Asian Futures:

- Australia's ASX 200 futures are down -1 points (-0.01%), the cash market is currently estimated to open at 7,510.10

- Japan's Nikkei 225 futures are up 160 points (0.58%), the cash market is currently estimated to open at 27,888.12

- Hong Kong's Hang Seng futures are up 124 points (0.47%), the cash market is currently estimated to open at 26,328.69

UK and Europe:

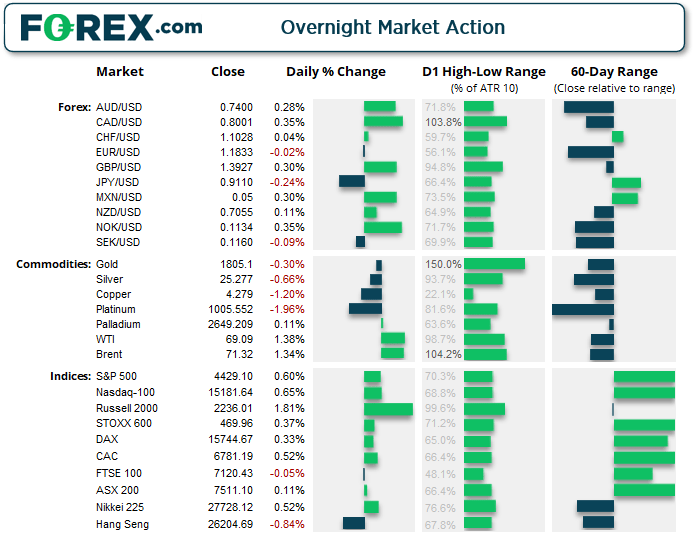

- UK's FTSE 100 index fell -3.43 points (-0.05%) to close at 7,120.43

- Europe's Euro STOXX 50 index rose 16.18 points (0.39%) to close at 4,161.08

- Germany's DAX index rose 52.54 points (0.33%) to close at 15,744.67

- France's CAC 40 index rose 34.96 points (0.52%) to close at 6,781.19

Thursday US Close:

- The Dow Jones Industrial rose 271.58 points (0.78%) to close at 35,064.25

- The S&P 500 index rose 26.44 points (0.61%) to close at 4,429.10

- The Nasdaq 100 index rose 98.248 points (0.65%) to close at 15,181.64

Indices higher on lower jobless claims

Equity markets were broadly higher overnight as favourable employment data hit the screens ahead of today’s Nonfarm Payroll report. Initial jobless claims were shed -14k to 385k, taking it back below its 4-week average of 394k.

The S&P 500 rose 0.6% and closed to a new record high, although is yet to break convincingly above the 4429.97 swing high. We retain our bullish bias above 4369 after a bullish engulfing candle formed at the highs on Tuesday. Financial and energy sectors were the strongest, and 9 of the 11 sectors closed higher (healthcare and materials were in the red). The Nasdaq 100 was up 0.65% led by bank and biotech stocks. The Russell 2000 was a strong performer, rising 1.81% with growth and valuer stocks all gaining around 1.8%.

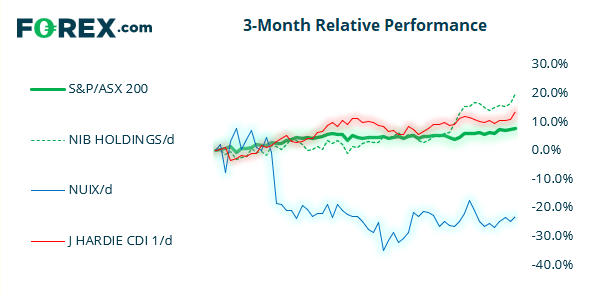

ASX 200 Market Internals:

ASX 200: 7511.1 (0.11%), 05 August 2021

- Real Estate (0.99%) was the strongest sector and Materials (-1.3%) was the weakest

- 8 out of the 11 sectors closed higher

- 6 out of the 11 sectors outperformed the index

- 87 (43.50%) stocks advanced, 97 (48.50%) stocks declined

- 71% of stocks closed above their 200-day average

- 59.5% of stocks closed above their 50-day average

- 67% of stocks closed above their 20-day average

Outperformers:

- + 3.05% - NIB Holdings Ltd (NHF.AX)

- + 2.75% - Nuix Ltd (NXL.AX)

- + 2.51% - James Hardie Industries PLC (JHX.AX)

Underperformers:

- -3.52% - Nickel Mines Ltd (NIC.AX)

- -3.40% - Fortescue Metals Group Ltd (FMG.AX)

- -3.34% - Champion Iron Ltd (CIA.AX)

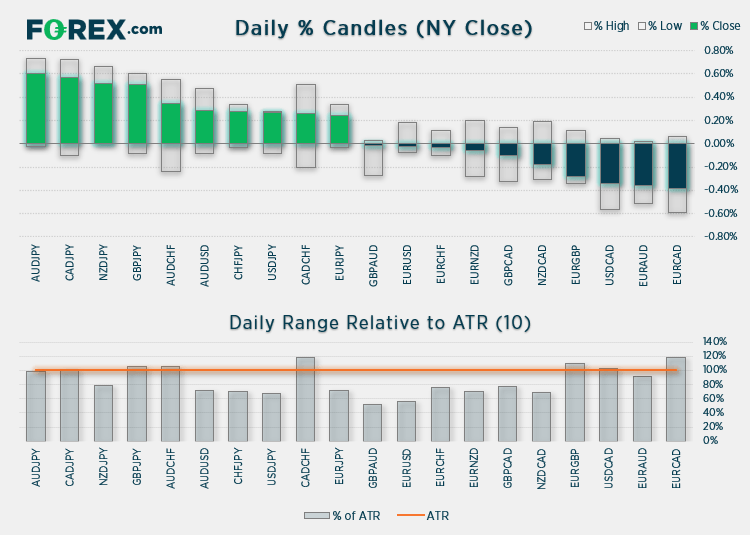

Forex: CAD higher with oil and strong trade surplus

The Canadian dollar was higher as their trade balance posted an unexpected surplus surprise, rising to its highest level since 2008 with rising exports and falling imports. Oil prices were also supportive due to a rise in Middle East tensions. USD/CAD fell -0.4% and produced a 3-bar bearish reversal on the daily (Evening Star) ahead of US and Canadian employment reports at 22:30 AEST.

The British pound was higher following a slightly more hawkish BOE meeting. Rates remained at 0.1%, one member dissented (to raise rates) and QE remained unchanged, although the threshold to begin tapering was lowered to rates being 0.5% from 1.5%. The British pound extended gains slightly although there were no real surprises from the BOE meeting to justify a stronger rally. EUR/GBP touched a new 4-mnonth low, GBP/USD printed a bullish engulfing candle back above its 50-day eMA, GBP/JPY rose to a 4-day high.

The Fed’s Christopher Waller reiterated his hawkish views during a virtual event overnight, saying her thinks the Fed “…will be able to pull back on accommodative monetary policy potentially sooner than others think." The US dollar index (DXY) touched an 8-day high although closed flat for the session with a small Doji candle (indecision).

NZD/JPY broke above 77.30. Should a risk-on environment continue then we expect the cross to be an outperformer (see yesterday’s video).

Commodities: Oil higher on rise of Middle Eastern tensions

Oil prices were around 1.3% higher due to a rise in Middle Eastern tensions, after the Israeli military struck a rocket launch site in Lebanon, in response to two rockets allegedly fired towards Israel from Lebanon.

WTI remains in a bearish trend on the four-hour chart although it’s found support at a bullish trendline. Still, the bounce overnight was modest for such circumstances, and the rise in the Delta variant continues to weigh on demand concerns. So if $70.0 continues to cap as resistance we retain a near-term bearish bias, whilst a break above the 50-day eMA assumes a reversal.

The Thomson Reuters CRB commodity basket snapped a 4-day losing streak and printed a marginally bullish outside day after finding support at Wednesday’s low (also a 50% retracement level). Whilst we remain bullish in the index it is unclear whether this is the corrective low, and it’s not yet clear that oil prices have troughed yet either.

Silver prices confirmed Wednesday’s bearish hammer with a break beneath its 25.25 low. A strong NFP report tonight could help it push below $25 in line with its bearish bias. Gold slipped below 1800 temporarily, yet closed beneath its 50 and 200-day eMA ahead of NFP. Platinum reached out 1000 – 1011 target zone and closed below 1000 for the first time this year.

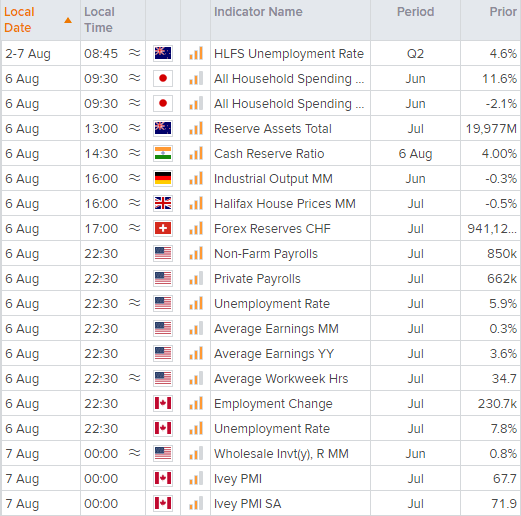

Up Next (Times in AEST)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log-in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.