Asian Futures:

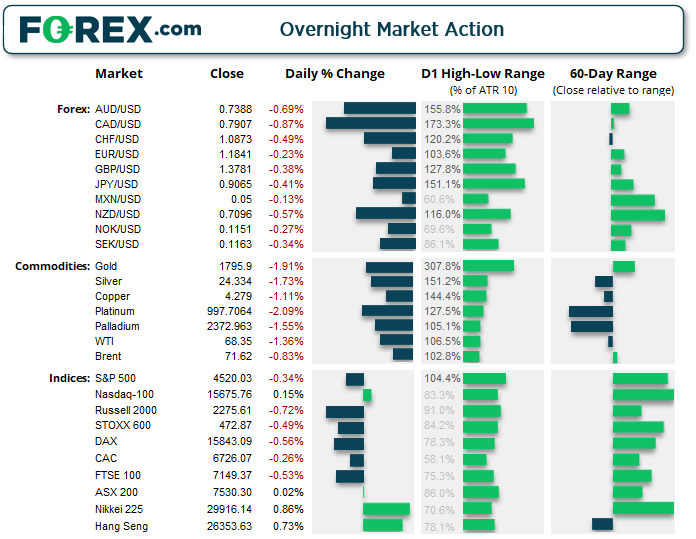

- Australia's ASX 200 futures are down -29 points (-0.39%), the cash market is currently estimated to open at 7,501.30

- Japan's Nikkei 225 futures are up 30 points (0.1%), the cash market is currently estimated to open at 29,946.14

- Hong Kong's Hang Seng futures are up 101 points (0.39%), the cash market is currently estimated to open at 26,454.63

UK and Europe:

- UK's FTSE 100 index fell -37.81 points (-0.53%) to close at 7,149.37

- Europe's Euro STOXX 50 index fell -21.12 points (-0.5%) to close at 4,225.01

- Germany's DAX index fell -89.03 points (-0.56%) to close at 15,843.09

- France's CAC 40 index fell -17.43 points (-0.26%) to close at 6,726.07

Tuesday US Close:

- The Dow Jones Industrial fell -269.09 points (-0.0076%) to close at 35,100.00

- The S&P 500 index fell -15.4 points (-0.34%) to close at 4,520.03

- The Nasdaq 100 index rose 22.905 points (0.15%) to close at 15,675.76

Tech stocks buck the trend in a bearish Wall Street session

Technology stocks posted a minor gain during their first day back from the long weekend, with the Nasdaq 100 rising 0.15% by the close yet also forming a small Doji at its newly minted record high. Apple (AAPL) and Netflix (NFLX) also rose to record highs, presumably as such companies are less effected by any concerns over rising covid cases in the dovish Fed environment. Yet the broader market closed lower, with the S&P 500 falling -0.34% and briefly touching a 5-day low, weighed down by the utilities and consumer staples sectors. The Dow Jones (DJIA) fell -0.71% to a 2-week low.

The ASX 200 remains in its 7430 – 7542 range, although several lower spies over the past week show that sell-offs get snapped up at the lows which does still keep the hopes of a breakout alive.

The Nikkei 225 rallied above 30k yesterday in line with our bullish bias, yet the bearish hammer which formed yesterday warns of the potential for mean reversion. Given the growing expectations of more stimulus from Japan and the strong momentum seen breaking out of its multi-month correct, the bias remains for an eventual break to new highs.

ASX 200 Market Internals:

ASX 200: 7530.3 (0.02%), 07 September 2021

- Telecomm Services (0.94%) was the strongest sector and Materials (-0.81%) was the weakest

- 8 out of the 11 sectors closed higher

- 4 out of the 11 sectors closed lower

- 7 out of the 11 sectors outperformed the index

- 97 (48.50%) stocks advanced, 94 (47.00%) stocks declined

- 70% of stocks closed above their 200-day average

- 65% of stocks closed above their 50-day average

- 60% of stocks closed above their 20-day average

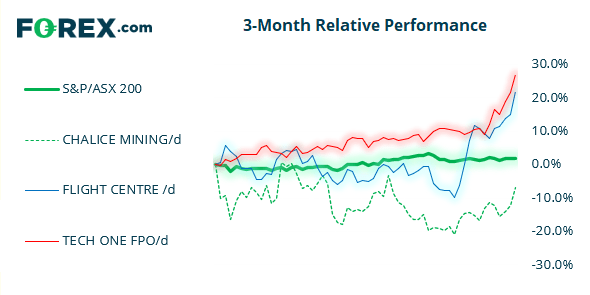

Outperformers:

- + 6.34% - Chalice Mining Ltd (CHN.AX)

- + 6.23% - Flight Centre Travel Group Ltd (FLT.AX)

- + 4.38% - TechnologyOne Ltd (TNE.AX)

Underperformers:

- -4.60% - Regis Resources Ltd (RRL.AX)

- -4.36% - Appen Ltd (APX.AX)

- -3.61% - Mineral Resources Ltd (MIN.AX)

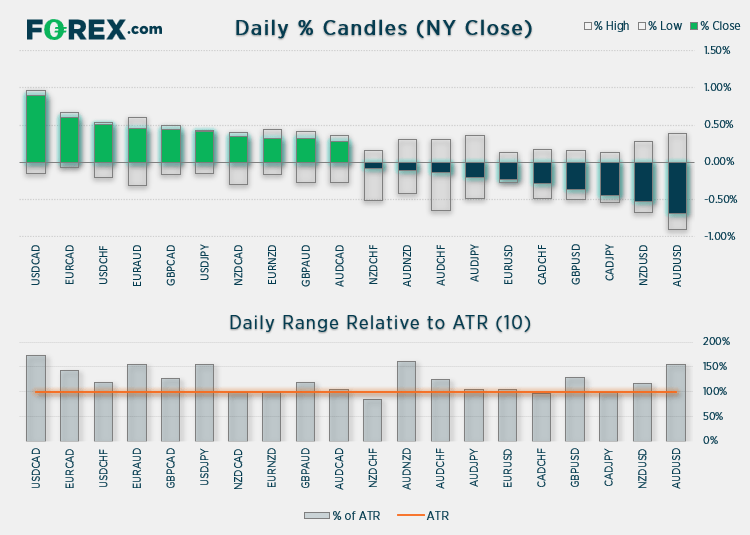

Forex: Dollar bulls return

USD was the strongest major currency yesterday, whilst CAD and AUD were the weakest as growth concerns lingered which helped the dollar catch a bid.

The US dollar index (DXY) sent a strong signal that is has formed a swing low around 92.0. Rising 0.38% on the day during its most bullish session in 12, bullish range expansion took hold to help it rebound from its 200-day eMA after printing 2 small compression candles at the lows. Also take note that we saw similar patterns emerge at the end of June, beginning of August and now early in September.

Given the strong close above trend resistance, we suspect the low is in place at 91.95 although we’d like to see prices hold above Monday’s highs (thereabouts) before heading towards 92.78.

AUD/USD has entered a corrective phase after yesterday’s RBA meeting, where they decided to walk back decision to taper due to the rise in delta cases. After initially rising around +30 pips momentum quickly turned and the Aussie closed to a 4-day low and produced a 3-bar bearish reversal (Evening Star formation) and was the weakest pair yesterday.

USD/CAD found itself top of the leader board, thanks to the combination of the stronger greenback and weaker oil prices. Take note that the BOC meeting is tonight at 00:00 AEST where, like the RBA meeting the focus is on whether they will decide to taper or not. And with restrictions for travellers being eased, they just might.

Commodities: Metals bear the brunt of dollar strength

With a stronger dollar comes weaker commodities, with metals leading the way lower yesterday. Palladium broke beneath last week’s low to suggest its bearish move which began just below 2500 remains in play. Silver‘s rally petered out before reaching $25 and fell back to 24.30, so a break of the daily retracement line assumes its next leg lower is underway. And gold fell nearly -2% during its worst session in a month, promptly removing it from our bullish watchlist for a break above 1835. Now below 1800 it is trying to find support around its broken trendline, although as we’re now bullish on the UD dollar we doubt this level will hold for gold if DXY continues higher.

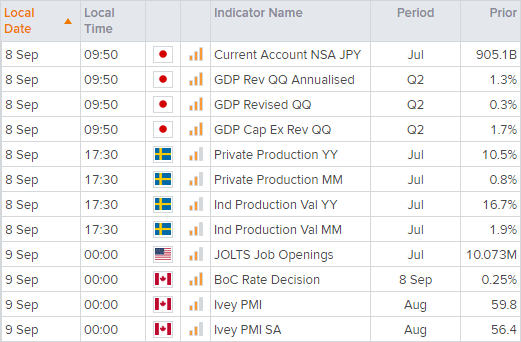

Up Next (Times in AEST)