Asian Futures:

- Australia's ASX 200 futures are down -12 points (-0.16%), the cash market is currently estimated to open at 7,367.50

- Japan's Nikkei 225 futures are down -120 points (-0.41%), the cash market is currently estimated to open at 29,321.30

- Hong Kong's Hang Seng futures are down -46 points (-0.16%), the cash market is currently estimated to open at 28,592.53

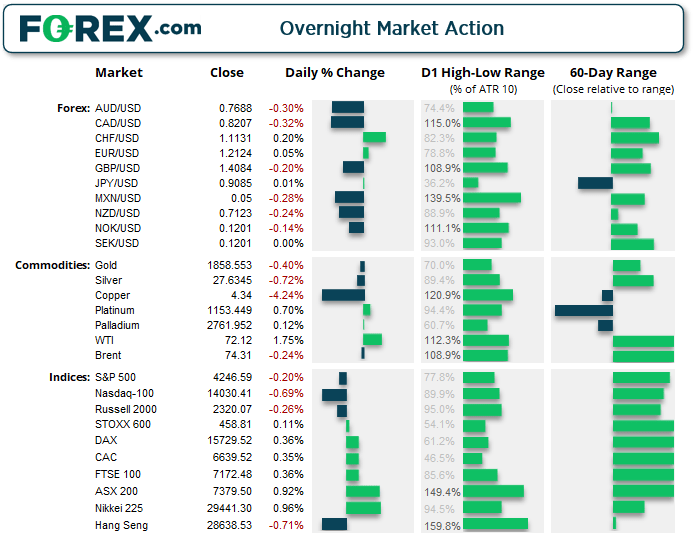

UK and Europe:

- UK's FTSE 100 index rose 25.8 points (0.36%) to close at 7,172.48

- Europe's Euro STOXX 50 index rose 10.85 points (0.26%) to close at 4,143.52

- Germany's DAX index rose 55.88 points (0.36%) to close at 15,729.52

- France's CAC 40 index rose 23.17 points (0.35%) to close at 6,639.52

Tuesday US Close:

- The Dow Jones Industrial fell -94.42 points (-0.27%) to close at 34,299.33

- The S&P 500 index fell -8.56 points (-0.21%) to close at 4,246.59

- The Nasdaq 100 index fell -97.789 points (-0.69%) to close at 14,030.41

Soft lead from Wall Street ahead of FOMC

Retail sales fell -1.3% in May, more than the -0.8% expected as consumers spent more on services but less on goods as vaccination and lockdown restrictions allowed them to travel more freely. That said, April’s sales were upwardly revised and the YoY rate was still in double digits at 28.1%, but that needs to be taken in context of a very low base seen 12 months ago.

But it was producer prices which spooked investors, with factory gates rising 6.6% YoY, up from 6.2% prior and rising 0.8% in May. Excluding energy prices PPI rose 4.8% YoY and 0.7% MoM. With pent-up demand exceeding supply, on the surface it appears to be more than simply a supply chain issue which the Fed is hanging its hat on for their ‘transitory CPI’ argument. Whether they’ll do a U-turn before August’s Jackson Hole symposium in August remains to be seen, but inflation remains a ‘hot’ topic going into today’s meeting.

Wall Street was broadly lower led by tech stocks, with the Nasdaq composite and Nasdaq 100 falling -0.81 and -0.69% respectively. Biotech stocks took a -1.62% hit whilst the Dow Jones and S&P 500 were 0.27% and 0.2% lower. The Russell 2000 fell -0.26% although value stocks were up slightly by 0.2%. The VIX (volatility index) rose to a three-day high at 17.01.

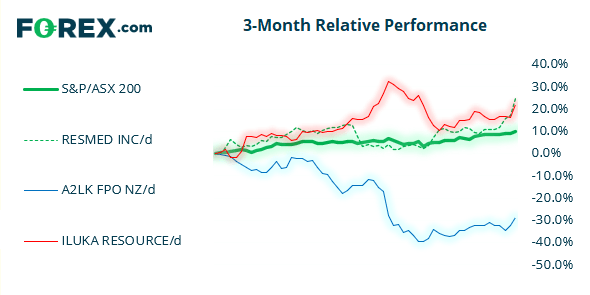

Another day, another new high for the ASX 200 after rallying over 1% following RBA’s minutes (which were basically dovish). It was its most bullish session in eight and broke clearly out of compression to the upside. Its debatable as to whether momentum will be sustained today ahead of the FOMC meeting but the ASX can (and does) do its own thing once in a while.

ASX 200 Intraday S/R

- R3: 7420

- R2: 7410 – 7412

- R1: 7398.60 – 4700

- S1: 7386.50

- S2: 7362 - 365

- S4: 7350

- S5: 7335

- S6: 7312.30

ASX 200 Market Internals:

ASX 200: 7379.5 (0.92%), 15 June 2021

- Healthcare (1.96%) was the strongest sector and Utilities (0.01%) was the weakest

- All sectors closed higher

- 4 out of the 11 sectors outperformed the index

- 115 (57.50%) stocks advanced, 72 (36.00%) stocks declined

- 22 hit a new 52-week high, 0 hit a new 52-week low

- 76% of stocks closed above their 200-day average

- 71.5% of stocks closed above their 50-day average

- 78% of stocks closed above their 20-day average

Outperformers:

- + 6.84% - Resmed Inc (RMD.AX)

- + 5.42% - A2 Milk Company Ltd (A2M.AX)

- + 5.00% - Iluka Resources Ltd (ILU.AX)

Underperformers:

- -9.01% - Austal Ltd (ASB.AX)

- -6.49% - Pointsbet Holdings Ltd (PBH.AX)

- -4.15% - Nickel Mines Ltd (NIC.AX)

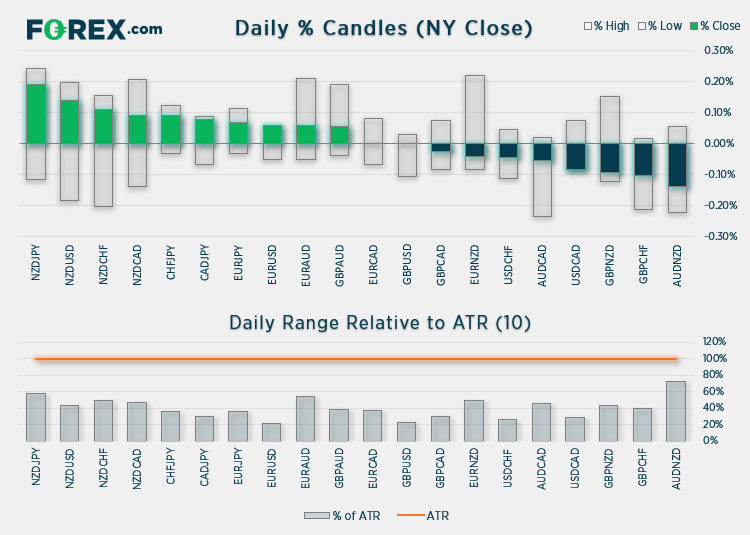

Forex: Australia to ‘beef’ up exports to UK

The UK struck its first free trade deal with Australia yesterday, making it the first such deal to be made since leaving the EU. Australian beef is now expected to make its way over and help plug the gap left from European beef tariffs will be removed from all UK products exported, including cars, whiskey, biscuits and ceramics. The deal is expected to provide a small boost to the UK economy but, ultimately, is seen as a positive step in a post-Brexit world for Britain. GBP/AUD rose 0.18% and was up 0.13% against NZD and CAD.

The US dollar index was little changed overnight, rising just 0.02% by the close after printing a marginal new high. Yet trendline resistance continues to cap gains ahead of today’s (or tomorrow early hours) FOMC meeting where a hawkish surprise could send the dollar higher. Take note that the 200-month eMA and 100-day eMA sit at 90.95, making 90.95 – 91.00 a likely resistance zone.

The Swiss franc and euro were the strongest major whilst commodity FX (CAD, AUD and NZD) were the weakest. Month to date the US dollar and Swiss franc remain the strongest currencies whilst NZD and CAD are now the weakest. That could all change by tomorrow if there are any surprises in the FOMC meeting.

EUR/AUD has bounced from support levels and risen to a four-day high to strongly suggest a swing low is in place. Three higher lows have now formed on the daily chart, with the most recent finding support at the 50-day eMA and Mondays low holding above the 100-day eMA. With range expansion now pointing higher we would welcome any dips towards Fridays high and for prices to retest the 200-day eMA / June high.

Copper feels the heat of inflation

Gold fell -0.4% overnight on the back of stronger producer prices (a key input to inflation). Although it closed with a bearish inside bar above 1845.44 support and below prior support at 1869.60. We suspect trade will be mostly sideways leading into the FOMC meeting, where little change for the Fed could support gold prices whilst a hawkish surprise could send it lower.

Copper was fell over -4% during its worst session since October. Investors appear concerned that monetary stimulus could be removed, which has been a major pillar of support for base metals over recent months. But this cuts both ways, because if the Fed remain unphased by signs of inflation, copper prices could easily recover. That said, the sell-off began during yesterday’s Asian session as traders in China returned to their desks after a three-day weekend, on fears that China may do more to curb rising commodity prices.

And Oil prices were again propelled higher on rising demand expectations, sending WTI to 72.48 and brent to 74.25.

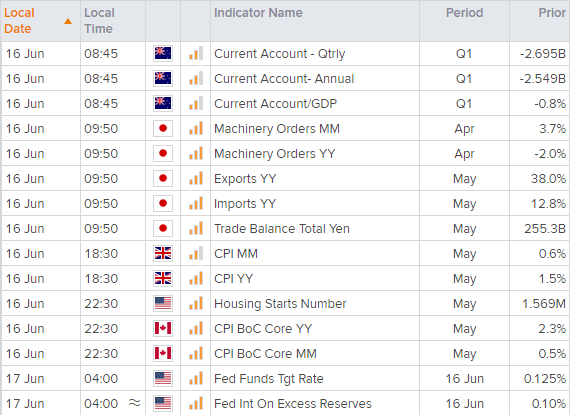

Up Next (Times in AEST)