Asian Futures:

- Australia’s ASX 200 futures are down 0 points (0%), the cash market is currently estimated to open at 7628.9

- Japan's Nikkei 225 futures are down -160 points (-0.57%), the cash market is currently estimated to open at 27817.15

- Hong Kong's Hang Seng futures are up 38 points (0.14%), the cash market is currently estimated to open at 26429.62

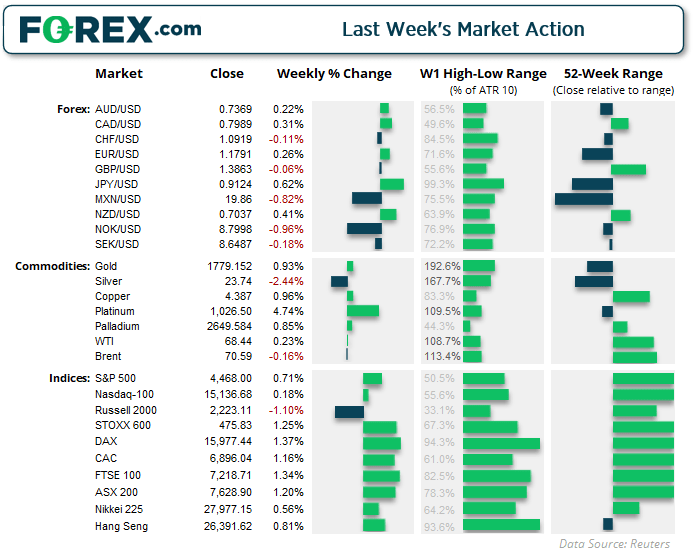

European Friday close:

- UK's FTSE 100 index rose 25.48 points (0.35%) to close at 7218.71

- Europe's Euro STOXX 50 index rose 3.37 points (0.08%) to close at 4229.7

- Germany's DAX index rose 39.93 points (0.25%) to close at 15977.44

- France's CAC 40 index rose 13.57 points (0.2%) to close at 6896.04

US Friday close:

- The Dow Jones rose 15.48 points (0.04%) to close at 35,515.38

- The S&P 500 rose 7.17 points (0.17%) to close at 4,468.00

- The Nasdaq 100 rose 47.695 points (0.32%) to close at 15,136.68

US indices rise on lack of confidence

The preliminary release of the University of Michigan Consumer Survey fell to a decade low, and that could be enough for the Fed to delay any plans to taper. And that is bullish for stocks! The S&P 500 and Dow jones closed to fresh record high, although only closed marginally higher by 0.16% and 0.4% respectively. For the week the S&P 500 rose 0.7% and outperformed the Nasdaq 100 which gained 0.19%. Biotech stocks fell -1.34% last week and small cap growth stocks were underperformers with a -1.9% fall.

The Nikkei 225 could come under further pressure should the Japanese yen continue to strengthen. We can see on the daily chart that the Nikkei 225 futures found resistance at the bearish trendline, a and bearish pinbar and Doji formed ahead of Friday’s sell-off (and closed below the 20-day eMA). Our bias remains bearish beneath the 28,265 high, although trend resistance could also be used to fine-tune risk management. The initial target is the lows around 27k and the lower bollinger band.

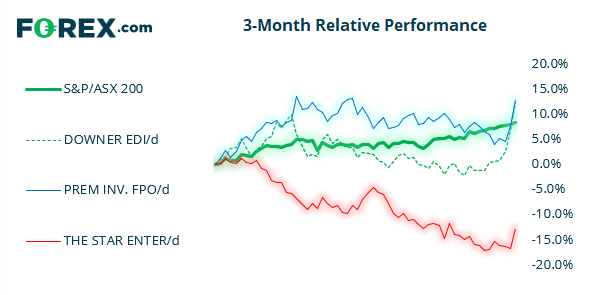

ASX 200 Market Internals:

ASX 200: 7628.9 (0.54%), 14 August 2021

- Healthcare (1.95%) was the strongest sector and Materials (-0.01%) was the weakest

- 11 out of the 11 sectors closed higher

- 1 out of the 11 sectors closed lower

- 7 out of the 11 sectors outperformed the index

- 146 (73.00%) stocks advanced, 46 (23.00%) stocks declined

- 71.5% of stocks closed above their 200-day average

- 69% of stocks closed above their 50-day average

- 75.5% of stocks closed above their 20-day average

Outperformers:

- + 5.2% - Downer EDI Ltd (DOW.AX)

- + 4.94% - Premier Investments Ltd (PMV.AX)

- + 4.78% - Star Entertainment Group Ltd (SGR.AX)

Underperformers:

- -5.65% - Chalice Mining Ltd (CHN.AX)

- -4.52% - Orocobre Ltd (ORE.AX)

- -3.21% - Suncorp Group Ltd (SUN.AX)

The Dollar suffers as traders push back tapering expectations

There were some big moves against the dollar on Friday after US consumer sentiment fell to a 10-year low. The surprise confidence knock saw traders selling the dollar in anticipation it will delay the Fed’s tapering plans.

The dollar was broadly lower which saw USD/CHF drop -0.91% amid its worst session in 7 weeks. The US dollar index (DXY) fell -0.56% to a 5-day low and EUR/USD climb 0.54% to a 5-day high and test its 20-day eMA. USD/JPY smashed below 110 with ease to settle at a 6-day low at 109.57.

The Australian dollar has been holding above its 200-week eMA these past four weeks (0.7339) and produced Doji’s a bullish hammer and inverted hammer over this period. Perhaps a base is building – and a potential bullish trigger could be the Fed not announcing a plan to taper over the coming weeks.

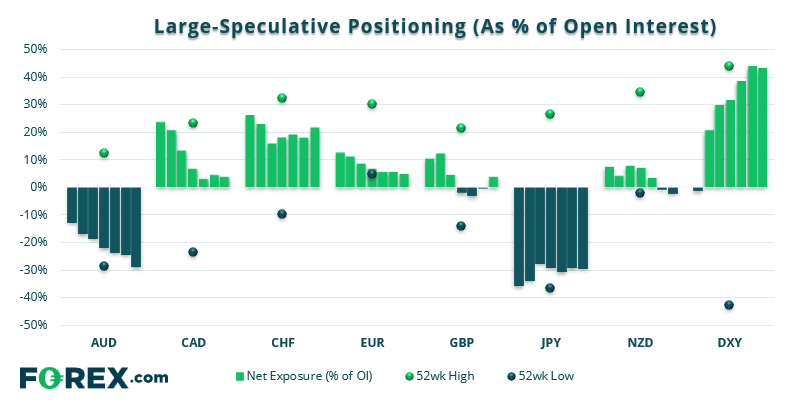

From the Weekly COT Report (Commitment of Traders)

From Tuesday 10th August 2021:

- There were no significant changes last week of net-exposure among FX majors, with all coming under +/-10k contracts changed.

- AUD traders increased their net-short exposure by 8k contracts, most of which were new shorts being initiated (7.6k gross longs added).

- Large speculators flipped to net-long exposure to GBP by 7.2k contracts.

- Traders were net-short NZD futures for a second consecutive week. Take note that RBNZ hold their monetary policy meeting this week.

- Net-long exposure to gold and silver fell by -27.9 and -11.6k respectively following last Monday’s dramatic sell-off. Traders are now their least bullish on silver futures in a year.

- Platinum continues to see a sharp rise in short bets with gross longs rising to the highest level in two years.

Commodities:

The Thomson Reuters CRB Commodity basket rose 1.2% last week and suggests its corrective swing low is in place at 210. However, resistance has been found at its previous 4-year high of 217.72 and two small Doji’s formed to show hesitation to break higher immediately. Overall, we remain bullish above 210.

Oil prices were effectively flat last week and produced Doji’s on the weekly chart. As WTI futures held above the 65 low and produced a small pullback just below 70, we’re now looking for a potential break back above this key resistance level.

It wasn’t the best week for precious metals following Monday’s dramatic sell-off on gold and silver. However, silver did recoup most of Monday’s losses and formed an elongate hammer, although we suspect buyers may be few and far between so upside potential could remain capped. Gold went one better and closed higher for the week which sows strong demand around 1676 but, like silver, has plenty of resistance levels nearby which could potentially cap bullish momentum.

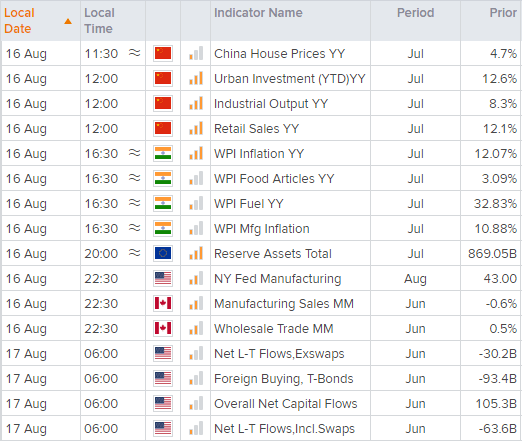

Up Next (Times in AEST)