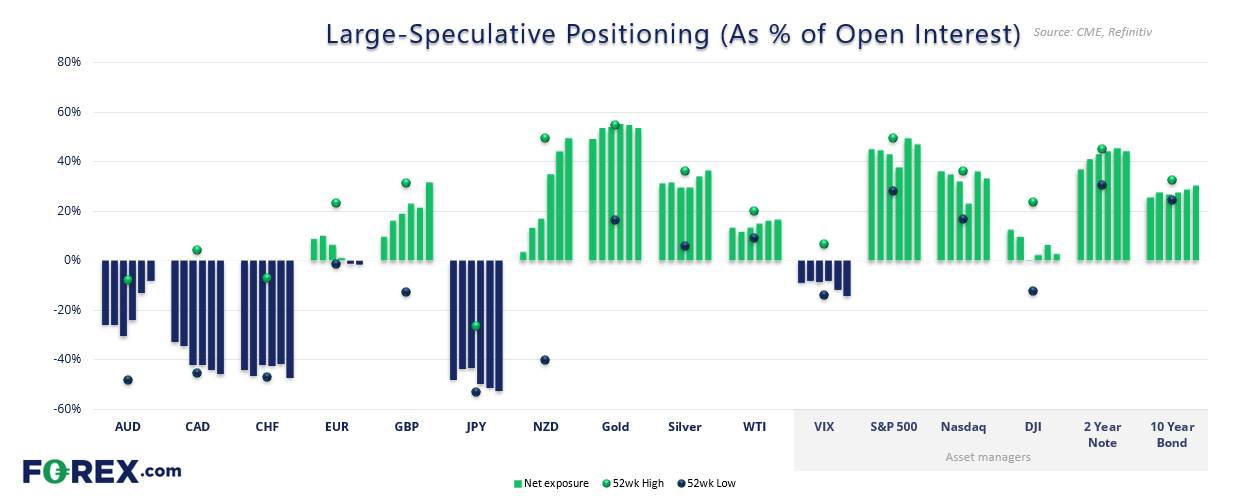

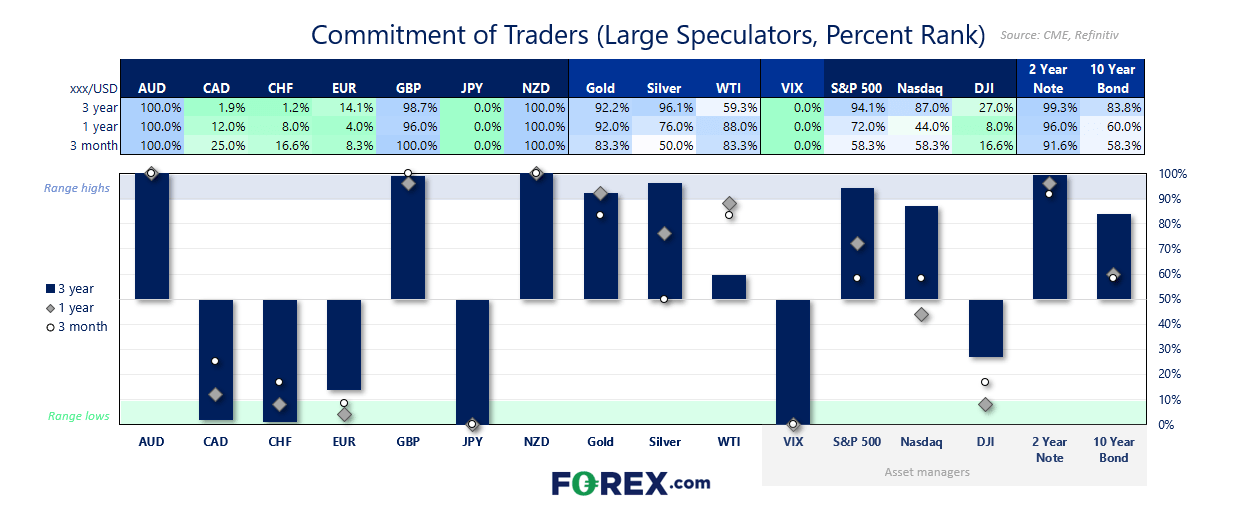

Market positioning from the COT report - as of Tuesday, 2nd July 2024:

- Large speculators were net-short EUR/USD futures for a second week

- Net-short exposure to AUD/USD futures fell to a 3-year low among large speculators

- Their net-log exposure to NZD/USD futures reached a 7-year high

- Net-short exposure to CAD futures declined for a second week from its record high

- They’re also very close to a record level of net-short exposure to yen futures

- Asset managers reached a fresh level of net-short exposure to VIX futures

- Net-long exposure to GBP/USD futures rose to a 16-week high

- Large speculators increased net-long exposure to WTI crude oil prices for a fourth week

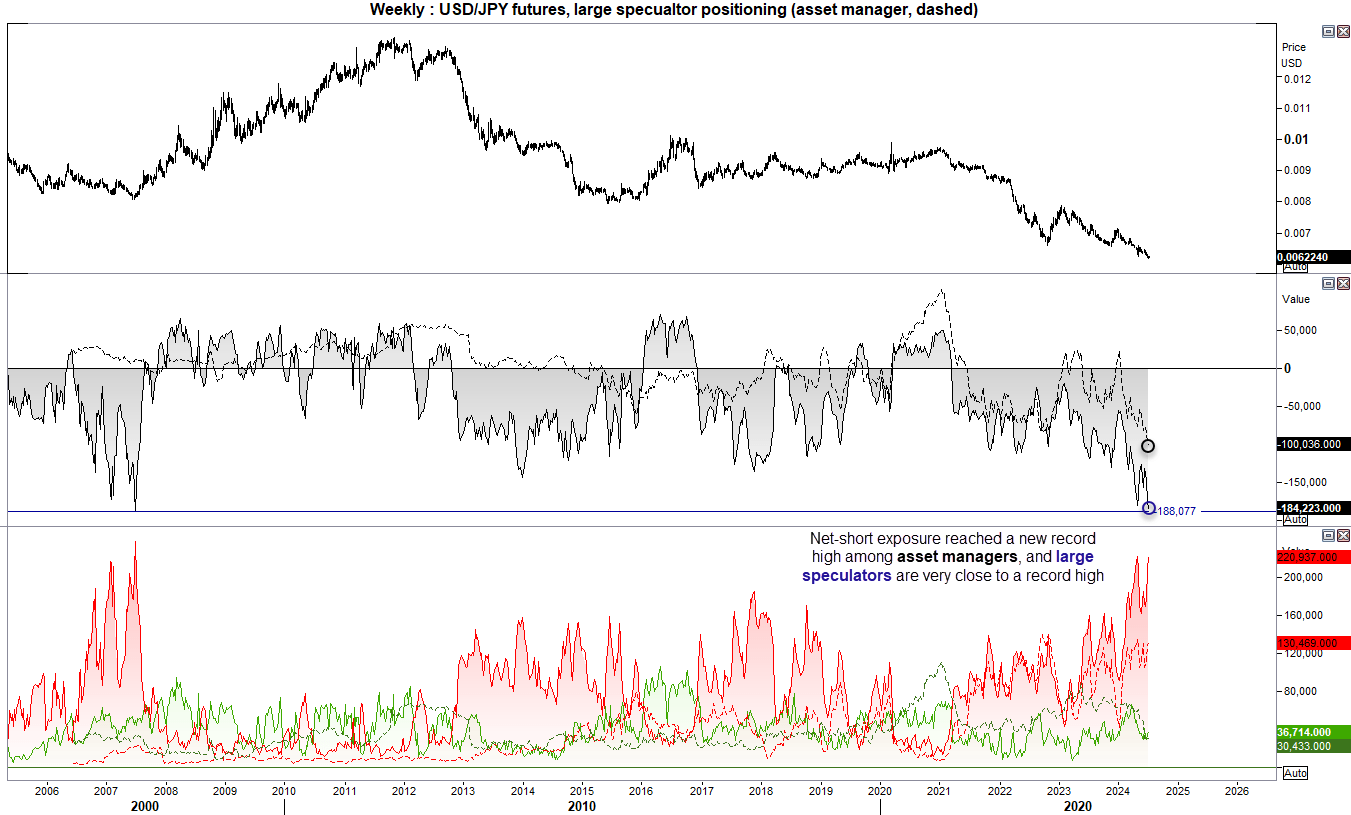

JPY/USD (Japanese yen futures) positioning – COT report:

Asset managers reached yet another new record of net-short exposure to yen futures, and large speculators are close to reaching their own bearish level set back in 2007. Usually this would scream sentiment extreme, yet the slow progress of policy normalisation from the BOJ alongside a relatively hawkish Fed means traders continue to ignore verbal warnings from MOF officials regarding the currency. Still, a small doji week formed on USD/JPY after a weak NFP report sent the pair back to the week’s open price. And if Powell strikes a dovish tone when he testifies to the Senate Banking committee later today and we’re treated to a softer set of inflation figures, dare I say we could finally see some mean reversion lower on USD/JPY. And possibly a break beneath 160.

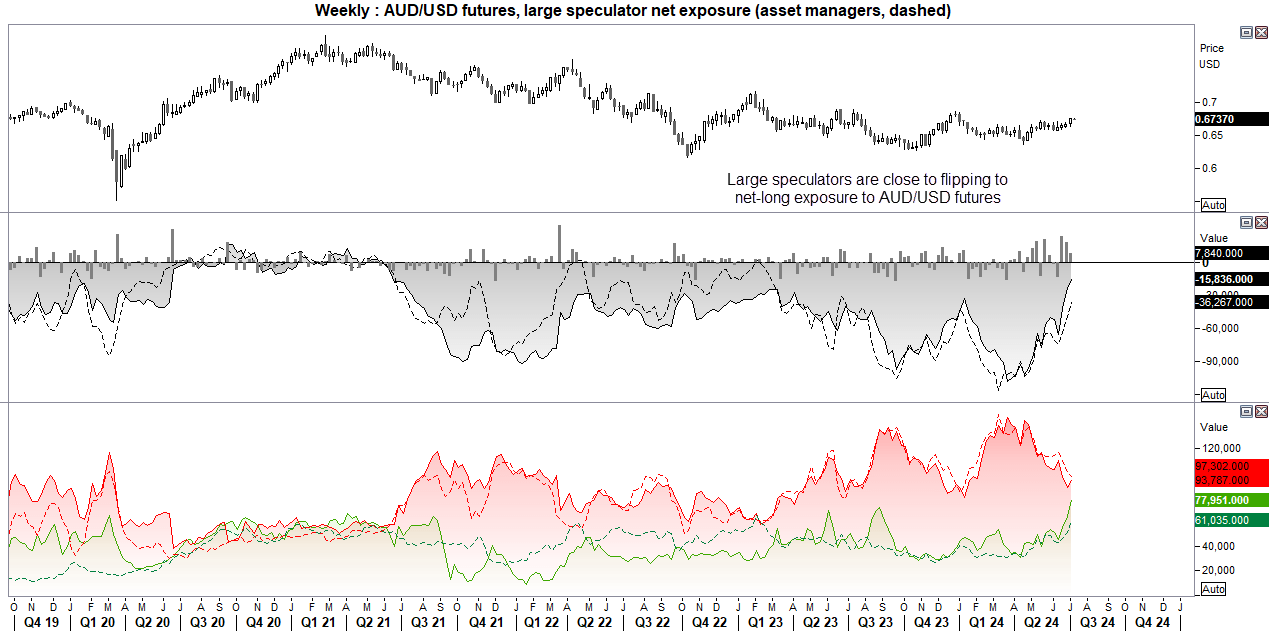

AUD/USD (Australian dollar futures) positioning – COT report:

Net-short exposure amongst large speculators fell to a three year low on Australian dollar futures. And it seems just a matter of time before they flipped net long exposure, with the risk of an RBA hike building whilst U.S. AUD/USD saw a decent breakout above 76c last week, so it is possible that large speculators may already be net long.

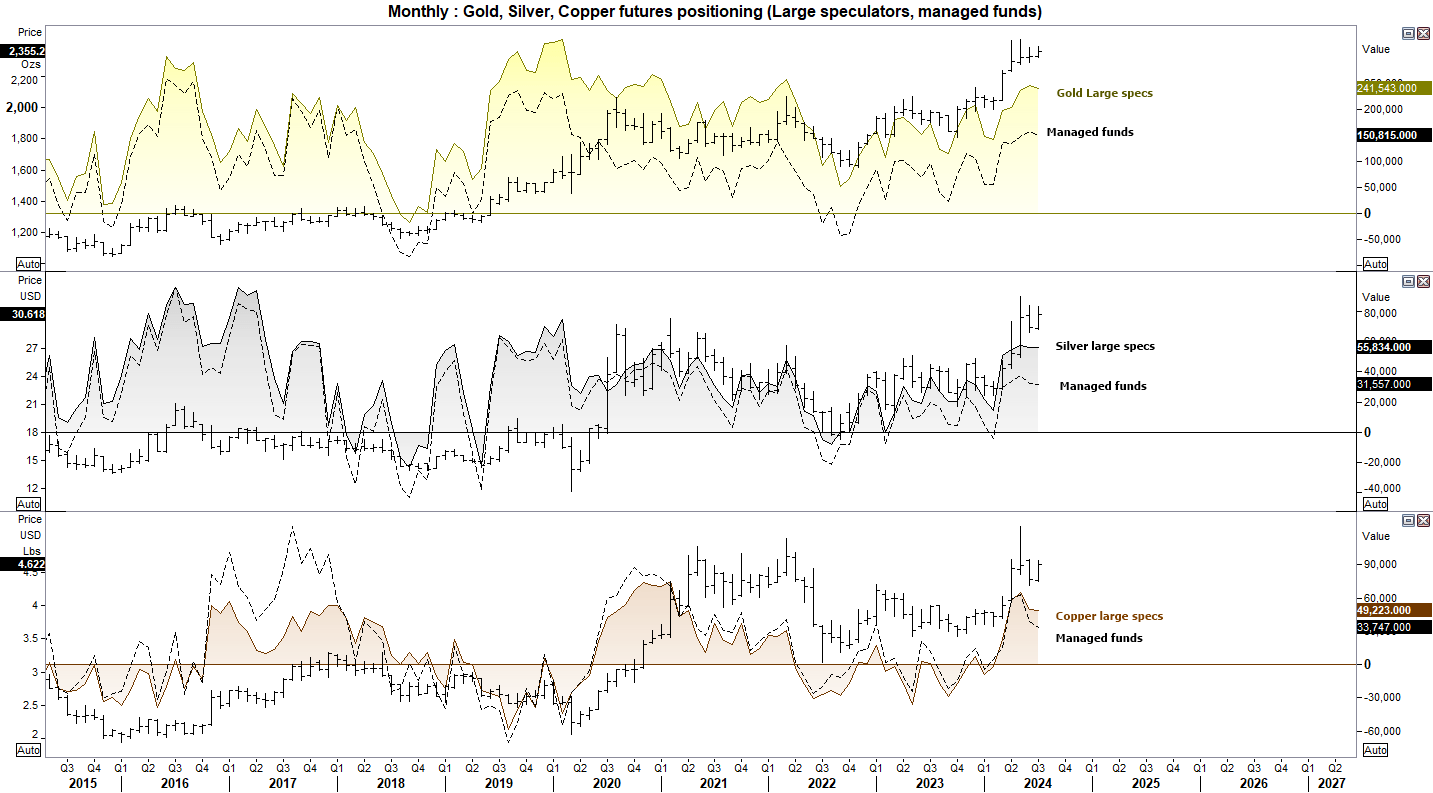

Gold, silver, copper futures positioning – COT report:

Lower yields and a softer US dollar have helped support metals, with copper futures rising nearly 6% last week – its best weekly performance in seven. Still, COT data shows that open interest has been falling alongside long and short exposure in recent weeks, although the surge in the second half of last week assumes bulls have returned to the table.

A similar observation can be made for silver futures, which also enjoyed its best week in seven after bullish and bearish bets were trimmed in the prior weeks. It now looks like silver futures are headed for $35.

Gold futures had their most bullish week in three months, with bullish momentum suggesting $2400 is back on the agenda with a potential retest of its record high. Gross-short exposure among large speculators fell to a 4-year low, 7.4 longs accounting for each short contract. Net-long exposure is at a 2-year high but not at a sentiment extreme.

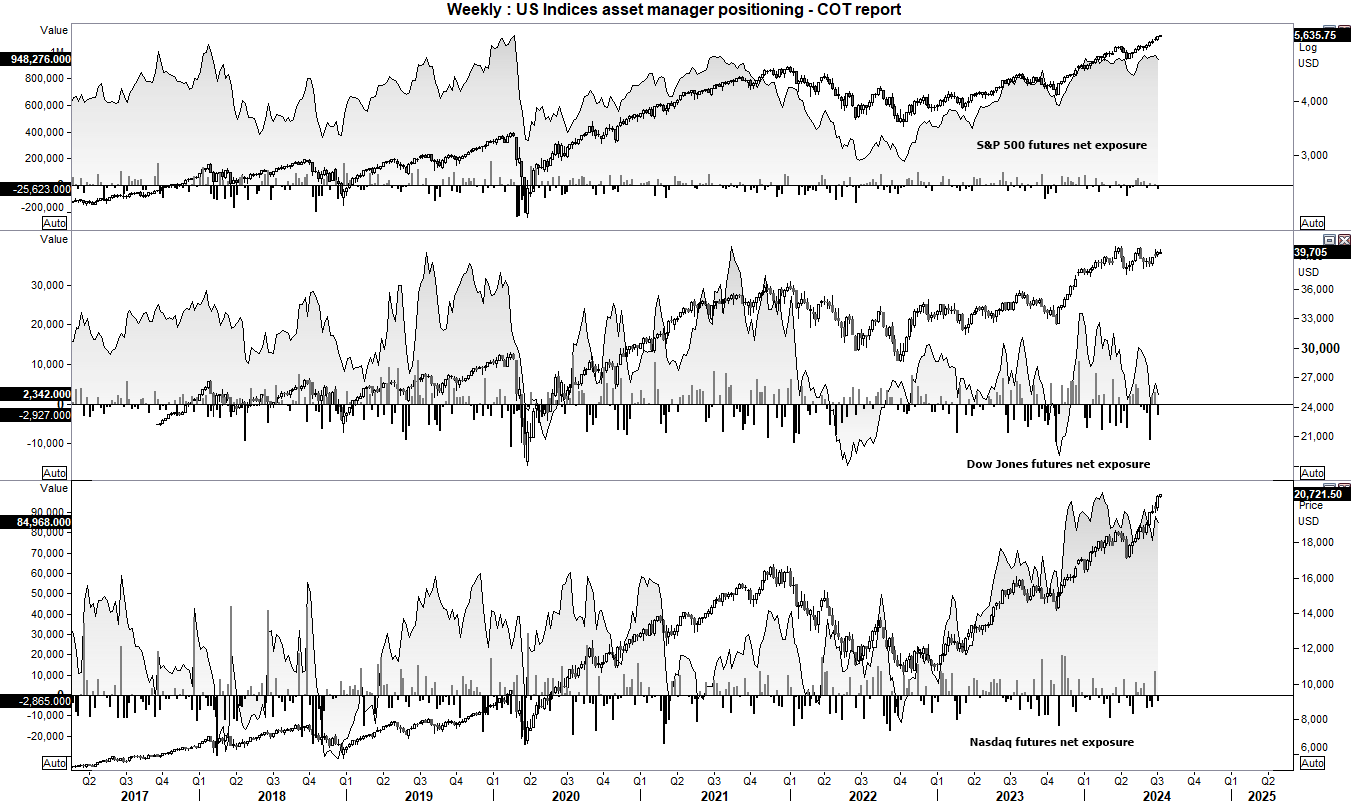

S&P 500, Dow Jones, Nasdaq 100 futures positioning – COT report:

Asset managers were closer to flipping to net-short exposure to Dow Jones futures last week, and net-long exposure was also lower against Nasdaq 100 and S&P 500 futures. Yet that didn’t prevent them from reaching record highs after the weaker Nonfarm payrolls report. However, bullish exposure could be near a sentiment extreme for the S&P 500, although shorting this market has done more damage than good for the past couple of years. And with asset managers also net-short VIX futures by a record amount, there are no immediate signs of concern for the S&P 500 bullish trend.