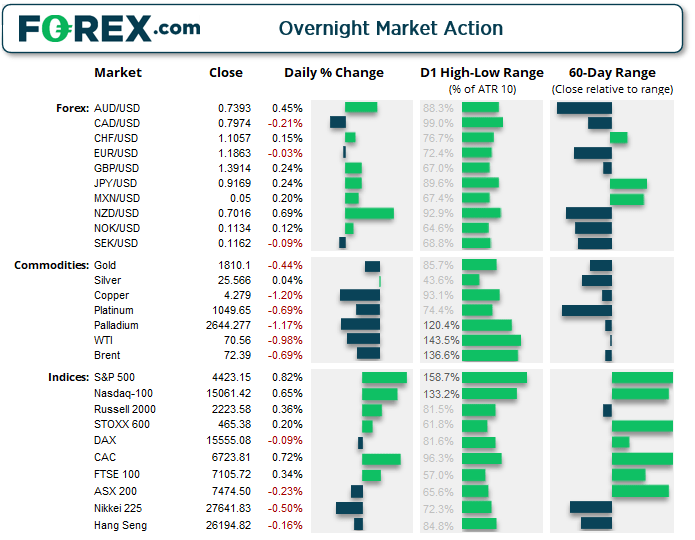

Asian Futures:

- Australia's ASX 200 futures are up 8 points (0.11%), the cash market is currently estimated to open at 7,482.50

- Japan's Nikkei 225 futures are up 60 points (0.22%), the cash market is currently estimated to open at 27,701.83

- Hong Kong's Hang Seng futures are up 42 points (0.16%), the cash market is currently estimated to open at 26,236.82

UK and Europe:

- UK's FTSE 100 index rose 24 points (0.34%) to close at 7,105.72

- Europe's Euro STOXX 50 index rose 1.33 points (0.03%) to close at 4,117.95

- Germany's DAX index fell -13.65 points (-0.09%) to close at 15,555.08

- France's CAC 40 index rose 47.91 points (0.72%) to close at 6,723.81

Tuesday US Close:

- The Dow Jones Industrial rose 278.24 points (0.8%) to close at 35,116.40

- The S&P 500 index rose 35.99 points (0.83%) to close at 4,423.15

- The Nasdaq 100 index rose 97.798 points (0.65%) to close at 15,061.42

Indices: Apple does the heavy lifting

All three major US indices were higher overnight, although Facebook (FB), Tesla (TSLA) and Netflix (NFLX) drifted lower to cap gains for the Nasdaq whilst healthcare stocks and Apple helped lift the S&P 500 to a new record close.

The S&P found support at the 20-day eMA and rallied its way to a bullish outside day and closed to a record high (although beneath the intraday high of 4429.97). A break above that level assumes bullish continuation. It was also a strong close for some European bourses with the STOXX 600 and CAC extending their record closes. Futures markets are also pointing towards a positive open in Asia, even though Chinese equity markets remain under pressure and the clear underperformers of late.

The ASX 200 retreated from its record high set on Monday in a corrective manner. Support was found just above the prior record high of 7447.90 so it’s likely to be a pivotal level early in today’s session. That said, the cash market is expected to open higher around 7482 so perhaps we may have already seen the low. Therefore, eyes are on a break above 7506.3 for bullish setups over the near-term. For those with a longer time horizon, we’d like to see the 7368.90 – 7400 zone hold as support to retain out bullish bias.

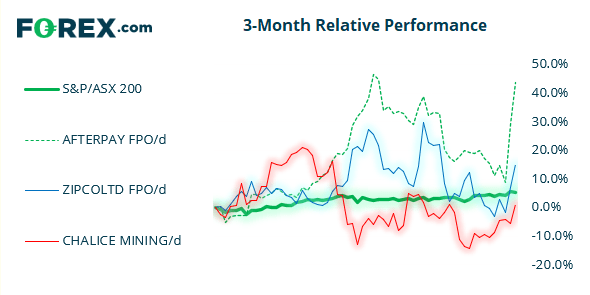

ASX 200 Market Internals:

ASX 200: 7474.5 (-0.23%), 03 August 2021

- Information Technology (4.38%) was the strongest sector and Materials (-0.85%) was the weakest

- 7 out of the 11 sectors closed lower

- 82 (41.00%) stocks advanced, 103 (51.50%) stocks declined

- 71% of stocks closed above their 200-day average

- 70.5% of stocks closed above their 50-day average

- 63% of stocks closed above their 20-day average

Outperformers:

- + 11.4% - Afterpay Ltd (APT.AX)

- + 7.46% - Zip Co Ltd (Z1P.AX)

- + 6.84% - Chalice Mining Ltd (CHN.AX)

Underperformers:

- -11.2% - Pointsbet Holdings Ltd (PBH.AX)

- -5.36% - Whitehaven Coal Ltd (WHC.AX)

- -3.55% - Perseus Mining Ltd (PRU.AX)

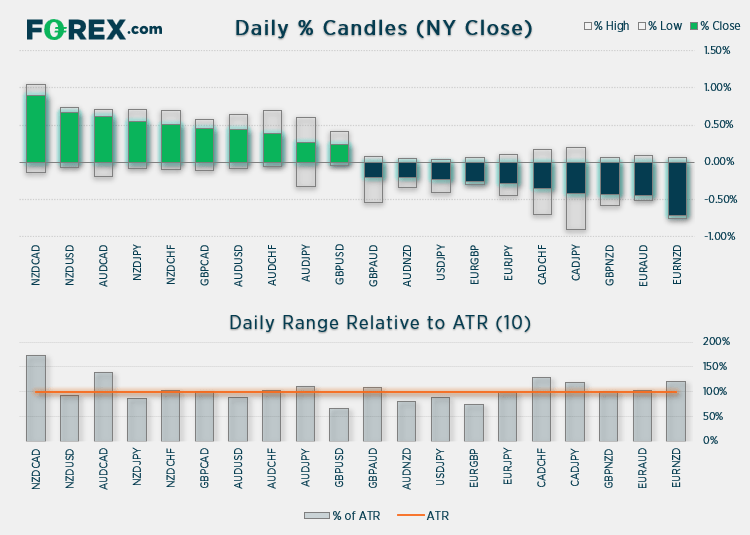

Forex: Antipodeans lead the way

Learn how to trade forex

NZD and AUD were the strongest major currencies overnight following RBA’s decision to taper, despite Australia’s extended lockdowns and rise in covid cases. With many expecting the RBA to have delayed their taper or even increase the level or duration of QE program, traders were caught off guard causing bears to cover. Given that RBNZ remain the more hawkish central bank of the two economics, NZD was the preferred long over AUD.

Meanwhile, CAD was the weakest FX major on the back of lower oil prices and a softer PMI report – the perfect outcome we outlined yesterday for a move lower on CAD/JPY. Manufacturing PMI fell to a 5-month low of 56.2 on supply constraints.

It was another low-volatility session for the dollar with the US dollar index (DXY) printing another Doji which closed above the 50 and 200-day eMA. And this may continue to be the case until ISM services on Thursday ad Nonfarm payroll on Friday are released.

0.7413 remains a pivotal level for AUD/USD, although we likely need to see DXY breakout of its small range this week for a conclusive move on the Aussie.

GBP/AUD corrected lower for a second session failing to test 1.9000, yet it closed with a bullish hammer on the daily chart and respected the lower trendline of a bullish channel.

EUR/JPY fell to a 9-day low and traded just +50 pips above our initial target around 129.0. Take note of the 200-day eMA at 128.95 but, if it can get past it, the lows around 128.20 are in focus for bears.

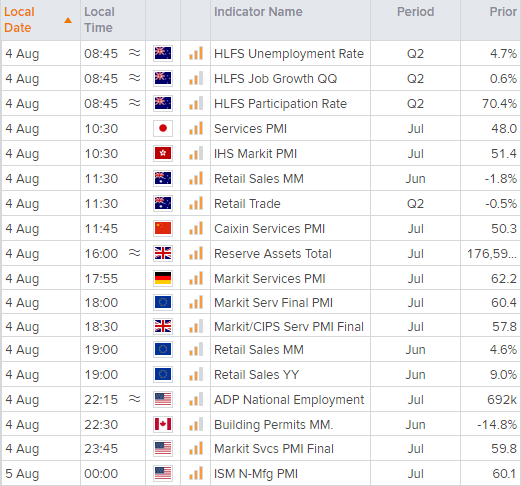

NZ employment data is the main economic event in today’s Asian session, released at 08:145 AEST. Australian retail sales are then released at 11:30 AEST.

Commodities: Oil continues to slide

Oil prices remained under pressure as week PMI’s and the delta variant fanned demand concerns. WTI initially rose near our $72.0 ‘fade’ zone before dropping straight through our initial $70.0 target. Prices have since recovered to 70.23. Meanwhile, the SPDR energy ETF (XLE) bounced back after a false break of Monday’s low. Regardless, our bias remains bearish beneath last week’s highs.

Copper also broken below 4.435 support although managed to climb back above its 50-day eMA near the end of the session, as demand concerns also hit the orange metal. Technically we suspect it remains in a corrective phase and our bias remains bullish above 4.466 over the medium-term.

With a sideways dollars come a sideways gold. We may need to wait until Friday’s NFP before we see it come back to life, barring any unexpected event beforehand.

Up Next (Times in AEST)